Could Sunrun’s (RUN) Vehicle-to-Grid Pilot Reveal a New Edge in Grid Services?

- Baltimore Gas and Electric Company, in partnership with Sunrun, recently announced the activation of the nation's first residential vehicle-to-grid distributed power plant, enabling Ford F-150 Lightning owners in Maryland to dispatch stored energy to the grid during peak periods.

- This collaboration marks a significant step in using residential electric vehicles as distributed energy resources, opening new avenues for customer participation and grid resiliency.

- We'll look at how Sunrun's pioneering vehicle-to-grid program may reshape its investment narrative through expanded grid services and innovation.

Find companies with promising cash flow potential yet trading below their fair value.

Sunrun Investment Narrative Recap

To be a Sunrun shareholder, you need confidence in the company's ability to evolve its grid services and storage offerings into scalable, recurring sources of revenue as policy incentives shift. The recent vehicle-to-grid project in Maryland showcases Sunrun’s capacity for meaningful innovation and leadership in distributed energy, but its immediate impact on the key risk, potential market contraction post-tax credit expiration, remains limited, as broader adoption beyond pilots is still to be proven.

Among Sunrun’s recent achievements, the August milestone where its home battery network supplied the largest share of power during California’s emergency demand response stands out. This announcement directly reinforces Sunrun’s position at the forefront of grid services and supports the essential catalyst for the business: leveraging storage deployments to secure recurring, value-added revenue streams as the company looks beyond traditional solar sales.

However, against this progress, the looming expiration of homeowner tax credits is a risk investors should be aware of, especially as ...

Read the full narrative on Sunrun (it's free!)

Sunrun's outlook anticipates $2.9 billion in revenue and $465.4 million in earnings by 2028. This scenario depends on a 10.4% annual revenue growth rate and an earnings increase of about $3.07 billion from current earnings of -$2.6 billion.

Uncover how Sunrun's forecasts yield a $15.92 fair value, a 17% downside to its current price.

Exploring Other Perspectives

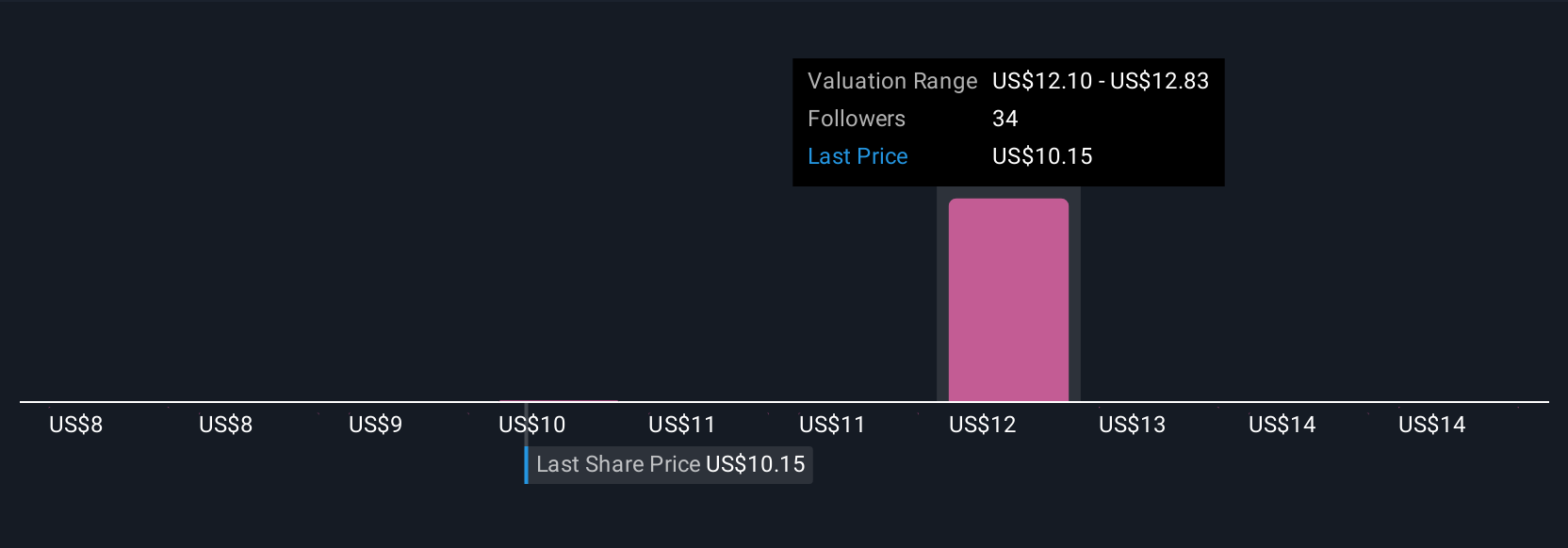

Five individual fair value estimates from the Simply Wall St Community place Sunrun’s value between US$8.58 and US$16.75 per share. As opinions on future value differ, keep in mind the company’s expanding grid services offerings may influence performance well beyond current consensus.

Explore 5 other fair value estimates on Sunrun - why the stock might be worth as much as $16.75!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal