Why Harmonic (HLIT) Is Up 7.1% After Winning Major Broadband Partnership With Comcast

- On September 29, Comcast announced it is partnering with Harmonic to expand fiber broadband access in new markets, leveraging Harmonic’s cOS virtualized broadband platform and network edge devices to deliver multi-gigabit symmetrical broadband to both residential and commercial customers.

- This collaboration showcases the rising adoption of Harmonic’s technology by major broadband operators and underscores its role in supporting cost-effective, rapid network expansion across both fiber and coax infrastructure, including rural deployments and BEAD-funded projects.

- We’ll explore how winning a large-scale Comcast partnership for next-gen broadband platforms may influence Harmonic’s long-term investment outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Harmonic Investment Narrative Recap

Owning Harmonic stock requires confidence in a multi-year global broadband network upgrade cycle and the company’s ability to extend market leadership, especially with key operators like Comcast. The recent Comcast partnership directly addresses Harmonic's biggest short-term catalyst, continued customer wins driving technology adoption. However, reliance on large customers, particularly Comcast (39% of recent revenue), remains the most important risk, as changes to Comcast’s purchasing plans could materially impact results.

Among the recent company updates, Harmonic's joint demonstration with Mediacom of real-world DOCSIS 4.0 deployments stands out for its relevance. This announcement reinforces Harmonic’s position in next-generation broadband and supports the same technology platform used in the Comcast agreement, underlining tangible momentum for Harmonic’s core catalysts.

By contrast, investors should carefully consider just how much revenue concentration with one customer could expose Harmonic to ...

Read the full narrative on Harmonic (it's free!)

Harmonic's narrative projects $695.5 million revenue and $70.6 million earnings by 2028. This requires a 0.3% annual revenue decline and a $2 million earnings increase from $68.6 million today.

Uncover how Harmonic's forecasts yield a $10.50 fair value, in line with its current price.

Exploring Other Perspectives

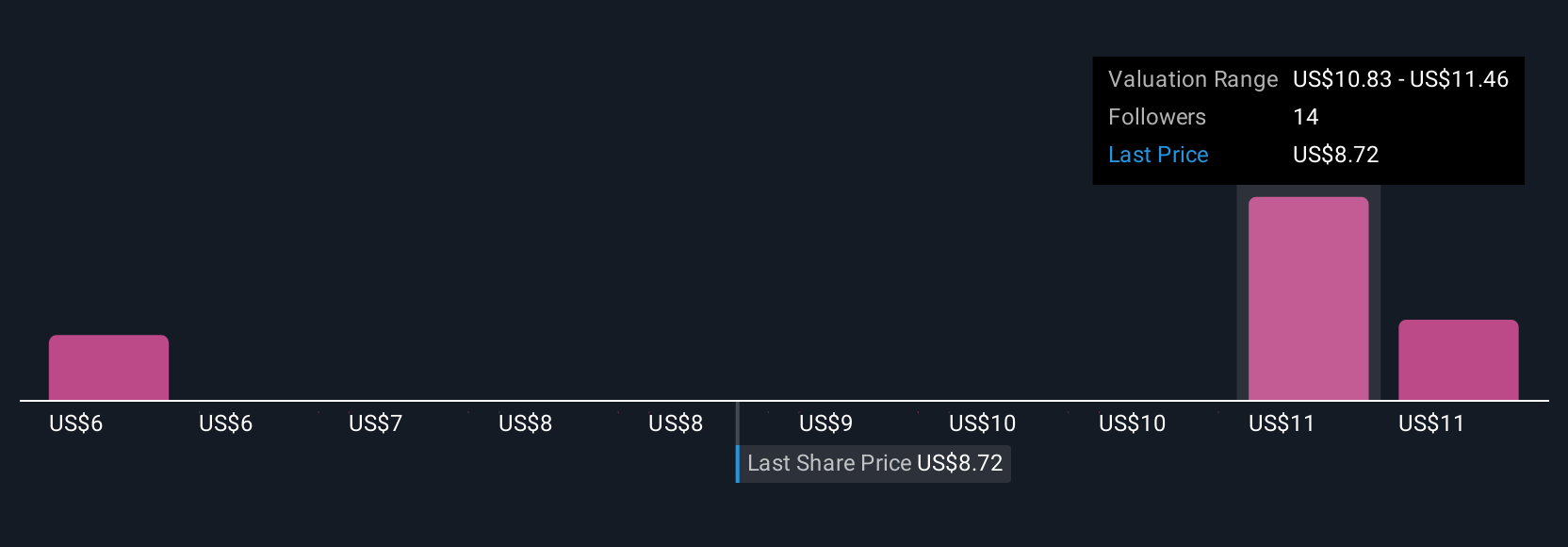

Simply Wall St Community members set Harmonic’s fair value from US$5.16 up to US$12.10 across three analyses. This wide spread of views contrasts with ongoing risks tied to heavy customer concentration and invites you to consider multiple angles on Harmonic’s future performance.

Explore 3 other fair value estimates on Harmonic - why the stock might be worth as much as 14% more than the current price!

Build Your Own Harmonic Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmonic research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal