Phillips 66 (PSX): Evaluating Valuation After Analyst Upgrades and Rising Earnings Estimates

Phillips 66 (PSX) has caught investors’ attention after a series of upgrades to a Zacks Rank #1. Recent increases in earnings estimates point to a more optimistic outlook for the company.

See our latest analysis for Phillips 66.

Phillips 66 has been making headlines with steady upgrades and strong earnings outlooks. However, the share price return over the past year reflects only a modest climb, hinting that excitement is building more around its future growth and improving fundamentals than quick wins for recent shareholders. Long-term investors have seen significant benefits, with total shareholder returns over the past three and five years well outpacing many peers. This signals that optimism around recent upgrades may have room to build further.

If you’re interested in what else could be gaining momentum, now’s the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With such analyst enthusiasm and improving fundamentals, investors may wonder whether Phillips 66 is trading at a bargain compared to its potential, or if the market has already factored in all of the good news, leaving limited room for upside.

Most Popular Narrative: 49.8% Undervalued

According to mschoen25, there is a substantial difference between the narrative’s fair value estimate and the latest share price. This suggests significant room for upside if the narrative’s assumptions play out. This context sets the stage for the narrative’s argument that Phillips 66 may be overlooked by the market.

Phillips 66 is a major player in the energy sector, particularly in refining, marketing, and transportation. Analysts often look at the company's ability to capitalize on operational efficiencies, asset optimization, and its integrated business model to improve profitability.

Wonder how a company with such a big discount to its fair value earns that bold status? The narrative is driven by aggressive assumptions on future margin expansion and a higher profit multiple. Curious which numbers create this valuation gap? Dive in to uncover the financial logic that supports this eye-catching price target.

Result: Fair Value of $268.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting market dynamics or unexpected operational setbacks could quickly challenge the optimism behind Phillips 66’s current undervalued thesis.

Find out about the key risks to this Phillips 66 narrative.

Another View: Market Multiples Suggest a Different Story

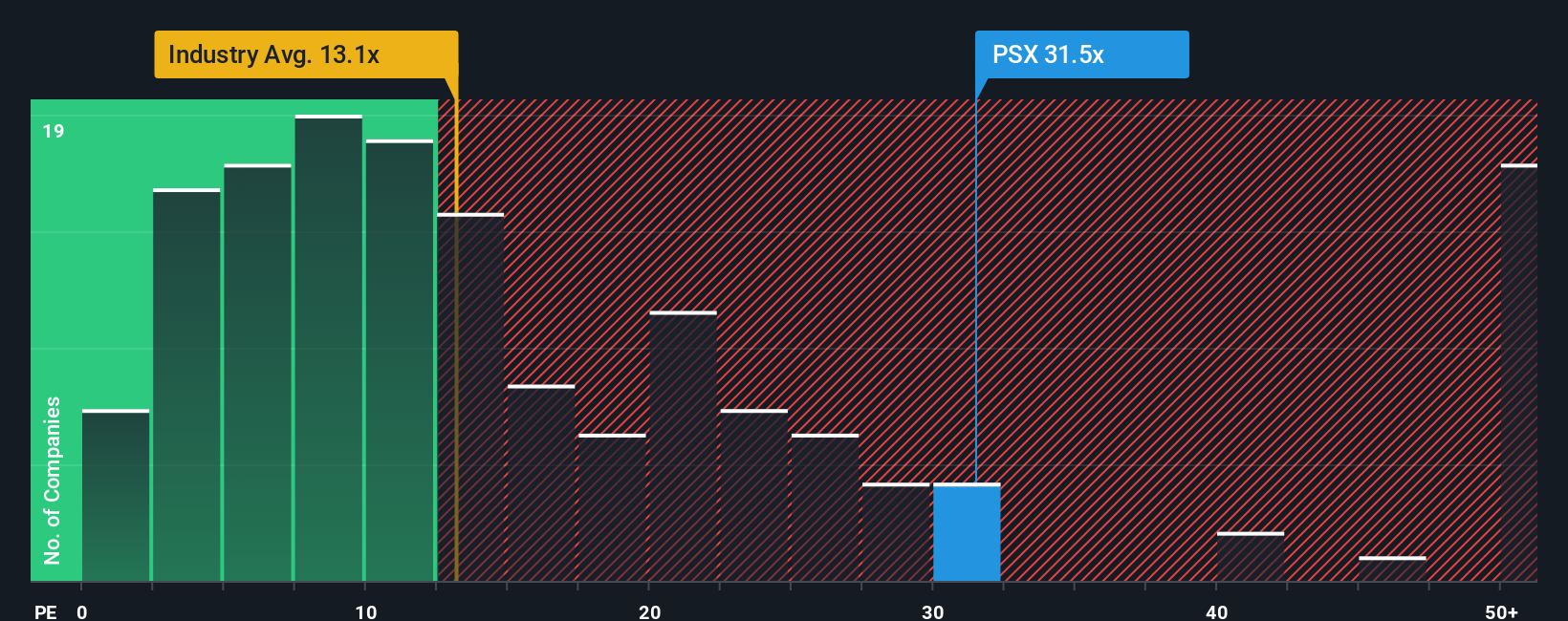

While some see Phillips 66 as attractively undervalued, its price-to-earnings ratio presents a more cautious perspective. The company trades at 31.9x, which is well above the industry average of 13.5x and a fair ratio of 22.2x. This premium could indicate either optimism or possible overvaluation. Which narrative will play out?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Phillips 66 Narrative

If you have your own perspective on the numbers or want to look deeper into the story, you can easily craft your narrative in just a few minutes. Do it your way

A great starting point for your Phillips 66 research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t just stop with Phillips 66. Expand your investment horizons and get ahead by tapping into new opportunities the market has to offer. Let’s make sure you’re in the best position to spot the next hidden gem.

- Capitalize on breakthrough tech innovations and amp up your portfolio by checking out these 24 AI penny stocks making moves in artificial intelligence.

- Earn steady income while growing your wealth by sizing up these 19 dividend stocks with yields > 3% boasting reliable yields over 3%.

- Ride the momentum of undervalued opportunities before the crowd catches on by targeting these 909 undervalued stocks based on cash flows delivering strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal