How Option Care Health's (OPCH) Credit Agreement Refinance May Influence Growth and Shareholder Strategies

- On September 22, 2025, Option Care Health amended its First Lien Credit Agreement, refinancing term loans at lower interest rates, securing an additional US$49.6 million in incremental term loans, and extending revolving credit commitments, with the total principal amount under the agreement now about US$678 million.

- This refinancing not only reduces interest expenses but also enhances financial flexibility, positioning the company to support ongoing investments in growth and shareholder returns.

- Next, we'll examine how Option Care Health's improved credit terms and financial flexibility could reshape its investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Option Care Health Investment Narrative Recap

To be a shareholder in Option Care Health, you need to believe in the expanding market for home and alternate site infusion therapies, powered by demographic trends and payer partnerships. The recent credit agreement amendment boosts the company’s financial flexibility and lowers interest expense, which may support ongoing investments, but it does not materially change the most important near-term catalyst, organic revenue growth, or the biggest risk, which remains exposure to reimbursement rate shifts and margin compression from therapy mix changes.

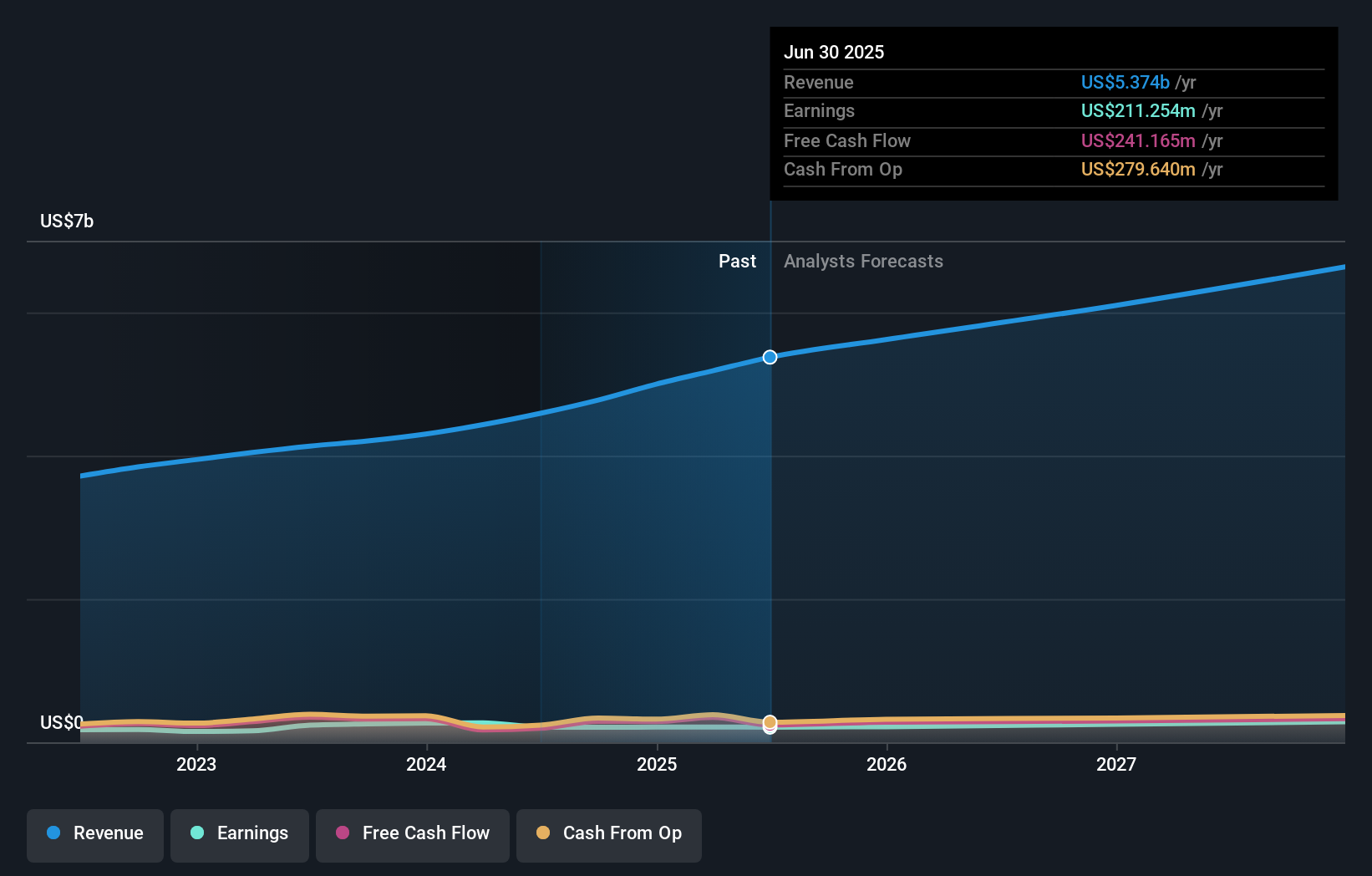

Among recent announcements, the company’s revised 2025 revenue guidance of US$5.50 to US$5.65 billion stands out, as it reinforces the current growth trajectory and offers investors a clear benchmark ahead of upcoming earnings. This guidance, combined with the new credit terms, gives a firmer foundation to judge how well Option Care Health can balance investment discipline with growth ambitions in the context of market opportunities and lingering reimbursement uncertainties.

However, it’s important that investors remain alert to the possibility of further margin pressure if payer reimbursement rates are renegotiated or therapy mix trends continue...

Read the full narrative on Option Care Health (it's free!)

Option Care Health's outlook anticipates $6.9 billion in revenue and $306.2 million in earnings by 2028. This scenario is based on an annual revenue growth rate of 8.8% and an earnings increase of $94.9 million from the current earnings of $211.3 million.

Uncover how Option Care Health's forecasts yield a $37.90 fair value, a 36% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Option Care Health’s fair value spans from US$29.19 to US$65.03 per share. While many are optimistic about the company’s expanding addressable market, keeping an eye on reimbursement risk could shape outcomes for those with different outlooks.

Explore 3 other fair value estimates on Option Care Health - why the stock might be worth over 2x more than the current price!

Build Your Own Option Care Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Option Care Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Option Care Health's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal