Waters (WAT): Evaluating Valuation Following New Drug Pricing Agreement and Regulatory Clarity

Shares of Waters (WAT) have attracted fresh attention after reports surfaced about a potential drug-pricing agreement between the White House and pharmaceutical companies. The deal aims to give the industry clearer regulatory signals regarding future pricing.

See our latest analysis for Waters.

Waters has seen only modest moves this year, hovering near a share price of $321.92 as headlines around drug-pricing reform and its recent earnings schedules played out. While the year’s share price returns remain lackluster, long-term investors have still enjoyed respectable total shareholder gains over three and five years. This suggests that the stock’s momentum could strengthen if regulatory clarity continues to improve.

If you’re looking for new ideas in the healthcare space, now's a prime moment to discover See the full list for free.

With shares lagging over the past year but trading at a noticeable discount to analyst targets, investors must now ask whether Waters is undervalued after these regulatory developments or if the market has already priced in future growth.

Most Popular Narrative: 7.3% Undervalued

Waters’ latest closing price sits below the narrative fair value estimate, fueling debate about whether the stock is set for a stronger run. The following direct narrative forecast describes what could shift the company’s valuation significantly in the coming years.

Waters is poised to benefit from robust growth in pharmaceutical R&D, evidenced by strong double-digit pharma segment expansion, increased instrument replacement cycles, and deeper penetration into high-growth areas like CDMOs and generics. This supports sustained revenue growth and pricing power as new product launches gain traction.

Want to know the growth blueprint behind this high valuation? The secret: ambitious earnings projections, major revenue catalysts from innovation, and anticipated future profit multiples that rival today's tech champions. Find out which bold assumptions drive this compelling fair value estimate and what could set the tone for Waters’ next chapter.

Result: Fair Value of $347.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in core end markets or delays in integrating recent acquisitions could quickly challenge this optimistic outlook for Waters’ growth trajectory.

Find out about the key risks to this Waters narrative.

Another View: Looking at Price Ratios

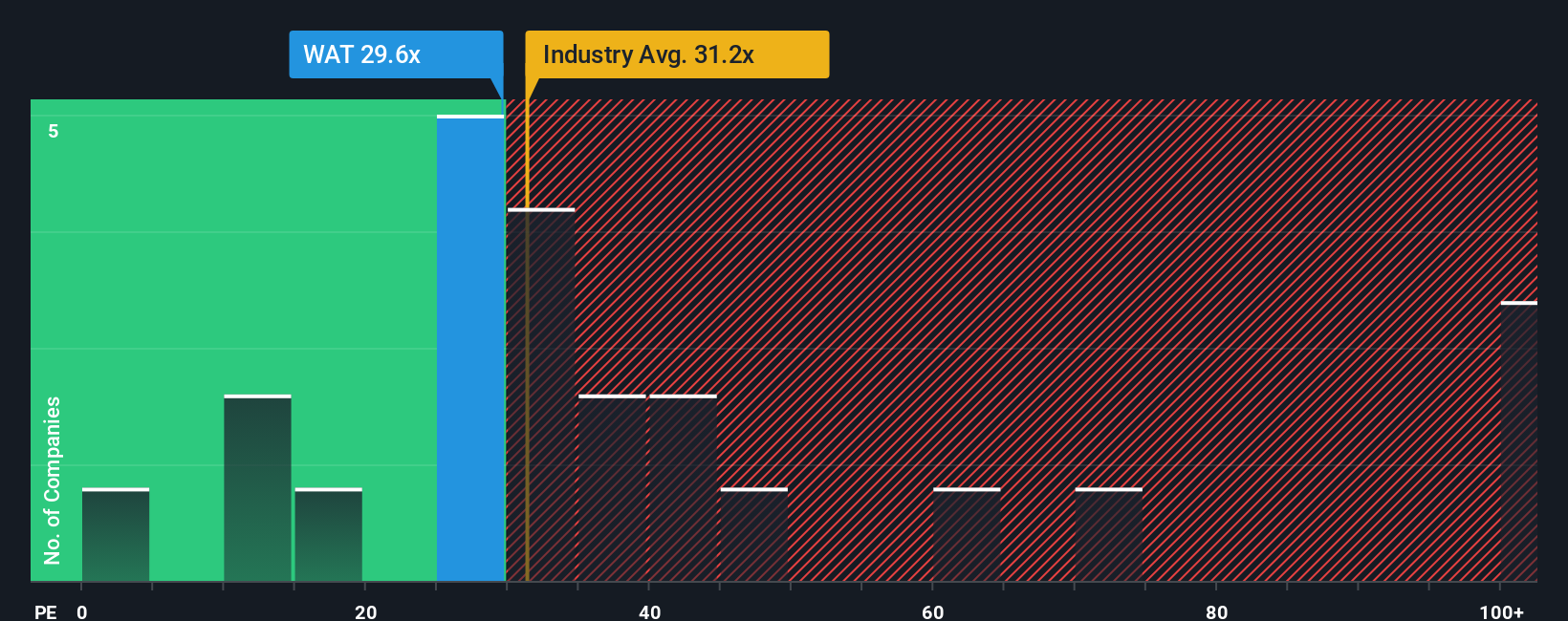

While analyst forecasts paint Waters as undervalued, its price-to-earnings ratio of 29x is noticeably higher than both its peers at 25.9x and the fair ratio of 22.1x suggested by market trends. This raises the question: is the stock's current premium truly justified given its growth outlook, or is there more risk than it seems?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Waters Narrative

If you see things differently or want to dive into the data on your own terms, you can craft a personalized story in just a few minutes. Do it your way

A great starting point for your Waters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Expand your investment radar and spot tomorrow’s winners using tailored screeners trusted by savvy investors around the globe.

- Uncover these 910 undervalued stocks based on cash flows that are primed for potential breakout based on their robust cash flows and attractive valuations before the crowd catches on.

- Accelerate your portfolio’s future with these 24 AI penny stocks supported by promising artificial intelligence breakthroughs and innovation-driven market shifts.

- Secure steady returns by tapping into these 19 dividend stocks with yields > 3% offering attractive yields and consistent income streams for long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal