A Fresh Look at Revvity (RVTY) Valuation After Sanofi Partnership in Early Diabetes Screening

Revvity (NYSE:RVTY) has just announced a partnership with Sanofi to expand its type 1 diabetes diagnostic offerings. The companies aim to roll out a 4-plex assay for early T1D detection on a global scale.

See our latest analysis for Revvity.

Revvity has been rolling out meaningful partnerships and product launches lately, yet the broader market hasn't fully responded. After getting dropped from the FTSE All-World Index in September and unveiling its AI-powered Living Image platform, the company's share price has mostly drifted sideways. Over the past year, Revvity's total shareholder return is down about 26%, with longer-term returns also in the red. With momentum still muted, investors appear to be waiting for these strategic moves to translate into more visible growth or improved sentiment.

If Revvity's updates in diagnostics and bio-innovation have you curious, this could be the perfect moment to explore other healthcare stocks making big moves. See the full list for free.

So, with Revvity showing long-term share price declines while trading at a substantial discount to analyst targets, is this a hidden value play, or is the market already factoring in the company's future diagnostics growth?

Most Popular Narrative: 20.6% Undervalued

Despite closing at $91.46, the most popular narrative puts Revvity's fair value closer to $115.19, indicating a strong upside if the company hits its targets. This outlook instantly grabs attention as it suggests current prices may not reflect the company's earnings potential.

*Ongoing shift in product mix toward higher-margin, software-enabled and consumables-driven offerings (e.g., SaaS Signals, reagents, new IDS i20 platform), along with structural cost actions, are expected to materially expand operating and net margins. 2026 is set to start at a higher 28% operating margin baseline.*

What is really behind this bold valuation? The narrative leans heavily on expanding profit margins and steady top-line growth, along with an operating margin target that turns heads. Want to see which ambitious financial leaps are baked into that price target? The playbook behind this call is more surprising than you might guess.

Result: Fair Value of $115.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory changes in China and ongoing weakness in government-funded markets could easily derail expectations for Revvity’s recovery narrative.

Find out about the key risks to this Revvity narrative.

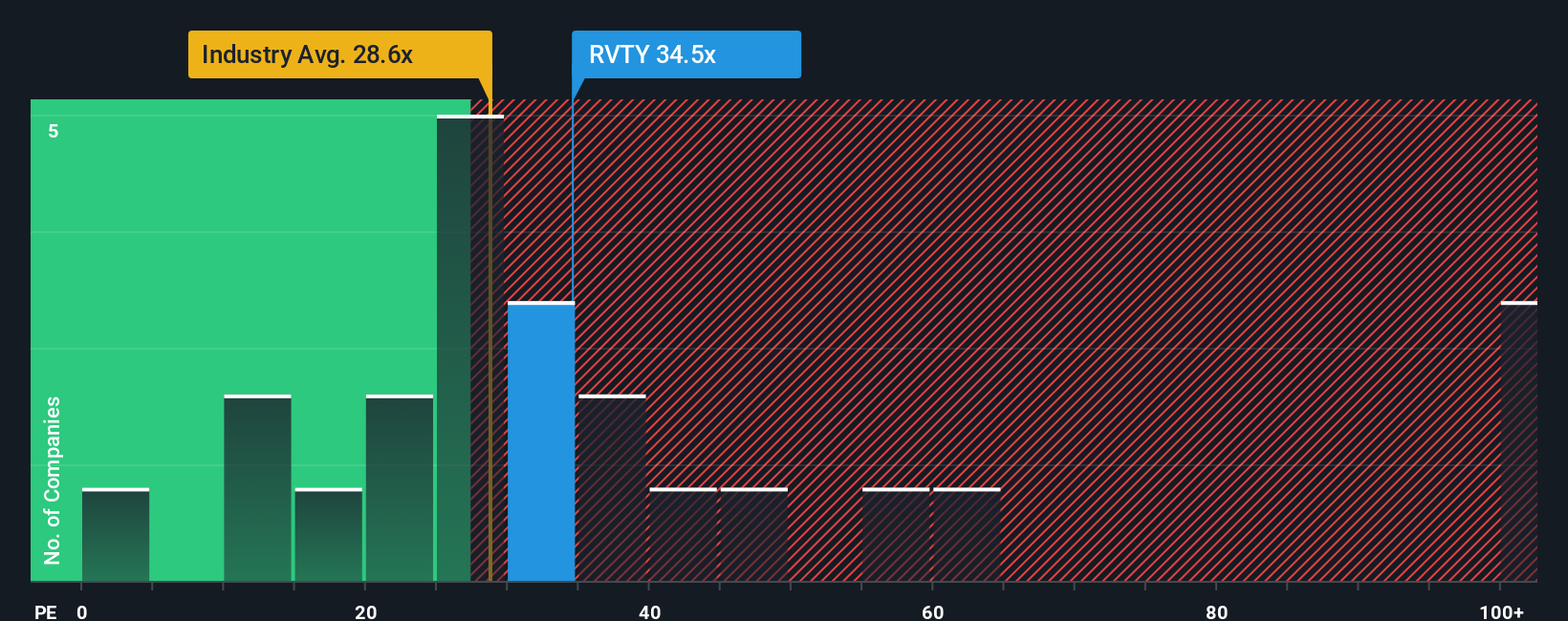

Another View: Price-Based Valuation Sends Mixed Signals

Looking at valuation through the lens of earnings, Revvity’s shares trade at a price-to-earnings ratio of 38.1x. This stands above the US Life Sciences industry average of 32.2x and also surpasses the fair ratio of 23.2x that our analysis suggests the market could revert towards. While Revvity looks attractively priced compared to some high-flying peers, this gap signals real risk if sentiment or expectations shift. This raises a critical question: will the company deliver enough growth to justify this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revvity Narrative

If you see the story differently, or want to dig into the numbers firsthand, you can build your own take in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Revvity.

Looking for more investment ideas?

Don't let opportunities pass you by. If you want potential upside and smart portfolio moves, it's time to go beyond the usual names. The Simply Wall Street Screener makes it easy to spot underappreciated stocks with real growth or yield on the horizon.

- Spot overlooked gems that could be the next big movers when you check out these 3568 penny stocks with strong financials.

- Capitalize on the future of healthcare breakthroughs by browsing these 31 healthcare AI stocks.

- Start building lasting returns with steady payouts. Explore these 19 dividend stocks with yields > 3% to find income-focused opportunities with strong fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal