Walmart’s Stock After AI and Sensor Upgrades: Are Shares Priced for 2025’s Innovations?

Thinking about what to do with Walmart stock lately? You are not alone. For investors, Walmart has always been a bellwether, and its recent stock movements have certainly sparked some new debates. Whether you are weighing a bit of profit-taking or wondering if there is more room to run, it helps to look under the hood at what is really driving the numbers.

Let us look at recent price moves to set the stage. Over the past year, Walmart has returned an impressive 27.7%, and it is up 13.0% year-to-date. That is not just slow and steady growth, either. In the last three years, shares have surged 140.7%, which is notable for a company many people think of as a predictable giant. While the last week has seen a slight pullback of -1.3%, the broader trend still points to resilience and momentum.

News stories have also been highlighting Walmart’s push into streamlining operations and using AI across the board. For example, the move to track pallets of groceries using sensors might seem like a behind-the-scenes tweak, but it signals a relentless drive for efficiency. At the same time, leadership’s public comments about AI shaking up every job at the company speak volumes about Walmart’s readiness to adapt, even in an industry known for razor-thin margins.

But here is the twist: despite all this action, our valuation score tallies Walmart as undervalued in just 1 out of 6 checks. That means it could be trading near or above its fair value by most metrics. Next, we will break down each valuation approach, and, just as importantly, touch on an even more insightful way to think about what Walmart shares are really worth at the end of this article.

Walmart scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by mapping out a company’s expected future cash flows and then discounting those projections back to today’s value. It aims to determine what all those future dollars are worth today, helping investors estimate the stock’s intrinsic value based on fundamentals rather than market excitement.

For Walmart, the current annual Free Cash Flow stands at approximately $15.7 billion. According to analyst forecasts and reasonable extrapolations, this cash flow is expected to grow steadily, reaching close to $30.98 billion by the year 2030. While analysts typically provide estimates for only the next five years, platforms like Simply Wall St extend these projections further, helping to give a long-term perspective.

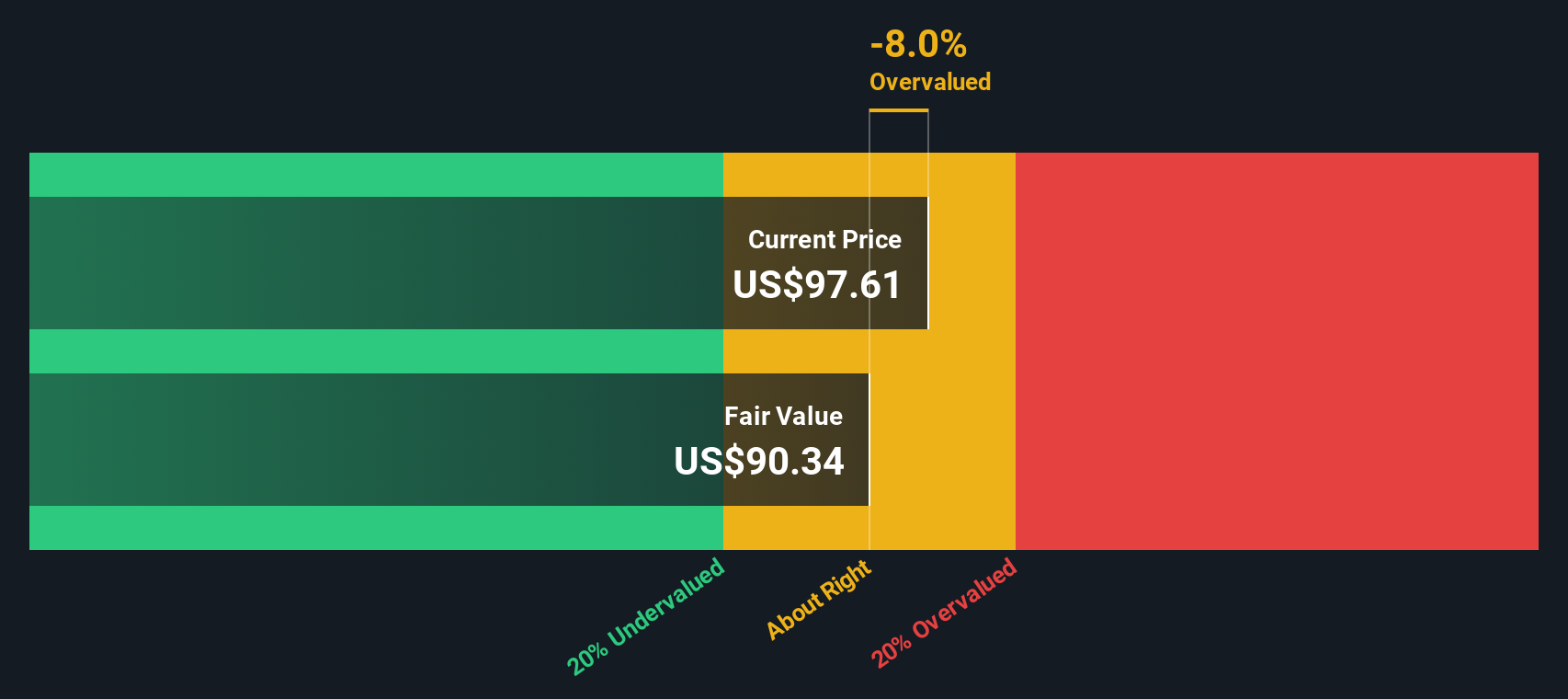

Based on the 2 Stage Free Cash Flow to Equity model, the DCF calculation results in an estimated intrinsic value of $106.59 per share. With the current share price only about 4.6% above this calculated value, Walmart appears to be very close to fairly valued at the moment. This small discount suggests the stock may not be a bargain, but it is also not trading at a high premium.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walmart's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: Walmart Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used metric for valuing companies with consistent profitability, like Walmart. Because it compares a company’s share price to its earnings, investors often use the PE ratio to gauge whether a stock is priced fairly relative to how much money the company actually makes.

It is important to remember that what counts as a "normal" or "fair" PE ratio can shift depending on growth expectations, profitability, and risk. Higher growth prospects or lower risk typically justify a higher PE, while slower growth or more uncertainty usually drag the ratio down.

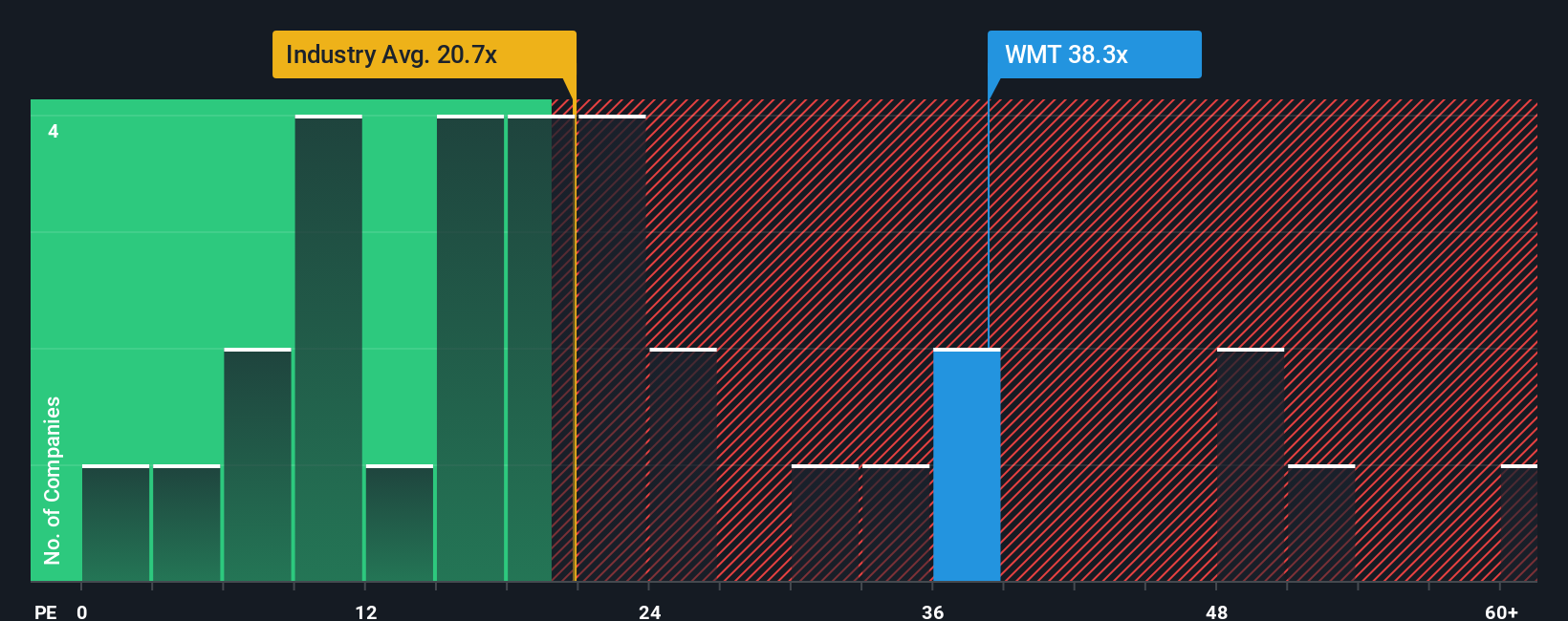

Currently, Walmart trades at a PE ratio of 38x. This stands in contrast to the Consumer Retailing industry average of about 21x and a peer group average of 25x. At a glance, Walmart appears more expensive than both its industry and closest rivals.

Simply Wall St’s Fair Ratio assesses what a “just right” PE should be for Walmart, taking into account not just industry trends and peer comparisons, but also growth rates, profit margins, size, and risk factors. In Walmart’s case, this Fair Ratio is 32x, reflecting its robust business model and access to unique growth avenues.

This means that, while the PE premium over industry and peer averages might look high, their proprietary Fair Ratio suggests Walmart’s above-average earnings quality justifies a higher-than-average multiple. However, the stock’s current PE is only slightly above the Fair Ratio, so it is trading in line with its business fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walmart Narrative

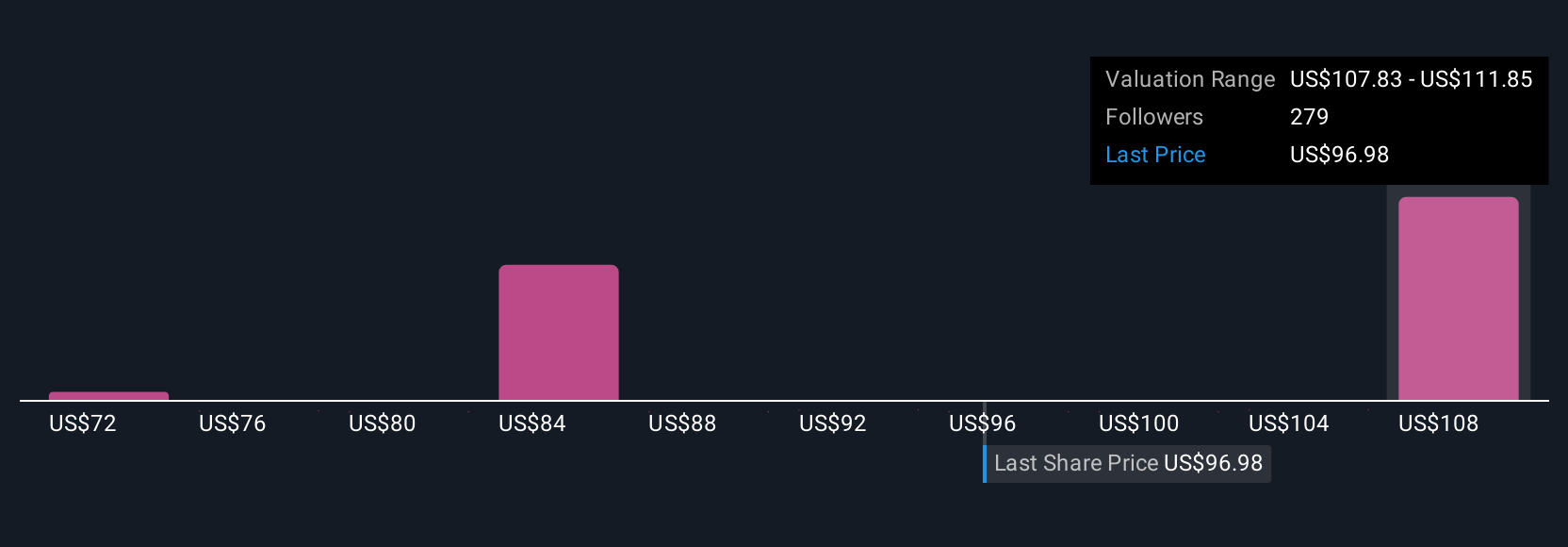

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a more dynamic tool for making investment decisions. A Narrative is simply your story or perspective about a company, built from your own assumptions around its future revenue, earnings, and margins. Rather than relying only on generic benchmarks, Narratives connect the dots from the company’s big-picture story to your financial forecast, turning those numbers into a clear, actionable fair value that is truly yours.

Narratives are easy to use and accessible through the Community page on Simply Wall St, where millions of investors share and compare their views. With a Narrative, you get to decide what you believe about a company’s future, see that view quantified as a fair value, and instantly check whether the current share price is below or above your own estimate. This can help you confidently decide when to buy, hold, or sell.

In addition, your Narrative updates automatically as new earnings, news, or events are announced, ensuring your analysis stays relevant. For Walmart, some investors' Narratives are optimistic, forecasting rapid growth from AI and global expansion, setting a fair value as high as $127. Others are more cautious, citing profitability pressures and pricing Walmart at just $64. Narratives put the power of the story, and the numbers, in your hands.

Do you think there's more to the story for Walmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal