Can Agilent Technologies' (A) AI Moves Redefine Its Edge in Diagnostics and Security Markets?

- In September 2025, Agilent Technologies introduced its new Insight Series Alarm Resolution Systems for airport security and a collaboration with Lunit to develop AI-driven companion diagnostics, alongside launching advanced HPLC columns for biotherapeutics applications.

- These initiatives underscore Agilent's expanding footprint in both the biopharma and global security markets, while harnessing artificial intelligence to advance precision diagnostics.

- We’ll explore how Agilent’s AI partnership in diagnostics is reshaping its long-term investment narrative and growth opportunities.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Agilent Technologies Investment Narrative Recap

To be a shareholder in Agilent Technologies, you need confidence in its ability to capture long-term growth from biopharma innovation, recurring revenue models, and market expansion despite global supply chain headwinds. The recent launches in security and diagnostics expand Agilent's opportunity set, but they do not materially alter the fact that supply chain and tariff-driven cost increases remain the single most important near-term risk to profitability.

The introduction of Agilent’s Insight Series Alarm Resolution Systems for airport security showcases the company's push into high-precision detection markets, aligning with catalysts around regulatory-driven demand growth and product innovation that can unlock new revenue streams while reinforcing competitive positioning.

Yet, against these opportunities, investors should be aware that if current efforts to offset rising tariff and input costs fall short in 2026...

Read the full narrative on Agilent Technologies (it's free!)

Agilent Technologies is projected to reach $8.0 billion in revenue and $1.7 billion in earnings by 2028. This outlook implies a 5.8% annual revenue growth rate and a $0.5 billion increase in earnings from the current $1.2 billion.

Uncover how Agilent Technologies' forecasts yield a $138.83 fair value, in line with its current price.

Exploring Other Perspectives

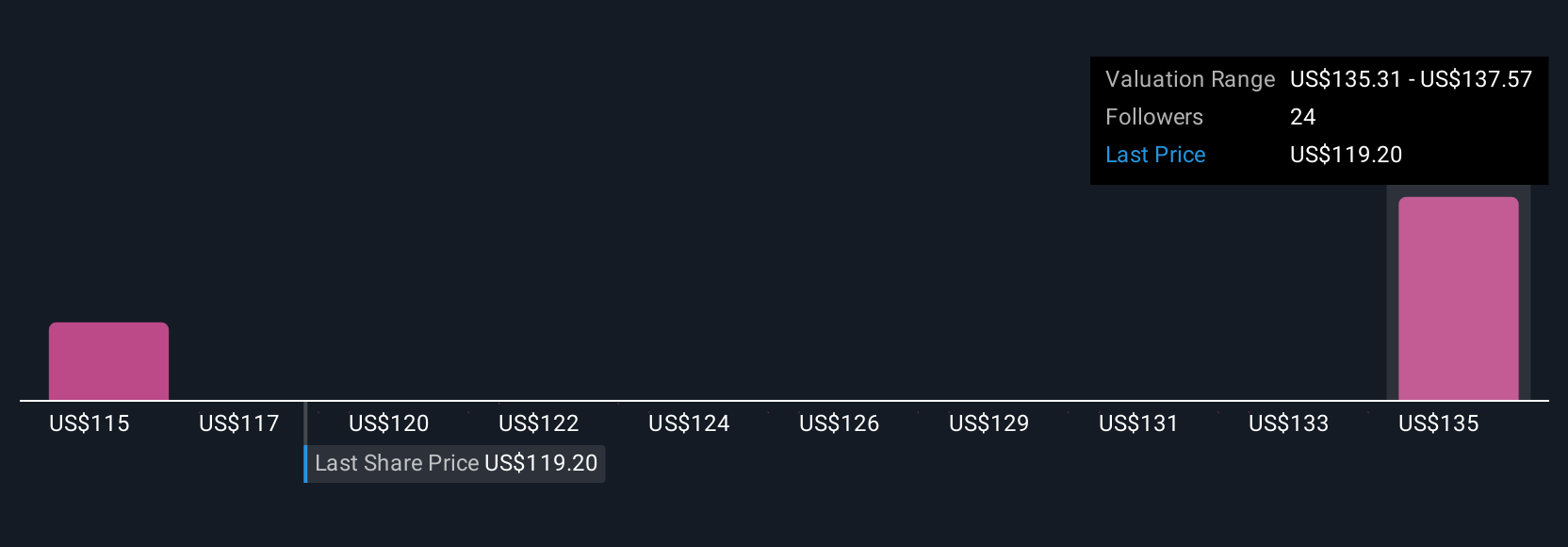

Simply Wall St Community members supplied four fair value estimates for Agilent, ranging from US$108.23 to US$138.83 per share. While optimism around recurring revenue growth is strong, these opinions highlight how widely expectations can vary; consider reviewing multiple viewpoints before making decisions.

Explore 4 other fair value estimates on Agilent Technologies - why the stock might be worth 22% less than the current price!

Build Your Own Agilent Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Agilent Technologies research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Agilent Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Agilent Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal