Should You Reconsider Walmart Shares After Prescription Delivery Expansion in 2025?

If you are weighing what to do with Walmart stock right now, you are not alone. It is a reasonable question, especially after a year when Walmart shares have surged 27.7% and are up more than 13% so far this year. Even with a slight dip of 1.3% this past week, the overall trajectory has been consistently upward. Long-term holders have seen more than a doubling since 2021, with a remarkable 140.7% return in three years. So, are you late to the party or is there meaningful upside left?

Walmart is far from standing still. The company keeps making headlines, from adopting sensors to streamline grocery logistics, to announcing plans for AI that could transform every job across its massive workforce. And just recently, Walmart introduced home delivery of refrigerated prescriptions, bringing medicines like Ozempic directly to customers' doors. These kinds of moves not only boost operational efficiency but also open doors to new revenue streams, helping explain why investors remain so interested.

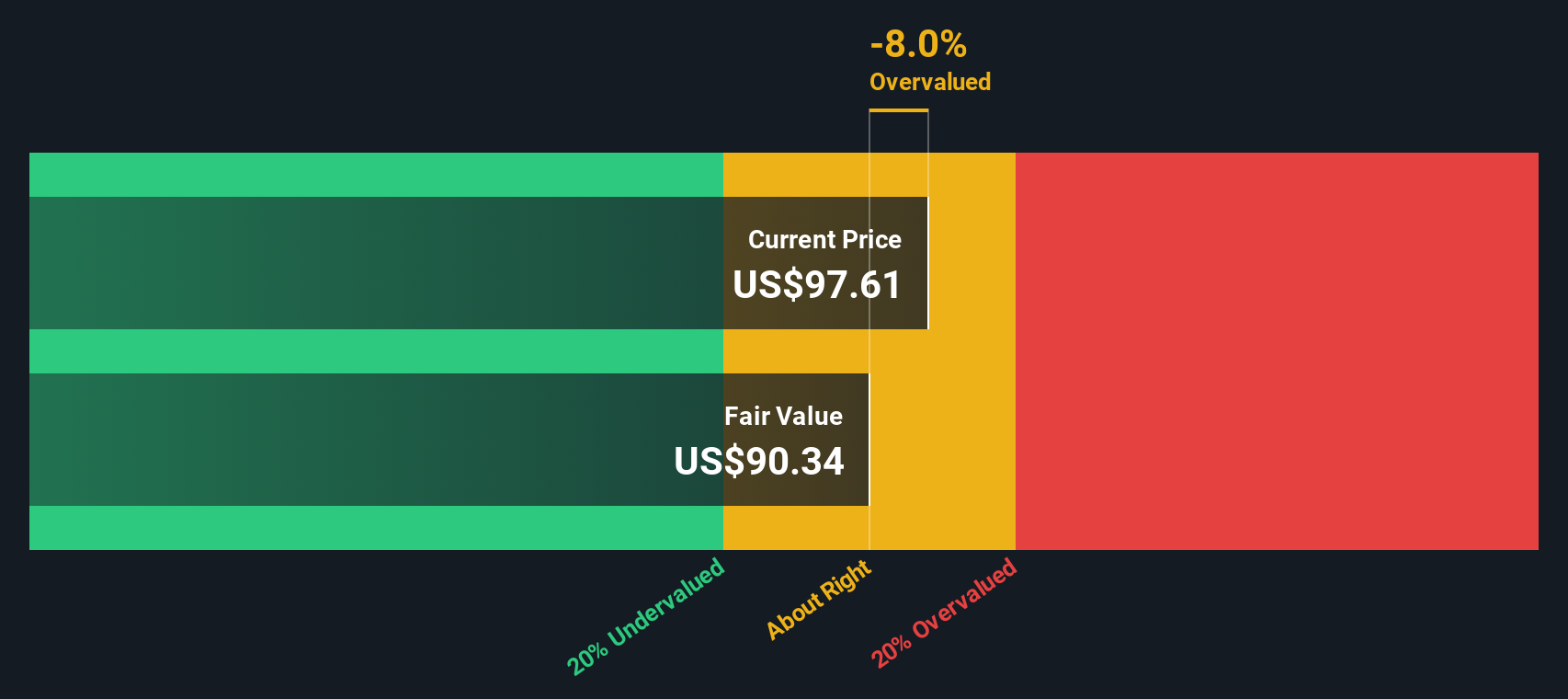

However, the pivotal question remains: are you paying a fair price for all this growth and innovation, or is the stock getting ahead of itself? By one composite valuation score, Walmart is currently undervalued in just 1 out of 6 common valuation checks. That means the market is already pricing in a lot of future optimism.

Next, we are going to break down exactly what these valuation checks mean for Walmart and how to interpret each one. Before we wrap up, we will also highlight a potentially more insightful way to think about Walmart’s true worth, so stay tuned.

Walmart scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Walmart Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting those amounts back to today's dollars. This approach aims to uncover what Walmart might actually be worth, based on cash generated over time rather than just surface-level metrics.

Walmart currently generates Free Cash Flow (FCF) of about $15.7 billion, and analysts forecast that number could accelerate, reaching $30.98 billion by 2030. While professional analysts only project the next five years, longer-range figures are extrapolated to gauge potential. Year after year, these cash flows are estimated and then adjusted for the time value of money, since future dollars are worth less than dollars in hand today. All numbers are calculated in US dollars ($).

After tallying and discounting all of Walmart’s projected cash flows, the model pegs the company’s fair value at $106.59 per share. With the stock currently trading at just a 4.6% premium to this estimate, Walmart appears to be priced about right when judged purely by cash flow projections.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out Walmart's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

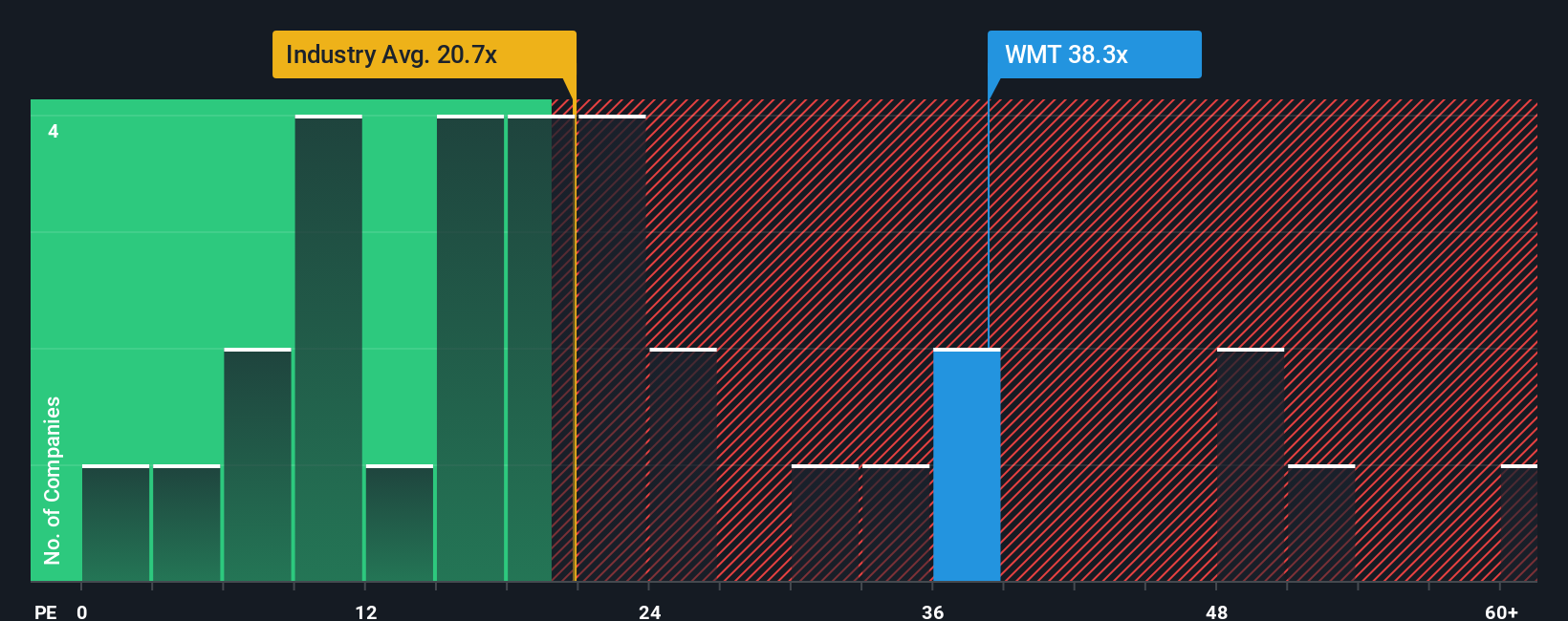

Approach 2: Walmart Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is widely regarded as the go-to metric for valuing profitable companies like Walmart. This is because it relates a company’s current share price to its earnings, offering a direct way to judge how much investors are willing to pay for each dollar of profit.

Interpreting the right PE ratio, however, requires context. Higher growth expectations or lower risk tend to justify a higher PE, as investors anticipate future gains or have greater confidence in steady returns. On the other hand, higher risk or minimal growth should result in a lower "fair" PE, reflecting greater uncertainty about the future.

Walmart currently trades at a PE of 38x, while the average for its peers is around 25x and the broader Consumer Retailing industry averages about 21x. These benchmarks suggest Walmart is priced well above the norm. However, Simply Wall St’s proprietary "Fair Ratio" for Walmart lands at 31.90x. This custom benchmark takes into account Walmart’s earnings growth, industry, profit margins, market size, and risk profile, making it far more tailored than a broad industry comparison. Because the Fair Ratio is uniquely modeled to the company, it offers a more nuanced view than simply looking at peers or sector averages alone.

Comparing Walmart’s actual PE and its Fair Ratio, the stock’s current valuation is somewhat elevated, as the difference is more than a fractional gap. This suggests investors are paying a notable premium, with the PE exceeding what the fundamentals currently justify.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walmart Narrative

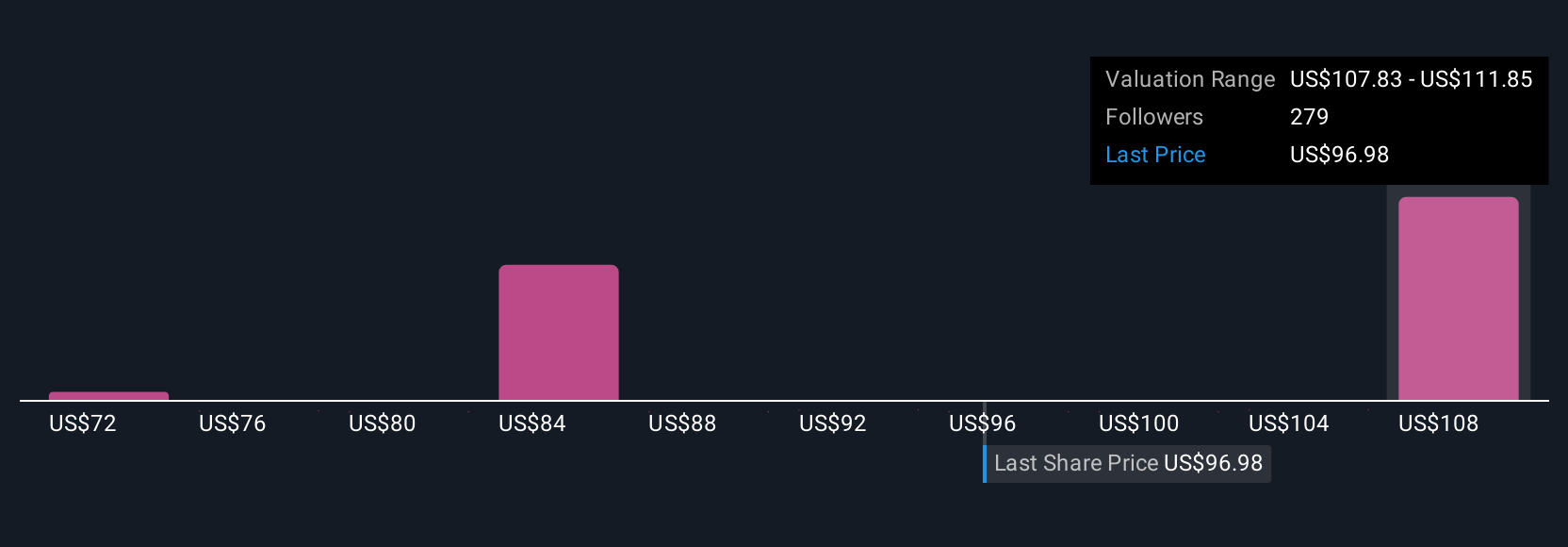

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, yet powerful, way to tell your story about a company by combining your personal perspective on Walmart’s future with numbers like fair value, expected revenue, profit growth, and profit margins. Narratives help you go beyond the basics, linking the big picture (“Why is Walmart special?”) with your own financial forecast and, ultimately, a fair value estimate for the stock.

On Simply Wall St’s Community page, Narratives are easy to use and designed so that anyone, from new investors to experienced analysts, can build and share their view. They work by letting you compare your calculated fair value for Walmart to its current share price, so you can clearly see if your story justifies a buy, hold, or sell decision. Narratives also automatically update as new earnings or news arrive, saving you from out-of-date assumptions.

For Walmart, some investors might see unstoppable omni-channel growth, new high-margin ventures, and technology leadership, driving fair value estimates as high as $127 per share. Others may focus on expenses, international risks, and competition, leading to a more cautious view and fair values as low as $64. Narratives let you quickly see where your conviction fits on this spectrum, making smarter decisions easier.

Do you think there's more to the story for Walmart? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal