United Natural Foods (UNFI): Is the Stock’s Current Valuation Justified After a 45% Year-to-Date Gain?

See our latest analysis for United Natural Foods.

While United Natural Foods’ share price has seen a steady climb this year, recent momentum suggests growing optimism about the company’s future, especially after a 45% gain year to date. Longer term, the picture remains constructive, with its 1-year total shareholder return also in positive territory.

If you’re thinking about broadening your portfolio, this is a good opportunity to see what’s happening with other fast-rising companies and discover fast growing stocks with high insider ownership

That recent rally brings an important question into focus: is United Natural Foods a bargain with more room to run, or is the current price already factoring in all the expected growth?

Most Popular Narrative: 38.1% Overvalued

United Natural Foods' most widely followed narrative puts its fair value noticeably lower than the last closing price, reflecting a more skeptical stance despite recent share price gains. This perspective sets the stage for deeper analysis of why analyst consensus believes the stock is richly valued.

The accelerating consumer demand for organic, natural, and specialty products is translating into robust growth for UNFI's core categories, as reflected by 12% sales growth in the Wholesale Natural Products business and sustained volume momentum. This long-term consumption shift supports future revenue expansion.

What bold growth targets are baked into this story? The most popular narrative hinges on ambitious expansion in core categories and a bet on resilient margins. Curious to discover the game-changing projections that drive this valuation? Unlock the full calculation and see what assumptions are fueling this high price tag.

Result: Fair Value of $29 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cybersecurity threats and mounting competition from major grocers remain key risks that could challenge United Natural Foods' positive growth narrative.

Find out about the key risks to this United Natural Foods narrative.

Another View: Our DCF Model Tells a Different Story

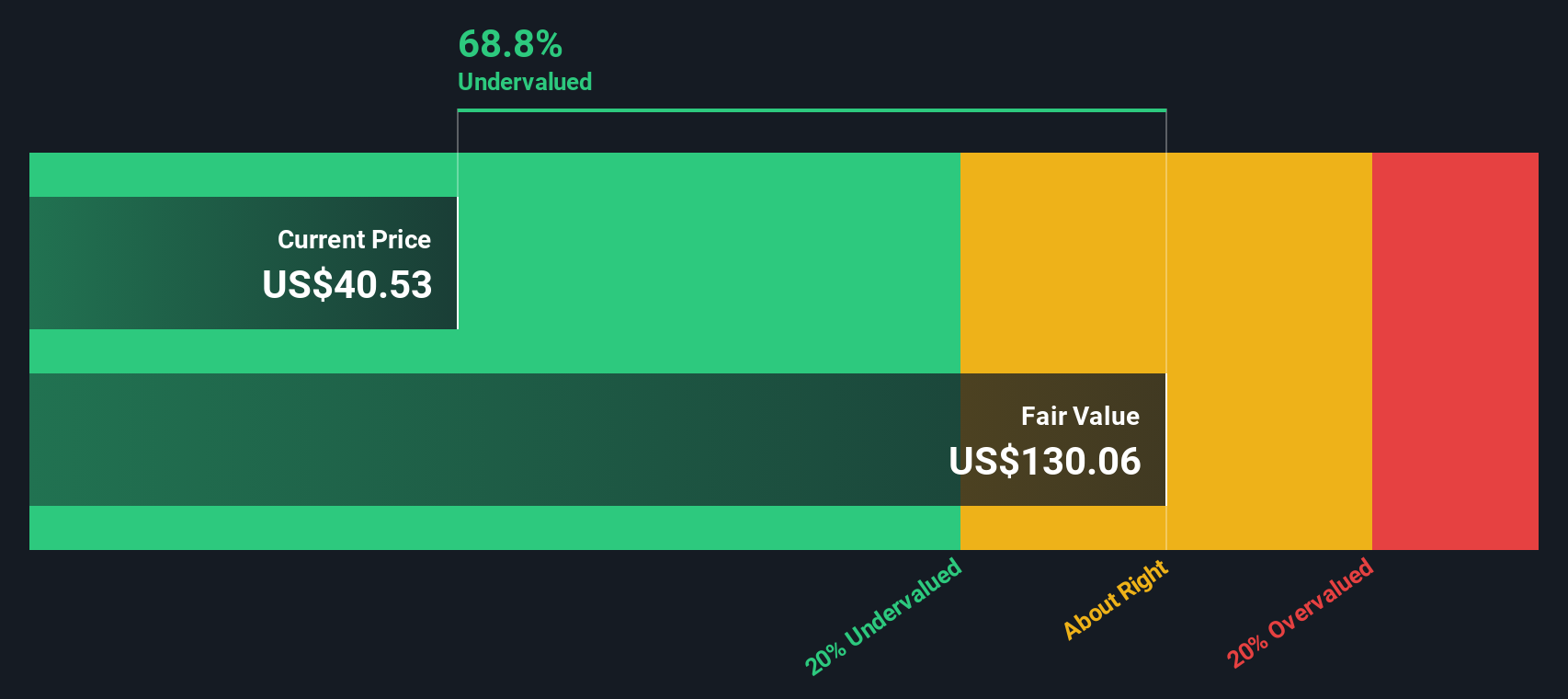

While the most popular narrative paints United Natural Foods as overvalued, our SWS DCF model takes an alternative stance. This method estimates the stock is trading a striking 69% below its fair value, which suggests the market might be underpricing future cash flow potential. Does this create a true value opportunity, or does the disconnect highlight market skepticism about unpredictable risks ahead?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own United Natural Foods Narrative

If you want to dig into the details and approach the numbers from your own perspective, you can build and personalize your narrative in just a few minutes. Do it your way

A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. Use the powerful Simply Wall Street Screener to spot standout stocks that could energize your portfolio today.

- Target steady income and maximize yield as you compare these 19 dividend stocks with yields > 3% with attractive payouts above 3% and solid track records.

- Tap into the future by reviewing these 24 AI penny stocks at the forefront of artificial intelligence, where tech innovation meets strong growth potential.

- Uncover bargain buys by checking these 904 undervalued stocks based on cash flows positioned for upside based on compelling cash flow valuations and overlooked potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal