How Index Inclusion and Share Buybacks Could Shape KE Holdings' (BEKE) Investment Appeal

- KE Holdings Inc. (SEHK:2423) was recently added to the S&P Global BMI Index and announced active share buybacks between July and September 2025 to consolidate its equity structure.

- The company’s inclusion in a global benchmark index and repurchase of shares signal growing confidence in its financial resilience and potential to attract a broader investor base.

- We'll explore how KE Holdings’ share buybacks highlight management’s confidence and may reinforce the company’s long-term investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

KE Holdings Investment Narrative Recap

To be a shareholder in KE Holdings, you need to believe in the recovery and digital transformation of China’s real estate market, where technology integration could drive future growth despite sector headwinds. The company’s recent addition to the S&P Global BMI Index and ongoing buybacks are positive signals but do not materially lessen the immediate catalyst, which remains the pace of transaction volume stabilization, nor do they eliminate the leading risk of prolonged weakness in China's property sector.

Among KE Holdings’ recent actions, the substantial increase in its authorized share buyback program, now up to US$5,000 million through 2028 following the latest round of repurchases, stands out. This development is closely tied to the current catalyst, as continued buybacks can support share price and reflect management’s view on underlying value, even as core housing activity remains under pressure.

However, investors should be aware that, by contrast, the risk of extended softness in China’s real estate market could still…

Read the full narrative on KE Holdings (it's free!)

KE Holdings' outlook anticipates CN¥136.4 billion in revenue and CN¥8.6 billion in earnings by 2028. Achieving this target implies a 9.8% annual revenue growth rate and an increase in earnings of CN¥4.7 billion from current earnings of CN¥3.9 billion.

Uncover how KE Holdings' forecasts yield a $22.83 fair value, a 20% upside to its current price.

Exploring Other Perspectives

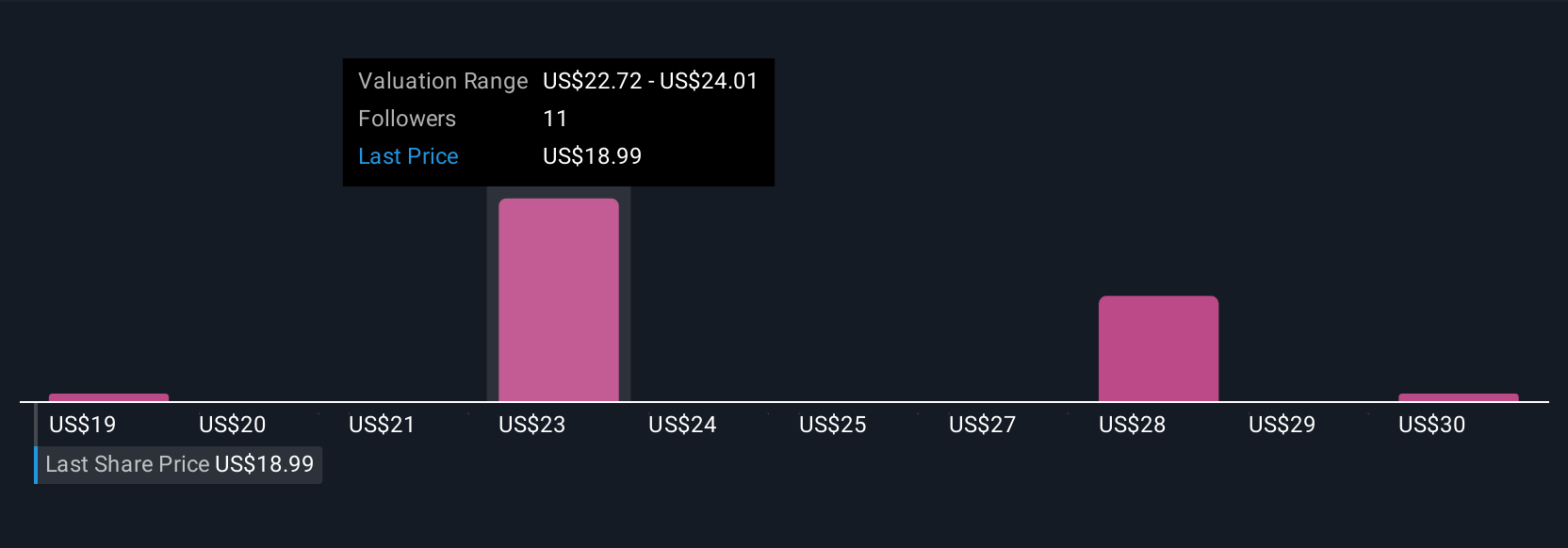

Community members provided four fair value estimates for KE Holdings ranging from US$18.86 to US$31.74. Against these varied opinions, it’s important to weigh the current risk that ongoing weakness in China’s housing activity could impact both near-term results and long-term returns, review several perspectives to inform your own view.

Explore 4 other fair value estimates on KE Holdings - why the stock might be worth as much as 67% more than the current price!

Build Your Own KE Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KE Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free KE Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KE Holdings' overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal