Is Cactus Worth a Second Look After Its 39% Price Drop in 2025?

Are you watching Cactus and wondering whether it’s time to make your move? Over the last year, Cactus’s share price has certainly tested investors’ nerves, falling by 38.8% and trailing even further on a year-to-date basis, down 35.8%. That might sound harsh, but zoom out to the past five years and you’ll see a dramatic turnaround, with shares still up an impressive 93.1% over that period. Volatility like this always sparks debate, especially when recent weeks have seen the price sliding another 6.3% in just seven days.

Behind these numbers, broader industry headwinds and changing investor sentiment for energy equipment have swayed the stock, sometimes overshadowing Cactus’s core strengths. What’s creating a buzz right now is the company’s potential value relative to its fundamentals. According to our latest analysis, Cactus scores a perfect 6 out of 6 on our valuation checklist. This means it is, by our measures, undervalued on every metric we track, which is a rare outcome and one that always catches my attention.

So how do we break down a value score like that and decide if the price is right? Let’s dig into the valuation approaches that matter most for Cactus and explore a smarter way to judge if this stock deserves a place in your portfolio.

Why Cactus is lagging behind its peers

Approach 1: Cactus Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by forecasting its future cash flows and discounting them back to today’s dollars. This approach helps assess whether the market is undervaluing or overvaluing the underlying business based on its real profit-generating potential.

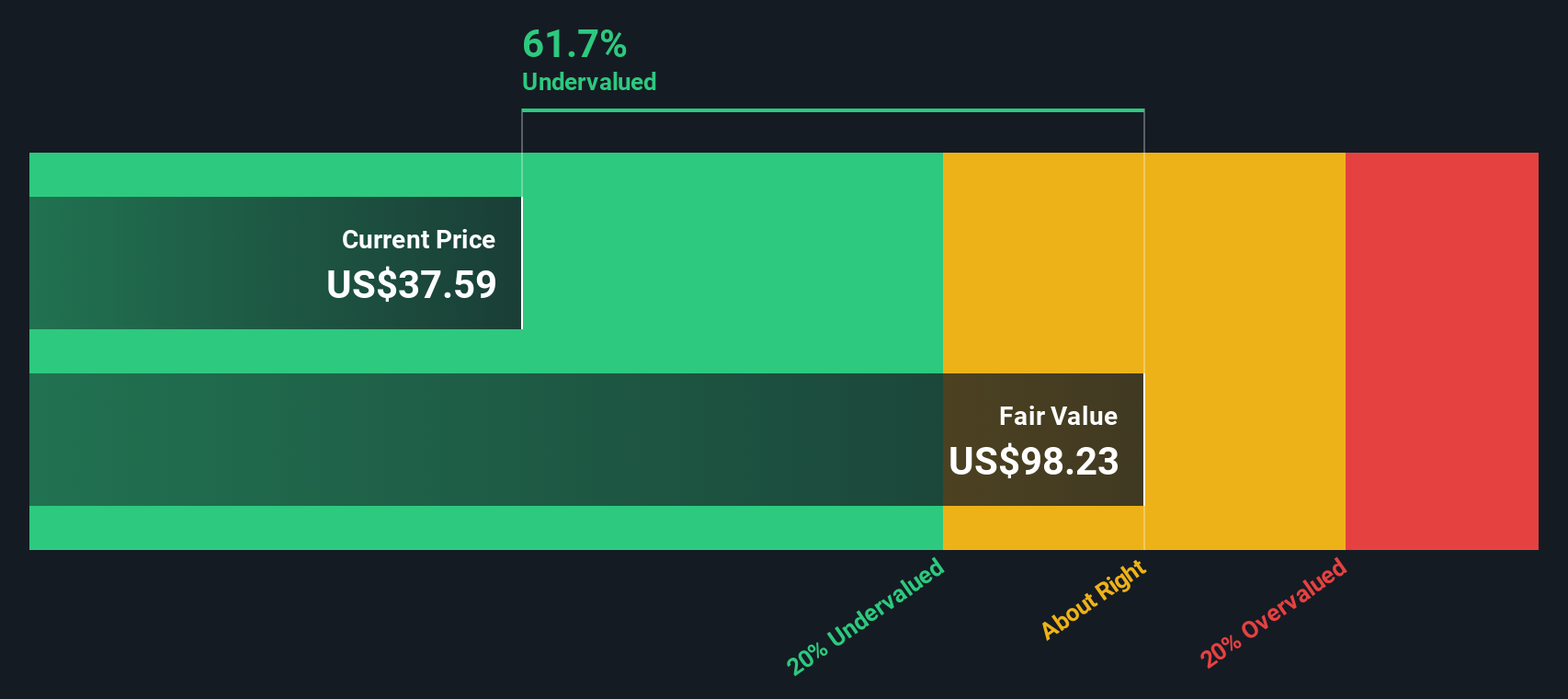

For Cactus, the latest reported Free Cash Flow stands at $233.7 million. Analysts forecast this figure to rise steadily over the next several years, reaching $304 million by the end of 2027. Further projections, based on historical growth rates and extended estimates, see free cash flow climbing as high as $451.6 million by 2035. All these forecasts are considered in US dollars, and most years show modest but consistent growth as the company matures.

After crunching the numbers with these projections, the DCF model calculates an intrinsic fair value of $98.06 per share. This suggests the stock is trading at a 61% discount to its estimated true worth using this methodology. In other words, the current share price is significantly below what the business fundamentals imply it should be.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cactus is undervalued by 61.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Cactus Price vs Earnings (PE Ratio)

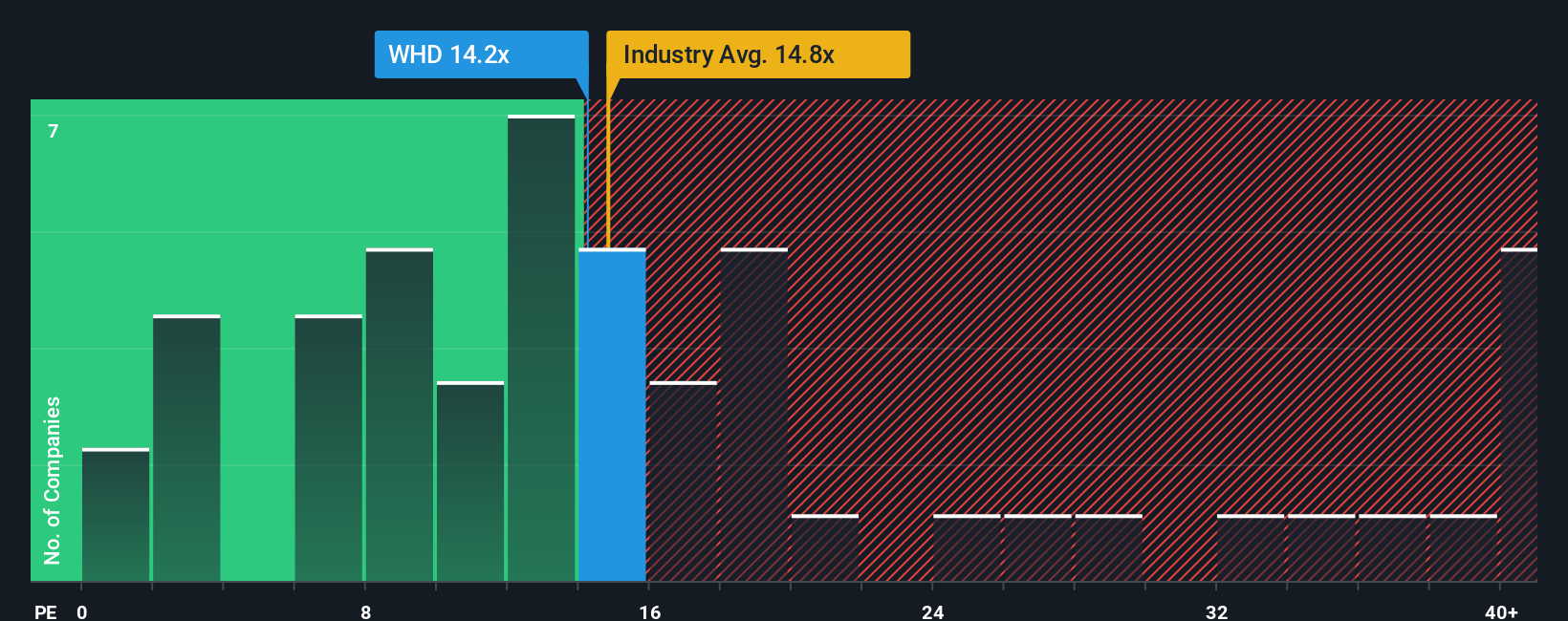

For consistently profitable companies like Cactus, the Price-to-Earnings (PE) ratio is a well-established way to value the business. It shows how much investors are willing to pay for each dollar of earnings, making it a practical benchmark for comparing similar firms and assessing investor expectations.

A company’s fair PE ratio depends on more than just today’s profits. Growth expectations, industry stability, and how risky the business is overall all play key roles. Fast-growing, resilient companies often command higher PE ratios, while lower growth or higher risk usually warrants a discount.

Cactus currently trades at a PE of 14.5x. This sits just below the Energy Services industry average of 14.8x and noticeably under the broader peer average of 20.3x. That is good context, but to get a tailored view, we turn to Simply Wall St's Fair Ratio. This proprietary measure weighs factors like Cactus’s earnings growth, risk profile, healthy margins, and where it sits in the industry. This results in a Fair PE Ratio of 16.1x.

Unlike simple industry or peer comparisons, the Fair Ratio offers a more refined benchmark. It accounts for things that really matter to Cactus, such as its expected earnings trajectory, risk characteristics, sector characteristics, and size. That makes it a more reliable way to gauge whether the stock is attractively priced.

With Cactus’s PE ratio at 14.5x, sitting below its Fair Ratio of 16.1x, the shares look undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cactus Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story and perspective about a company, where you connect your assumptions about its future, such as expected revenue growth, profit margins, and risks, to a financial forecast, and from there, to an estimated fair value per share.

On Simply Wall St's Community page, Narratives turn dry numbers into actionable insights. You can easily build or choose a Narrative that reflects your outlook on Cactus, relying on your own or consensus assumptions about the company’s growth, challenges, and industry trends. This makes it simple for you to see how changes in forecasts, margins, or market risks shift the company’s fair value and whether its share price looks attractive or not.

Because Narratives update automatically when new news or earnings emerge, you’re always working with the latest, most relevant information. This empowers you to confidently decide when to buy or sell based on how your Narrative’s fair value compares with today’s share price.

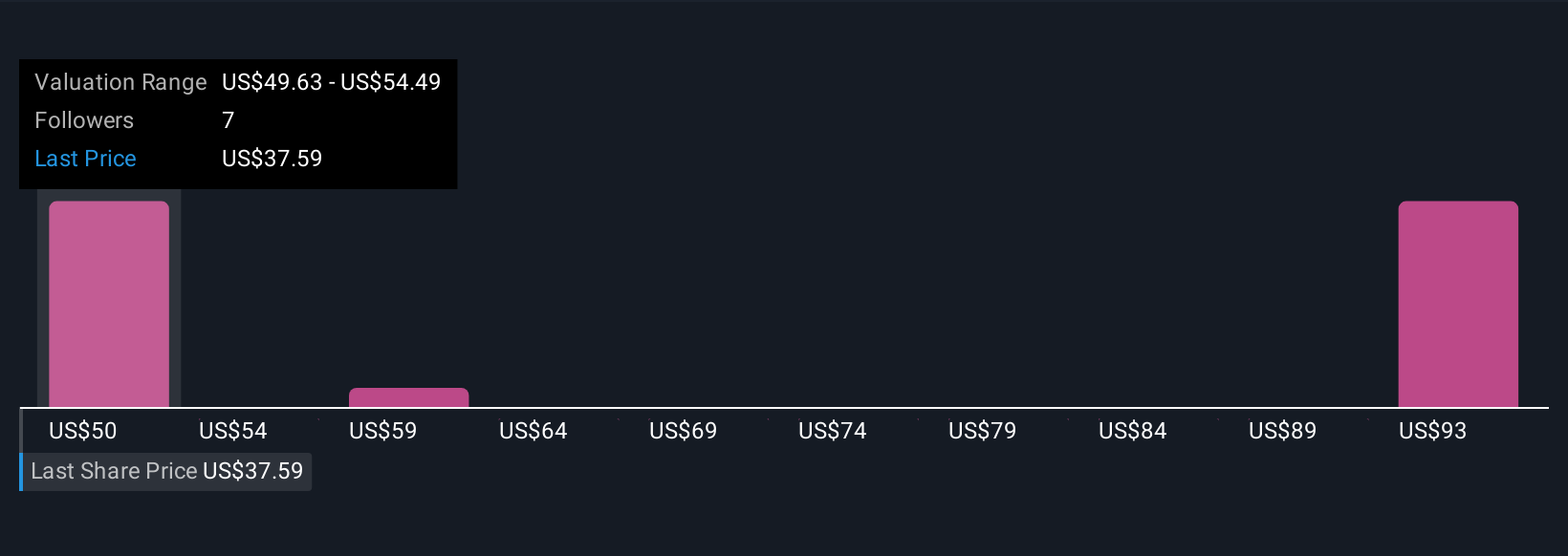

- One investor’s Narrative might see Cactus expanding rapidly in the Middle East, forecasting strong revenue growth and setting a bullish fair value of $56.0 per share.

- Another might worry about rising costs and industry headwinds, landing on a more cautious fair value of $39.0.

Do you think there's more to the story for Cactus? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal