Can GE HealthCare Technologies (GEHC) Leverage AI Upgrades to Strengthen Its Competitive Edge in Oncology?

- GE HealthCare recently announced updates to its Intelligent Radiation Therapy software, unveiling enhanced AI-supported workflow solutions and a new capability for managing theranostics workflows at the 2025 ASTRO Annual Meeting in San Francisco.

- This move highlights the company's deepening focus on integrating advanced digital and AI technologies to boost efficiency and connectivity in radiation oncology departments.

- We'll explore how GE HealthCare's advancements in radiation therapy software may influence its long-term outlook and competitive position.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

GE HealthCare Technologies Investment Narrative Recap

To be comfortable as a GE HealthCare shareholder, you need conviction in the company’s push into digital and AI-driven medical technology, harnessing product innovation to grow recurring revenue and gain share in a competitive sector. While the Intelligent Radiation Therapy updates showcase GE HealthCare’s commitment to workflow efficiency, the announcement does not materially alter the foremost short-term catalyst: commercialization of new product lines that are expected to lift future revenues, nor does it change exposure to tariff and China-related risks, which remain the most important threats to near-term performance.

The third quarter dividend affirmation at US$0.035 per share stands out as the most recent announcement in context, reflecting management’s intent to sustain shareholder returns even as the business faces global trade and regulatory uncertainties. This continued payout may support investor confidence, but does not offset the risk from potential earnings pressures if tariffs or cash flow constraints intensify.

However, investors should also keep in mind, in contrast, the persistent risks related to tariffs and regulatory changes...

Read the full narrative on GE HealthCare Technologies (it's free!)

GE HealthCare Technologies' outlook anticipates $22.7 billion revenue and $2.5 billion earnings by 2028. This relies on 4.3% annual revenue growth and a $0.3 billion increase in earnings from the current $2.2 billion.

Uncover how GE HealthCare Technologies' forecasts yield a $88.00 fair value, a 15% upside to its current price.

Exploring Other Perspectives

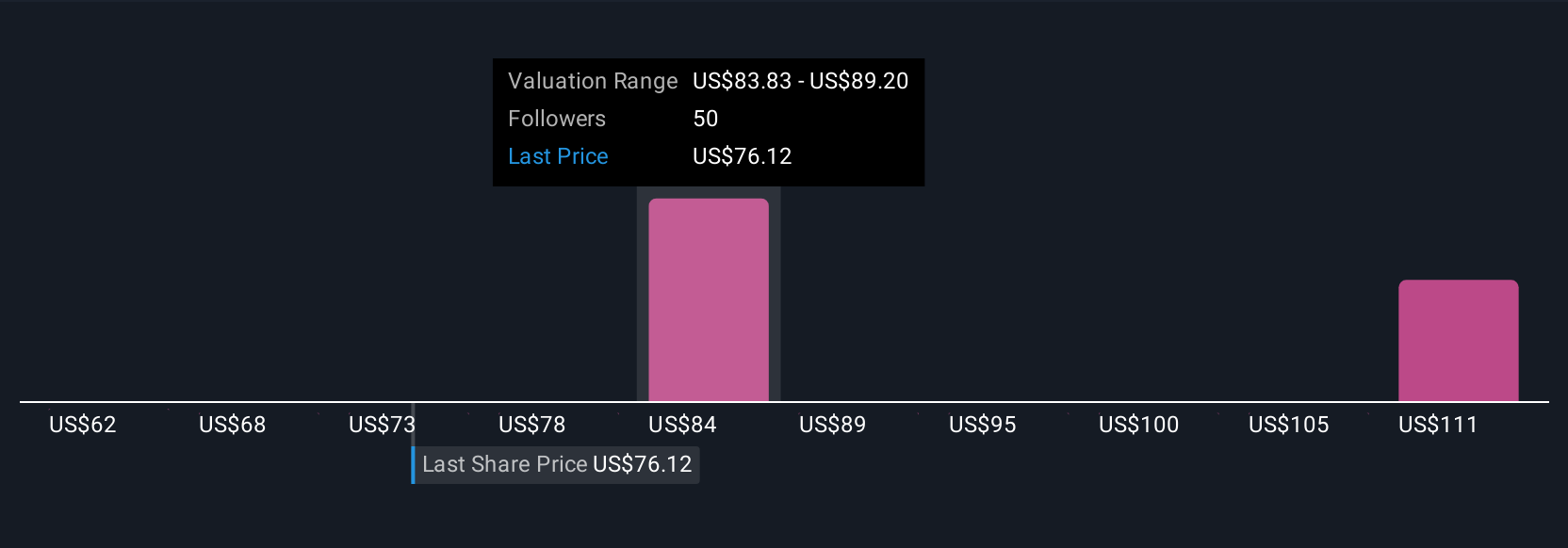

Fair value opinions in the Simply Wall St Community span from US$62.11 to US$123.97 per share, across five unique analyses. With tariffs and regulatory risk still at the forefront, these differences highlight the importance of reviewing several viewpoints before forming your outlook.

Explore 5 other fair value estimates on GE HealthCare Technologies - why the stock might be worth 19% less than the current price!

Build Your Own GE HealthCare Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GE HealthCare Technologies research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free GE HealthCare Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GE HealthCare Technologies' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal