Casey's General Stores (CASY): Reassessing Valuation After Analyst Upgrades and Bold New Growth Plans

Casey’s General Stores (CASY) has caught fresh investor attention following a series of analyst upgrades and positive signals on its growth plans. The company confirmed ambitious new store openings, continued share repurchases, and reaffirmed its outlook.

See our latest analysis for Casey's General Stores.

After a year of steady company milestones, including new market entries in Michigan and the doubling down on youth partnerships, Casey's General Stores is seeing some clear signs of building momentum. The recent reaffirmation of long-term growth goals and ongoing share buybacks have coincided with growing investor confidence, as shown in the solid 12-month total shareholder return of 54% and the company’s ability to outperform peers over multiple years.

If you’re watching for companies with rising momentum, it could be an ideal time to broaden your outlook and discover fast growing stocks with high insider ownership

Even with these impressive gains and ambitious expansion plans, the key question for investors remains: is Casey’s current valuation still leaving room for future upside, or has the market already factored in all the growth ahead?

Most Popular Narrative: 1.7% Undervalued

Casey’s General Stores is trading just below the narrative’s calculated fair value, with the last close price slightly under the estimated target. This tight margin draws attention to the underlying growth factors and future profit expectations supporting the valuation model.

Strategic investments in digital platforms (nearly 9.5 million Rewards members, personalized promotions), analytics, and targeted guest engagement lay the groundwork for higher frequency, bigger basket sizes, and incremental revenue, as digital adoption rises in convenience retail.

Want to see which bold projections drive this price? The real story is about aggressive digital growth, soaring engagement, and future earnings power. Find out what makes analysts believe Casey’s deserves a premium retail multiple. See the full picture in the narrative for all the figures and tension points.

Result: Fair Value of $571.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, including potential delays in synergy gains from new acquisitions and Casey’s heavy regional concentration. Both factors could impact future growth.

Find out about the key risks to this Casey's General Stores narrative.

Another View: Caution from Market Comparisons

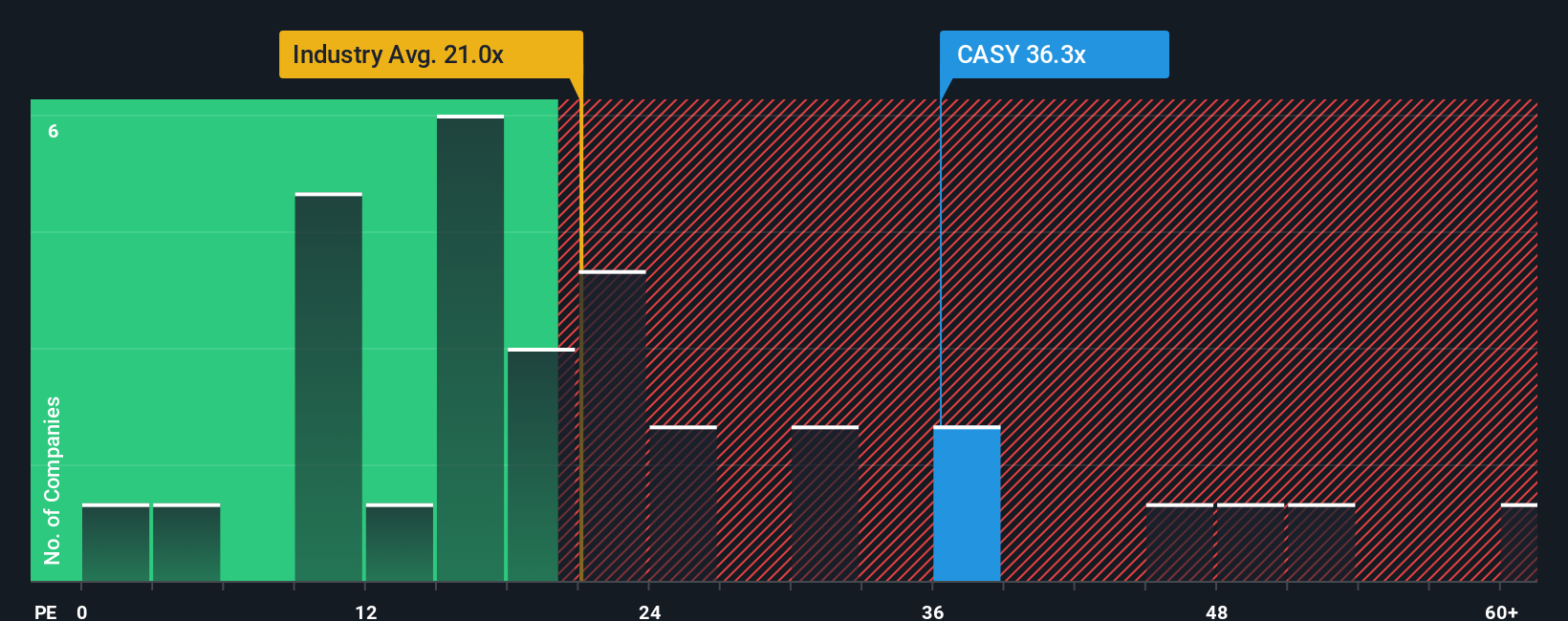

Looking at Casey’s through a price-to-earnings lens paints a less optimistic picture. The company is trading at 35.9x earnings, which is significantly higher than the 20.6x industry average, the 17.3x peer average, and even its own fair ratio of 21.4x. This suggests the market is pricing in strong future growth, but it could also mean investors are taking on more valuation risk. Is this premium really justified, or are expectations running too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Casey's General Stores Narrative

If you see things differently or want to test your own insights, you can quickly build your own perspective from the latest numbers in just a few minutes, then Do it your way

A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Miss out on the best opportunities and you leave potential gains on the table. Use these smart shortcuts to immediately access high-potential stocks tailored to different themes.

- Capitalize on market upswings by tapping into these 909 undervalued stocks based on cash flows, selected for strong cash flow prospects and attractive entry points.

- Jump ahead of industry trends and spot breakthrough innovators among these 24 AI penny stocks, leveraging the power of artificial intelligence in real-world businesses.

- Secure consistent payouts for your portfolio by choosing from these 19 dividend stocks with yields > 3%, which offer reliable and above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal