Why Acadia Healthcare (ACHC) Is in Focus After Activist Calls for Strategic Review and Board Reforms

- In recent weeks, activist investors Khrom Capital Management and Engine Capital have called on Acadia Healthcare's Board to pursue a formal review of strategic alternatives, including a possible sale, and implement sweeping governance reforms, citing ongoing concerns over underperformance and decision-making.

- This public escalation shines a spotlight on growing shareholder dissatisfaction and raises the pressure on Acadia Healthcare’s leadership to address long-standing management and operational issues.

- We'll assess how heightened activist involvement and demands for a strategic review could influence Acadia Healthcare's future investment outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Acadia Healthcare Company Investment Narrative Recap

For shareholders of Acadia Healthcare, the key investment thesis rests on its ability to capture sustained growth from rising behavioral health demand and improved operating efficiency. Recent activist pressure for a strategic review has brought near-term uncertainty, yet unless the Board responds decisively, these events may not materially alter the main business catalyst: restoring consistent earnings growth through better facility performance. The biggest risk remains ongoing operational headwinds and underperforming locations that continue to weigh on earnings and sentiment.

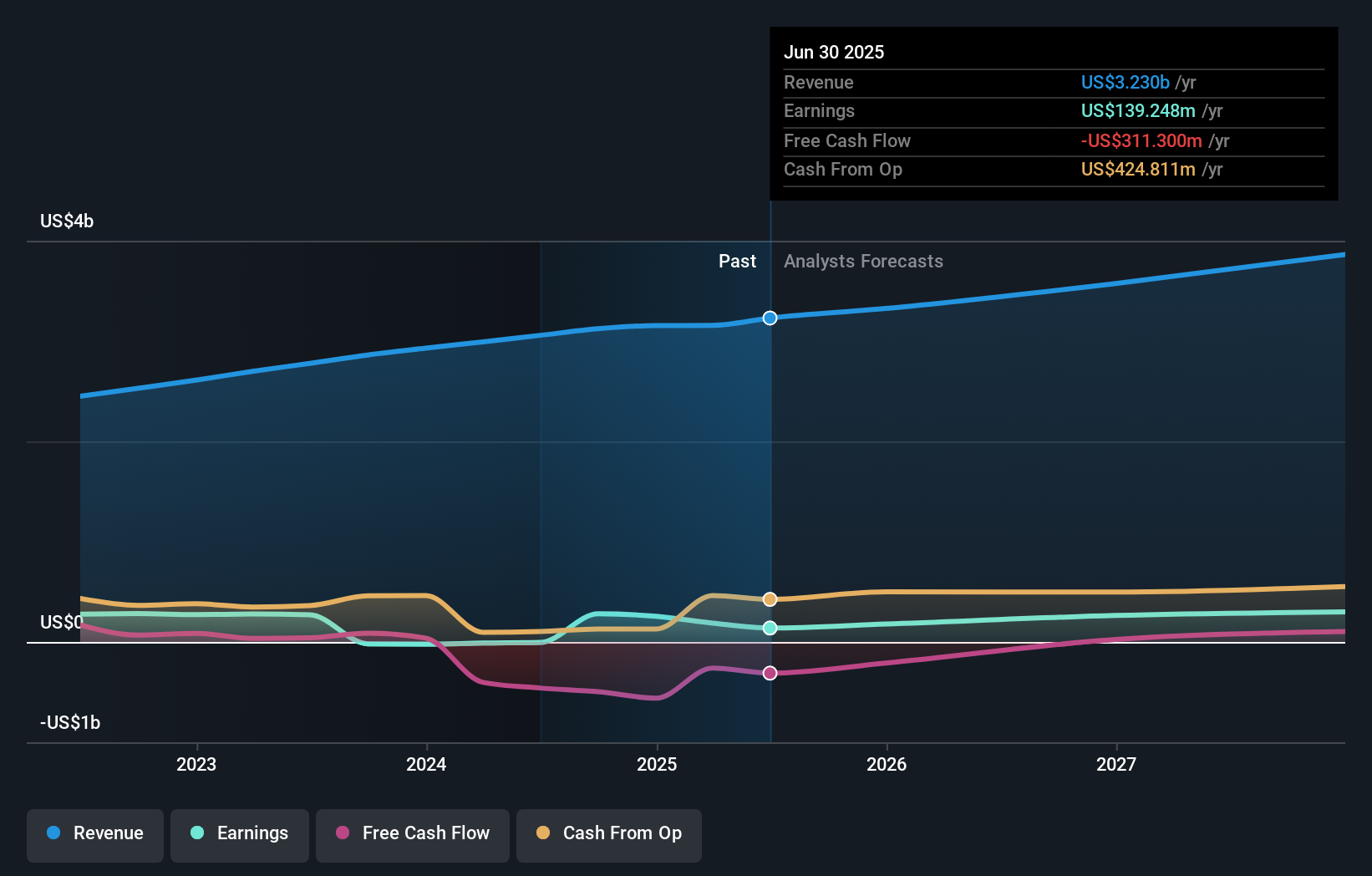

Among recent developments, the latest quarterly earnings report is especially relevant, as it underlines the operational pressure activists are citing. Despite higher quarterly revenues of US$869.23 million, net income dropped sharply to US$30.13 million, highlighting challenges in cost management and execution that could delay or diminish the earnings recovery that many investors view as critical.

By contrast, investors should also consider potential disruption if board-level governance changes stall or fail to address...

Read the full narrative on Acadia Healthcare Company (it's free!)

Acadia Healthcare Company's narrative projects $4.1 billion revenue and $322.9 million earnings by 2028. This requires 8.3% yearly revenue growth and a $183.7 million earnings increase from $139.2 million today.

Uncover how Acadia Healthcare Company's forecasts yield a $30.43 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Just one fair value estimate from the Simply Wall St Community is available at US$30.43, reflecting minimal divergence in views so far. With activist demands growing and earnings under strain, you may want to compare several alternative outlooks before forming your own view.

Explore another fair value estimate on Acadia Healthcare Company - why the stock might be worth just $30.43!

Build Your Own Acadia Healthcare Company Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Acadia Healthcare Company research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Acadia Healthcare Company research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Acadia Healthcare Company's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 32 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal