United Natural Foods (UNFI): Losses Worsen 36.2% Annually, Deep Value Sparks Debate on Turnaround

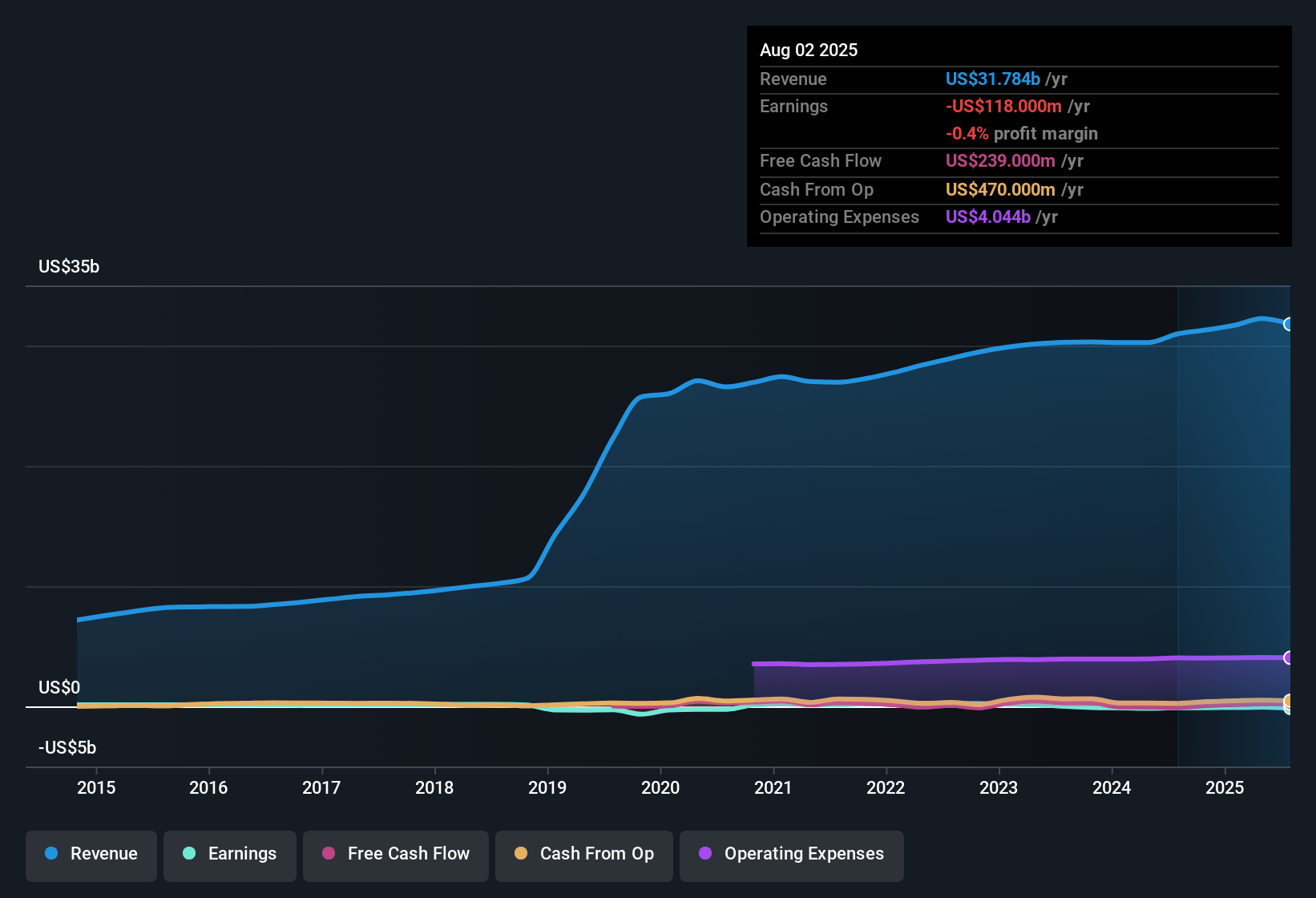

United Natural Foods (UNFI) remains in the red, with losses widening at an annual rate of 36.2% over the past five years and no improvement in net profit margin this year. Despite its unprofitable track record, forecasts suggest earnings could surge by 46.51% per year and tip into positive territory within three years. Revenue is set to grow a modest 1.8% per year, trailing behind the US market’s 9.8% pace. With shares trading below the estimated fair value of $129.37 and boasting a Price-To-Sales Ratio of just 0.1x, investors are closely watching the company’s path to profitability and standout valuation metrics.

See our full analysis for United Natural Foods.Next up, we’ll see how these headline numbers compare to the market’s widely discussed narratives. Some perspectives could be confirmed, while others might face tough questions.

See what the community is saying about United Natural Foods

12% Wholesale Natural Products Sales Growth Outpaces Core Revenue

- United Natural Foods’ Wholesale Natural Products segment posted a 12% sales increase, a robust contrast to the company’s overall 1.8% annual revenue growth forecast.

- According to the analysts' consensus view, this strength is attributed to rising demand for organic and specialty foods and operational efficiencies:

- Rising consumer trends in natural and specialty categories have translated to sustained volume momentum and future expansion for high-growth segments.

- Strategic investments in automation and digital supply chain solutions, plus a focus on higher-return customer relationships, put the company in a stronger position to drive margin growth and improve free cash flow compared to slower-growing peers.

- Want to see how analysts weigh these growth drivers versus risks? Dig into the full consensus case with the detailed breakdown. 📊 Read the full United Natural Foods Consensus Narrative.

Margin Expansion Forecast: Profitability Shift in 3 Years

- Profit margins are projected to climb from -0.2% currently to a positive 0.3% in three years, marking a shift from persistent losses toward expected profitability.

- Analysts' consensus view highlights improved margin outlook due to:

- Lean management and network optimization, including exiting unprofitable customer contracts, are expected to unlock operational leverage and support the transition into the black.

- Investments in warehouse management and inventory technology are designed to bolster service levels and reduce costs, helping stabilize gross margins and improve industry competitiveness.

Valuation: Price-To-Sales at 0.1x and Shares Below DCF Fair Value

- With a Price-To-Sales Ratio of 0.1x, significantly below the US Consumer Retailing industry average of 0.5x, and shares at $40.04 versus a DCF fair value of $129.37, United Natural Foods is trading at a steep discount on both industry and intrinsic valuation metrics.

- Analysts' consensus view underscores the tension here:

- While the current share price is meaningfully under the DCF fair value, the average analyst target (37.63) sits just slightly below the market, indicating they see the business as fairly priced and suggesting near-term skepticism about fundamental turnaround.

- This large gap between DCF fair value and current price could act as a catalyst for upside if the company delivers on margin improvement and profit growth, but further operational setbacks may reinforce concerns over financial health and execution risk.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for United Natural Foods on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different take on the figures above? Share your viewpoint and craft your individual narrative in just a few minutes: Do it your way

A great starting point for your United Natural Foods research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

United Natural Foods struggles with inconsistent profitability and weak margin trends, lagging behind the market in both revenue growth and financial stability.

If you’re seeking companies with more resilient finances and lower risk of setbacks, focus your search on solid balance sheet and fundamentals stocks screener that demonstrate stronger balance sheets and healthier fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal