Plug Power Stock Hit A New 52-Week High Today: What's Going On?

Shares of Plug Power Inc (NASDAQ:PLUG) are trading sharply higher Friday, continuing a powerful rally that has seen the hydrogen fuel-cell company’s stock climb over 120% in the past month. The stock is being propelled by an analyst update and operational news.

What To Know: Fueling the gains, H.C. Wainwright reiterated its Buy rating and more than doubled its price target on Plug to $7.00 from a previous $3.00. The firm highlighted that rising electricity costs and growing support for nuclear power are creating strong tailwinds for the green hydrogen industry, improving its cost-competitiveness.

The note specifically identified the potential for Small Modular Reactors to provide stable, carbon-free power for electrolysis, making hydrogen production more predictable and cost-effective.

The bullish analyst sentiment follows a key announcement from earlier in the week. Plug successfully delivered its first 10-megawatt electrolyzer to Galp's Sines refinery in Portugal, a critical step for one of Europe’s largest green hydrogen projects.

This European expansion, coupled with growing investor excitement over the technology’s potential to power energy-intensive AI data centers, has provided a significant boost to the stock’s recent performance.

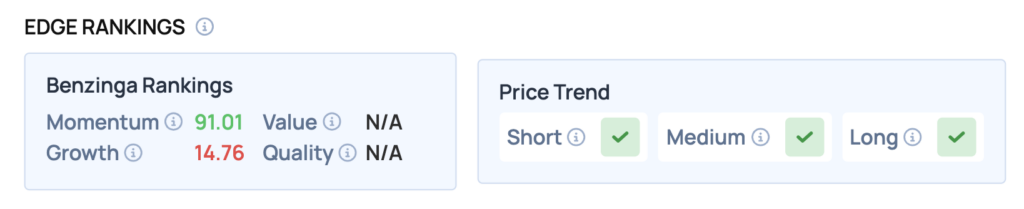

Benzinga Edge Rankings: Underscoring the stock recent performance, the stock boasts a Benzinga Edge Momentum score of 91.01.

PLUG Price Action: Plug Power shares were up 34.28% at $3.79 at the time of publication Friday, according to Benzinga Pro.

The current price is significantly above the 50-day moving average of $1.77, indicating a bullish trend. Resistance is observed at the recent high of $3.62, while support may be found near the 50-day moving average.

Read Also: How A Government Shutdown Could Turn A Hot IPO Stream Cold

How To Buy PLUG Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Plug Power’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal