How Investors May Respond To Nucor (NUE) Securing Nuclear-Grade Steel Supply for U.S. Energy Revitalization

- In late September 2025, The Nuclear Company announced a partnership with Nucor Corporation to revitalize the U.S. nuclear supply chain by evaluating the production of steel materials that meet strict NQA-1 certification standards. This collaboration directly supports federal goals for expanding domestic nuclear infrastructure and manufacturing capabilities in response to recent executive orders.

- An interesting aspect of this agreement is its focus on securing American-made, nuclear-grade steel, which could position both companies at the center of a renewed national effort to modernize energy infrastructure and spur reinvestment in domestic manufacturing.

- We'll now explore how Nucor's commitment to supplying nuclear-grade steel may reshape its investment narrative and future growth outlook.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Nucor Investment Narrative Recap

To be a Nucor shareholder today, you have to believe in the future of American infrastructure investment and the company’s ability to compete in specialized, high-certification steel markets such as nuclear energy. While the recent partnership with The Nuclear Company aligns Nucor with a major national initiative, it does not immediately resolve the most important short-term catalyst, the company’s margin compression amid softer steel demand, nor does it remove near-term risks like earnings volatility tied to input costs.

The recent announcement of Q3 2025 earnings guidance, which forecast lower earnings per share compared to the previous quarter, is particularly relevant. It reflects the immediate challenge of compressed margins, which remains a key focal point for investors even as Nucor positions itself for longer-term growth through new strategic partnerships and capacity expansions.

In contrast, with input costs still a moving target, investors should also be aware of ...

Read the full narrative on Nucor (it's free!)

Nucor's narrative projects $37.2 billion revenue and $3.7 billion earnings by 2028. This requires 6.5% yearly revenue growth and a $2.4 billion increase in earnings from $1.3 billion today.

Uncover how Nucor's forecasts yield a $159.75 fair value, a 15% upside to its current price.

Exploring Other Perspectives

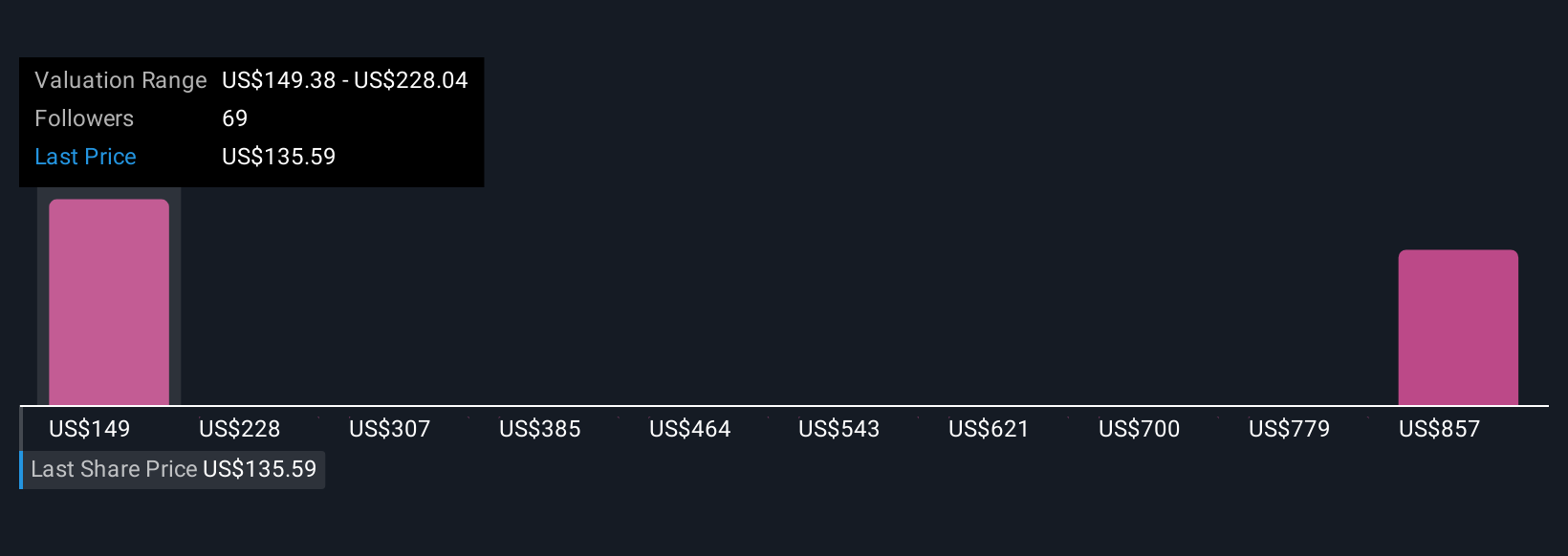

Seven different fair value estimates from the Simply Wall St Community for Nucor span from US$149.38 up to US$948.31 per share. Investors express widely different views, and recent earnings guidance highlighting margin pressures adds important context to consider before forming your own outlook.

Explore 7 other fair value estimates on Nucor - why the stock might be worth over 6x more than the current price!

Build Your Own Nucor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nucor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nucor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nucor's overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal