What Schlumberger (SLB)'s Brazil Ultra-Deepwater Tech Contract Win Means For Shareholders

- On September 25, 2025, Petrobras awarded Schlumberger a major contract to provide advanced completion technologies and digital solutions for up to 35 ultra-deepwater wells in Brazil's Santos Basin, with completions work scheduled to begin in mid-2026.

- This contract highlights Schlumberger's expanding role in high-tech offshore operations and underscores its ongoing momentum in deploying digital oilfield solutions in resource-rich environments.

- We'll examine how this significant contract win expands Schlumberger's presence in Brazil and its implications for the company's investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Schlumberger Investment Narrative Recap

To be a Schlumberger shareholder today, you need to believe that sustained global investment in complex, high-tech energy infrastructure will outweigh cyclical pressures in shorter-cycle markets. The sizable Petrobras win reinforces Schlumberger’s international growth ambitions and digital expansion, but by itself, it does not fundamentally alter the near-term risk tied to declining upstream spending in North America or ongoing macro uncertainty.

The launch of Electris, Schlumberger’s digitally enabled electric completions portfolio in May 2025, is particularly relevant to this Petrobras contract, as that same technology is being deployed to enhance production control in these challenging ultra-deepwater wells, supporting the company’s positioning in providing high-value digital oilfield solutions that may help buffer some cyclical volatility.

But while this international contract pushes growth, investors should also be mindful that global operator spending cuts could still trigger earnings volatility in the quarters ahead if...

Read the full narrative on Schlumberger (it's free!)

Schlumberger's outlook anticipates $38.7 billion in revenue and $4.9 billion in earnings by 2028. Achieving this will require 2.9% annual revenue growth and an $0.8 billion increase in earnings from the current $4.1 billion.

Uncover how Schlumberger's forecasts yield a $46.69 fair value, a 37% upside to its current price.

Exploring Other Perspectives

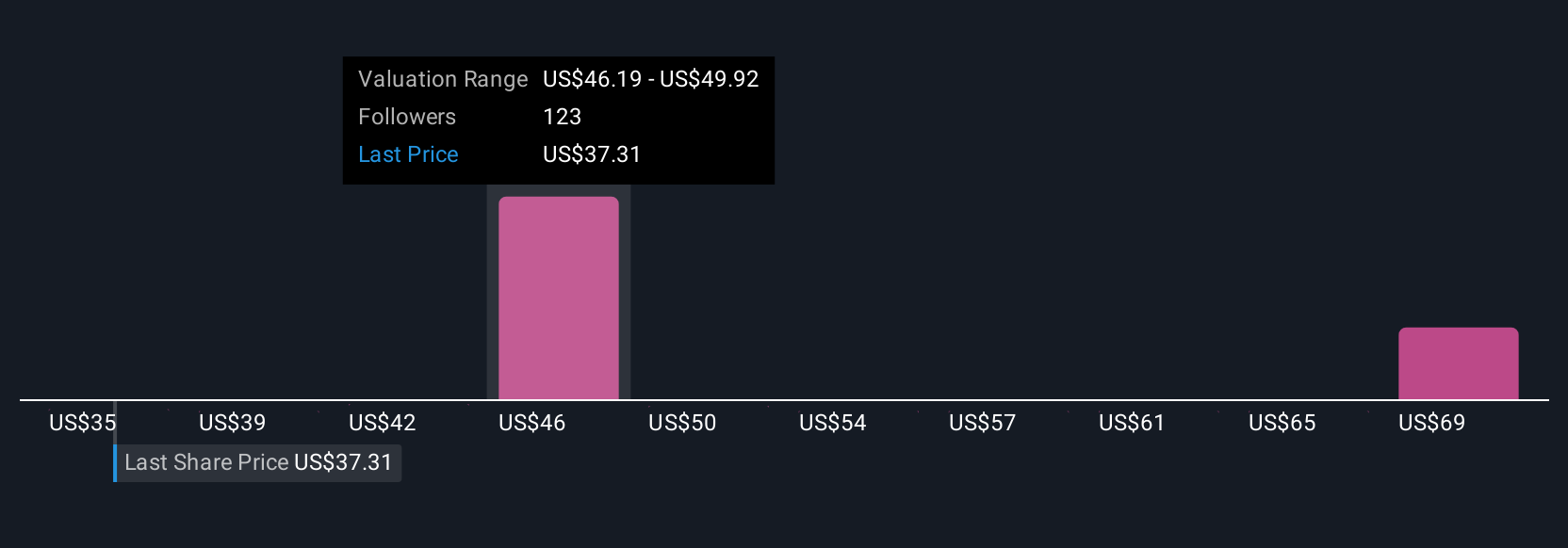

Thirteen private investors in the Simply Wall St Community estimate Schlumberger’s fair value ranges widely from US$36 to US$67 per share. As offshore demand grows, however, the risk from potential operator spending cuts continues to shape the company’s earnings path, explore how your view compares.

Explore 13 other fair value estimates on Schlumberger - why the stock might be worth as much as 97% more than the current price!

Build Your Own Schlumberger Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Schlumberger research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Schlumberger research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Schlumberger's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal