Why Dragonfly Energy (DFLI) Stock Is Up 100% This Week

Shares of Dragonfly Energy Holdings Corp (NASDAQ:DFLI) are trading higher Friday morning. The stock is higher by 100% this week after the company announced it has been selected by Nevada Tech Hub for first-round funding. The contract is currently being finalized.

What To Know: The funding will support the advancement of Dragonfly’s battery manufacturing capabilities and workforce development. The award, expected to be approximately $300,000, will be used to modernize production systems, upgrade the company’s Battle Born Batteries manufacturing lines and work toward ISO 9001 certification. These initiatives are expected to improve efficiency and reduce costs.

Nevada Tech Hub is a federally designated entity focused on supporting the state’s lithium battery and critical materials ecosystem.

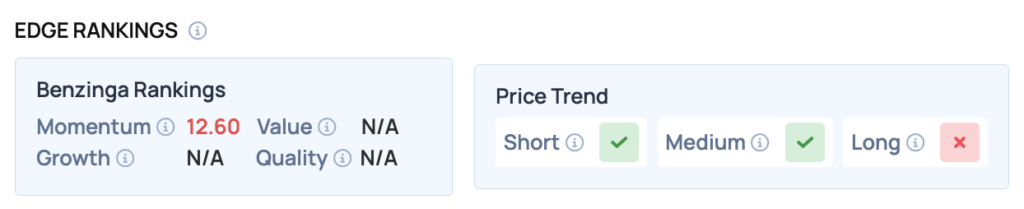

Benzinga Edge Rankings: Reflecting this news, the stock’s Benzinga Edge rankings show a Momentum score of 12.60 and a positive short and medium-term price trend.

DFLI Price Action: Dragonfly Energy shares were up 28% at $1.38 at the time of publication Friday, according to Benzinga Pro.

Read Also: USA Rare Earth Stock Jumps On White House Talks — Will Trump Take A Stake?

How To Buy DFLI Stock

By now you're likely curious about how to participate in the market for Dragonfly Energy – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

In the case of Dragonfly Energy, which is trading at $1.38 as of publishing time, $100 would buy you 72.46 shares of stock.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal