Encompass Health (EHC): Evaluating Valuation as Expansion and Top National Quality Rankings Drive Growth Momentum

Encompass Health, the nation’s largest owner of inpatient rehabilitation hospitals, has been in the spotlight after earning Newsweek and Statista’s top recognition for clinical quality and announcing a milestone expansion in Connecticut.

See our latest analysis for Encompass Health.

Encompass Health’s recent Connecticut debut and continued national recognition come amid a year of moderate, steady progress for long-term investors. While the company’s 1-year total shareholder return stands at a respectable 31%, recent share price momentum has cooled as expansion investments become the focus. This signals a shift from rapid gains toward a longer-term growth narrative.

If you’re tracking healthcare’s next leaders, now’s a great time to see who’s gaining ground. Check out See the full list for free.

With the company earning continued accolades and expanding its national footprint, the key question for investors now is whether Encompass Health’s proven performance and future ambitions are fully reflected in its share price or if an opportunity remains for those seeking value and sustained growth.

Most Popular Narrative: 10.1% Undervalued

With Encompass Health's last close at $123.55 and the most widely followed narrative placing fair value at $137.42, the market may be underestimating future growth potential tied to hospital expansion and changing demographics.

The surge in the 65-plus population and persistent undersupply of inpatient rehabilitation beds are driving high and still-unmet demand for Encompass Health's core services. Ongoing hospital openings and bed expansions position the company to capture significant incremental patient volume, supporting higher revenue growth for years to come.

Want the real numbers behind this valuation? The forecast rests on ambitious revenue growth, margin improvement, and a future profit multiple rarely seen outside industry disruptors. Which assumptions back this price and what pipeline projections give analysts confidence? Dive in to see the data story that’s moving the narrative.

Result: Fair Value of $137.42 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent labor shortages and the threat of disruptive care models could quickly change the outlook for Encompass Health’s projected growth.

Find out about the key risks to this Encompass Health narrative.

Another View: What Do Market Multiples Say?

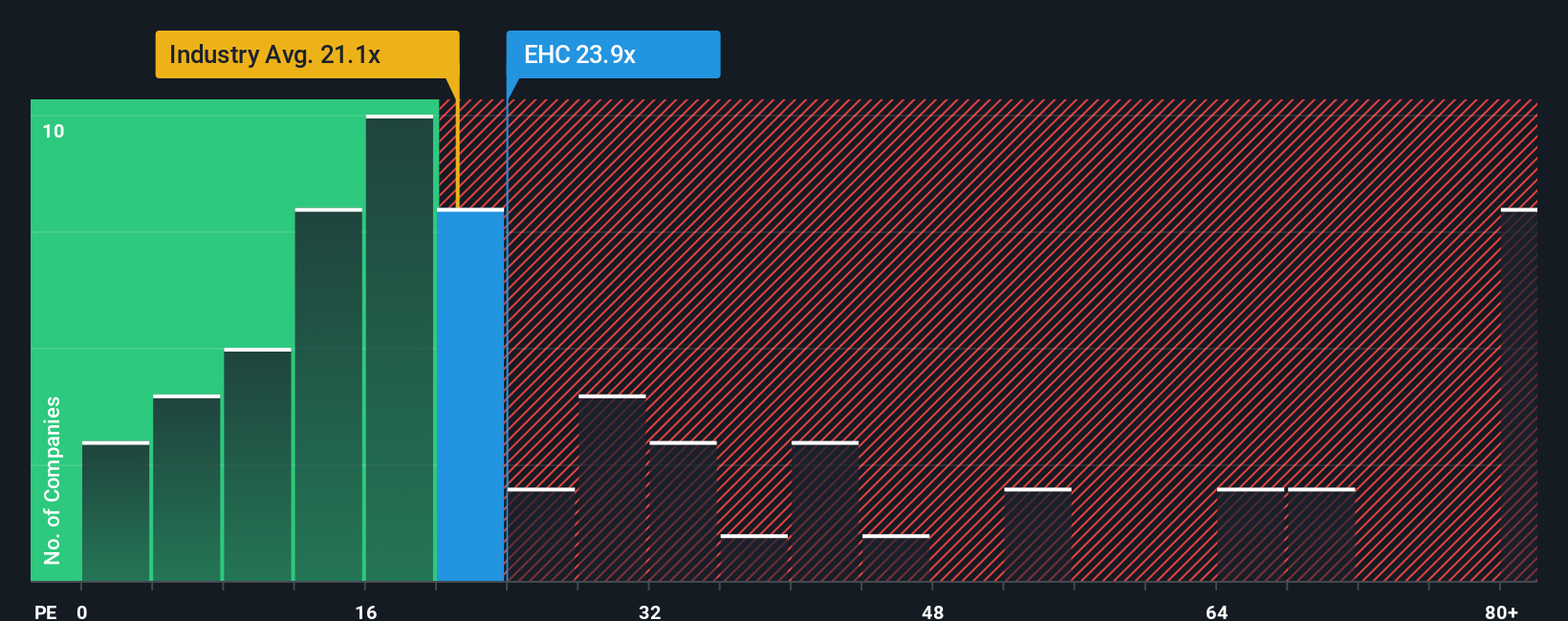

While a future earnings-based strategy estimates Encompass Health is undervalued, comparing its price-to-earnings ratio tells a different story. At 23.8 times earnings, Encompass Health is noticeably more expensive than its peer average of 17.8 and the US Healthcare industry’s 21.2. Its current valuation also stands above the fair ratio of 21.6, which suggests limited margin for safety if growth disappoints. Could the enthusiasm be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Encompass Health Narrative

If you see things differently or want to dig into the numbers firsthand, crafting your own narrative based on your analysis takes just a few minutes. Do it your way

A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never stand still. Find hidden opportunities and fresh angles by checking out these expert-vetted stock picks. Missing them could mean missing your next winner.

- Tap into the potential for future breakthroughs and resilient returns by reviewing these 904 undervalued stocks based on cash flows that others are overlooking right now.

- Get ahead of the hype and see which cutting-edge companies are making waves by using these 24 AI penny stocks for your next big move.

- Secure a stream of reliable income with these 19 dividend stocks with yields > 3% chosen for strong yields and steady financial footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal