Canadian Solar (NasdaqGS:CSIQ) Valuation: Assessing the Impact of Major Battery Storage Wins in Ontario

Canadian Solar (NasdaqGS:CSIQ) shares moved higher after its e-STORAGE subsidiary announced new agreements to supply and maintain two large-scale battery energy storage projects in Ontario. These long-term deals expand the company’s presence in the province’s energy storage sector.

See our latest analysis for Canadian Solar.

Momentum for Canadian Solar has been modest this year, with the announcement of these major battery storage projects providing a welcome boost after a flat patch. While the one-year total shareholder return is barely changed, ongoing expansion moves like this could help rebuild market confidence and put some wind back in the company’s sails.

If recent energy storage deals have you interested in what else is gaining traction, it’s worth broadening your search and discovering fast growing stocks with high insider ownership

With Canadian Solar’s stock only slightly higher over the past year and new growth initiatives underway, does the current price reflect true potential, or could investors be overlooking a genuine buying opportunity?

Most Popular Narrative: 23% Overvalued

With Canadian Solar’s fair value in the most widely followed narrative set at $12.37, the last close of $15.27 stands well above that mark. This divergence highlights key assumptions underpinning the narrative’s cautious stance and invites a closer examination of what drives this premium.

Canadian Solar faces rising supply chain and manufacturing costs, including increased tariffs, duties, and upstream material costs like polysilicon and wafers. Module price increases are expected to lag behind these cost hikes, creating long-term pressure on module profitability and net margins.

Curious what quantitative leap or margin squeeze the most popular narrative is betting on? The outlook turns on a bold forecast for top- and bottom-line growth, as well as a future-profit multiple that could surprise many in this sector. Want to know what critical financial drivers and future assumptions are at the heart of this valuation? The answer lies just one click away.

Result: Fair Value of $12.37 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing U.S. policy uncertainty and the potential for increased tariffs create real risks that could quickly upend even the most optimistic outlook.

Find out about the key risks to this Canadian Solar narrative.

Another View: SWS DCF Model Says Shares Are Deeply Undervalued

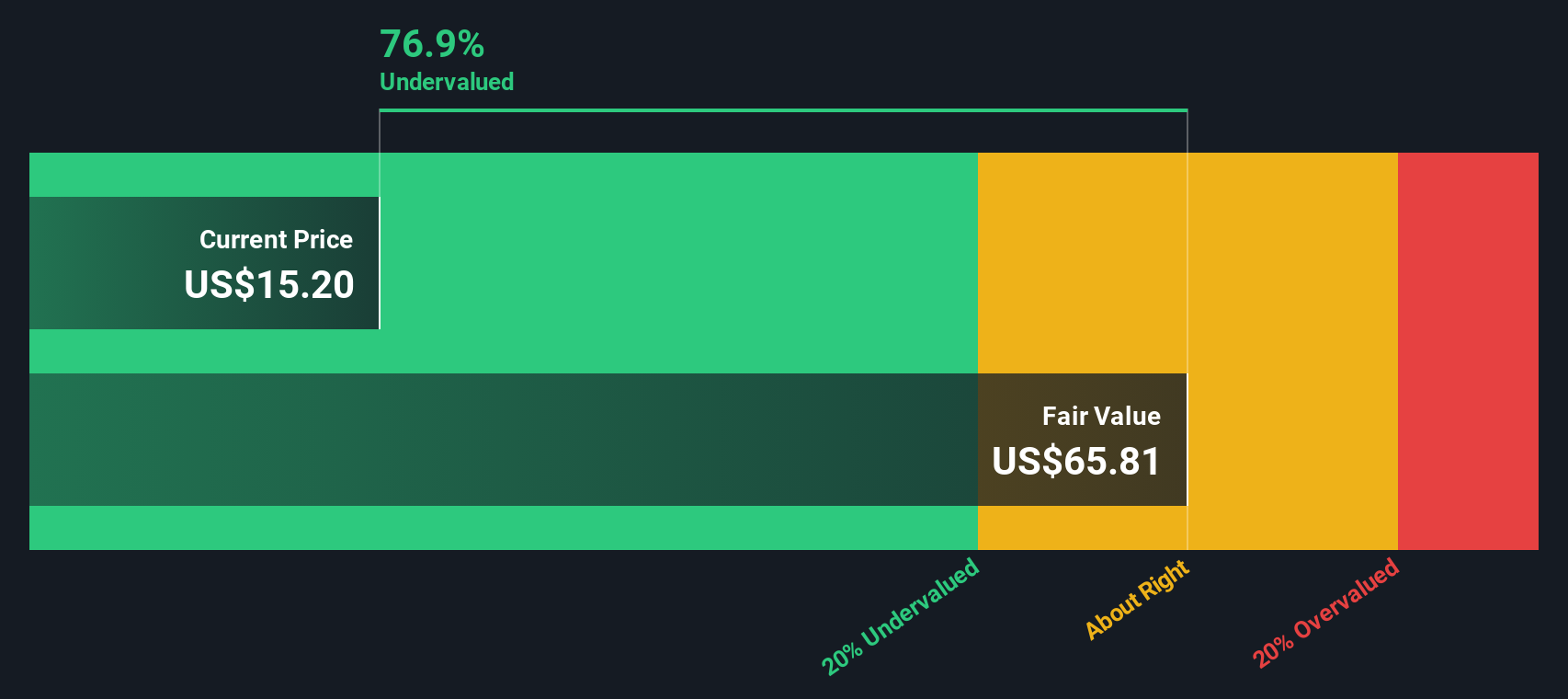

While many see Canadian Solar as overvalued using traditional price targets, our SWS DCF model provides a very different perspective. It estimates fair value at $65.81 per share, which indicates the current price is nearly 77% below this model’s figure. Does this signal an overlooked bargain, or is it just wishful thinking in today’s market?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If you see things differently or want to dive into the numbers yourself, there’s nothing stopping you from building your own view in just a few minutes, and putting it to the test with Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for the next headline to inspire your portfolio. Take control of your investing journey and spot hidden opportunities by tapping into these hand-selected ideas:

- Unlock potential by checking out these 904 undervalued stocks based on cash flows, which may be trading for less than their true worth and could be primed for long-term gains.

- Boost your income and portfolio resilience by browsing these 19 dividend stocks with yields > 3%, offering attractive yields above 3%.

- Ride the innovation wave by exploring these 24 AI penny stocks, at the forefront of artificial intelligence advancement and machine learning breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal