Will Chord Energy’s (CHRD) $750 Million Debt Deal Redefine Its Growth Path?

- Chord Energy Corporation recently completed a US$750 million offering of 6.000% senior unsecured notes due 2030, with proceeds allocated for asset acquisitions in the Williston Basin, related expenditures, and general corporate needs.

- This significant capital raise through debt signals the company's intention to pursue expansion and operational growth, potentially reshaping its asset base and future capital structure.

- We'll explore how the new US$750 million debt financing for acquisitions could alter Chord Energy's investment narrative and growth prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Chord Energy Investment Narrative Recap

To own shares of Chord Energy, an investor needs to believe in the long-term value of concentrated Williston Basin assets and management's ability to use acquisitions to drive efficiency and free cash flow. The recent US$750 million debt raise for acquisitions could act as a short-term catalyst if it leads to meaningful volume growth or margin improvement, though it also increases exposure to the risk of operational disruptions or regulatory tightening in this single region.

Of the company’s recent announcements, the pending acquisition of oil and gas assets from XTO Energy stands out. This move ties directly to the new debt issuance, signaling a commitment to reinvest in core operations and potentially address the persistent challenge of high production declines at shale wells, which if mitigated, could improve near-term output and ease pressure on margins.

But if regional risks do materialize or new regulations tighten faster than expected, investors should be aware that...

Read the full narrative on Chord Energy (it's free!)

Chord Energy's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This scenario implies a 4.3% annual revenue decline and an earnings increase of $734 million from current earnings of $265.7 million.

Uncover how Chord Energy's forecasts yield a $135.07 fair value, a 39% upside to its current price.

Exploring Other Perspectives

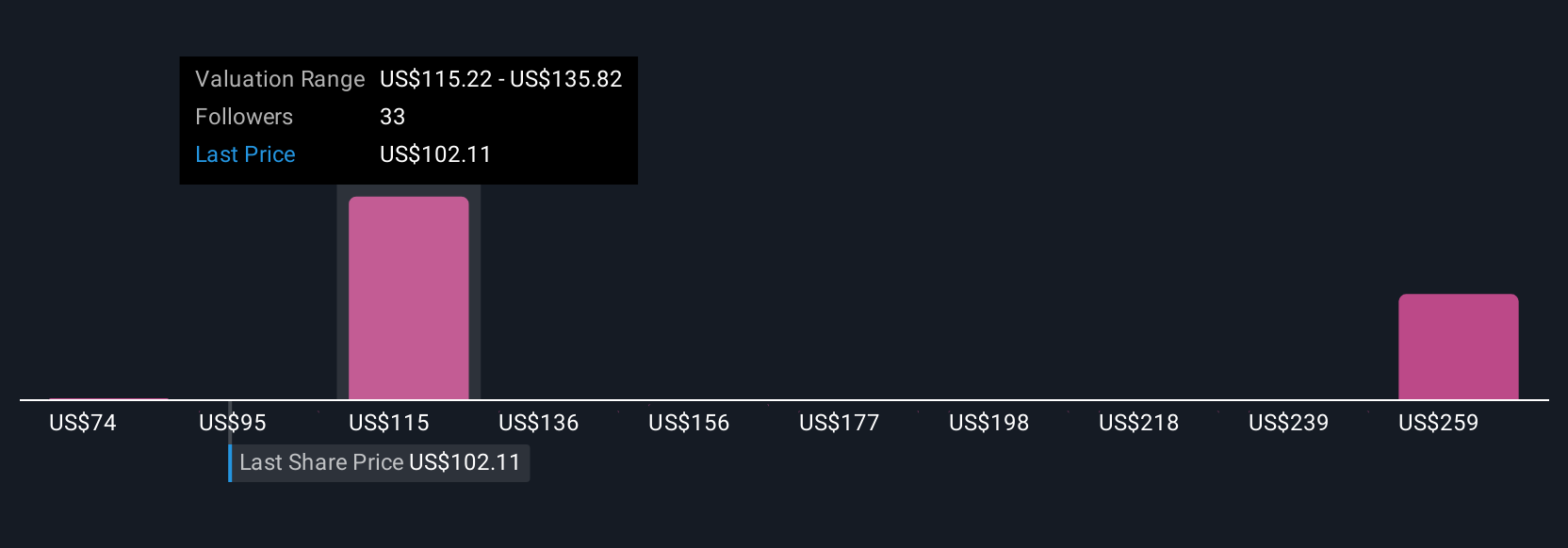

Simply Wall St Community members provided five unique fair value estimates for Chord Energy, ranging widely from US$74 to over US$424 per share. While acquisition-driven growth could support optimistic outlooks, concentrated regional exposure means market participants may weigh risks very differently, see how these varied perspectives stack up against your own.

Explore 5 other fair value estimates on Chord Energy - why the stock might be worth over 4x more than the current price!

Build Your Own Chord Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chord Energy research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Chord Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chord Energy's overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal