Performance Food Group (PFGC): Is There More Value Left After a 31% Total Return Surge?

See our latest analysis for Performance Food Group.

Performance Food Group’s share price has gained solid ground in 2024, but the upward trend has really stood out over the past year with a 31% total shareholder return. This points to building momentum as confidence in its growth story grows.

If you’re tracking companies with similar breakout potential, now’s an ideal time to broaden your scope and discover fast growing stocks with high insider ownership

But with shares rising steadily and still trading at a discount to analyst targets, the real question now is whether Performance Food Group is undervalued or if the market has already accounted for all the growth ahead.

Most Popular Narrative: 14.2% Undervalued

Performance Food Group’s narrative valuation points to a fair value $17 above its last close. This sets the stage for a debate on growth and future market leadership.

The company's robust track record of targeted acquisitions, with a continued focus on disciplined, synergistic M&A and successful integration (as seen with Cheney Brothers and José Santiago), enhances scale, broadens the customer base, and supports higher long-term earnings and cash flow.

What’s the secret behind such an optimistic valuation? It’s not just about market share; think strategic deals, bigger margins, and sky-high earnings assumptions. The most aggressive numbers are hidden beneath the surface. Want to see how these bold projections come together? Unlock the full story and discover what really drives this price target.

Result: Fair Value of $119 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent challenges in the Convenience segment or increased competition could quickly pressure profit margins and call the bullish outlook into question.

Find out about the key risks to this Performance Food Group narrative.

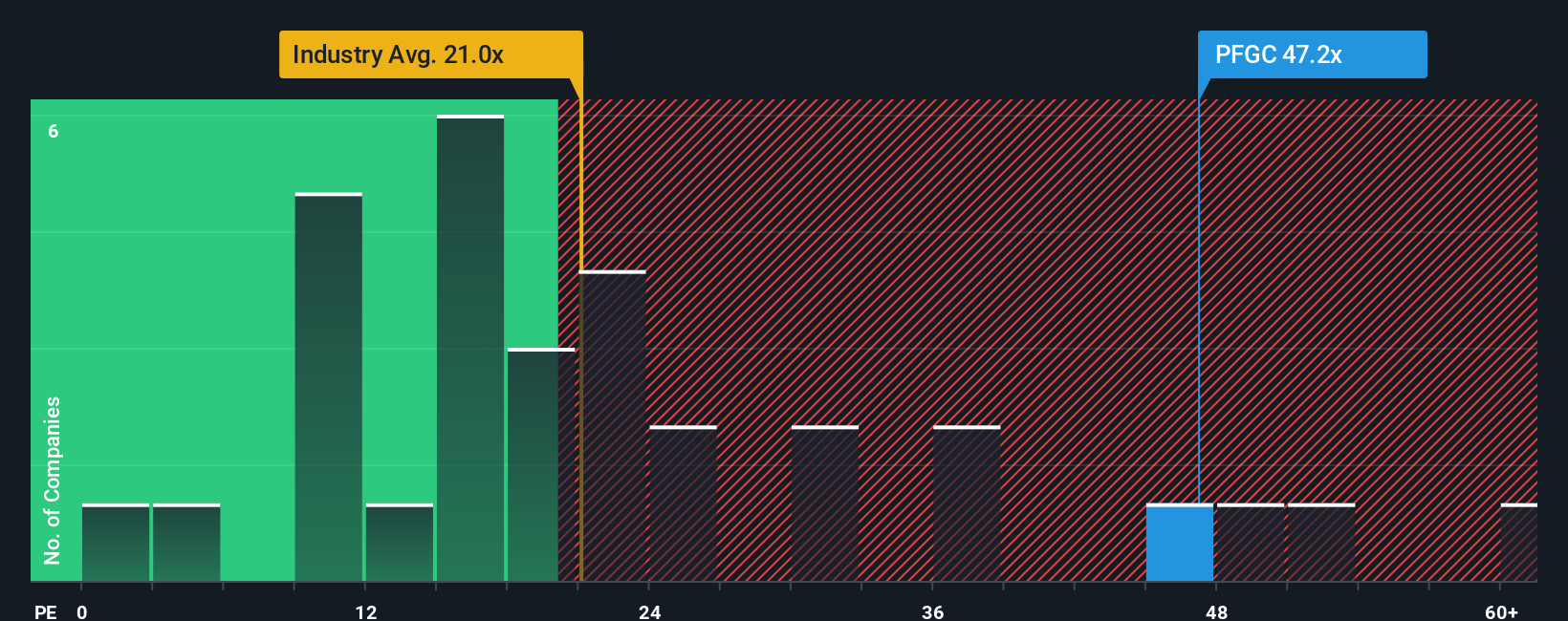

Another View: High Earnings Multiple Raises Questions

While many see Performance Food Group as undervalued, its current price-to-earnings ratio sits at 47.1x. This is much steeper than both the peer average of 25.5x and the fair ratio of 28.6x. This large gap points to real valuation risks if growth stalls. Is the market being too optimistic, or is this a sign of true breakout potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Performance Food Group Narrative

If you think the story goes differently, or want to dig into the numbers yourself, it takes less than three minutes to build your own view and Do it your way.

A great starting point for your Performance Food Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Great opportunities rarely stick around. Supercharge your portfolio by seeking out fresh perspectives that could help you stay one step ahead of the market.

- Tap into the next major growth trend by uncovering innovators in artificial intelligence with these 24 AI penny stocks. Connect with companies at the heart of future tech advances.

- Boost your potential returns by targeting strong financials among these 3563 penny stocks with strong financials. Discover where agility and upside can be found before others catch on.

- Lock in reliable yields and steady income with these 19 dividend stocks with yields > 3%. Explore a handpicked list of stocks offering dividends above 3% for smart, income-focused investors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal