Marathon Petroleum (MPC): Examining Valuation After Recent Share Price Momentum

See our latest analysis for Marathon Petroleum.

Zooming out, Marathon Petroleum’s strong 1-month share price return fits into a broader trend, with the stock posting an impressive 1-year total shareholder return of nearly 12% and more than doubling shareholders’ money over three years. This performance suggests momentum is gathering pace, fueled by both company fundamentals and shifting market sentiment around large energy firms.

If you're interested in what else is accelerating in the energy landscape, it's a great moment to broaden your search and discover fast growing stocks with high insider ownership

But with shares now trading around analyst targets and recent gains, the question is whether Marathon Petroleum is still undervalued compared to its fundamentals, or if the market has already priced in all the good news and growth prospects.

Most Popular Narrative: Fairly Valued

Marathon Petroleum’s latest narrative price target sits just slightly below the share’s last close, suggesting markets are now closely tracking long-term analyst expectations. This introduces a debate about whether further upside depends on surprise catalysts or future changes in the company’s growth path.

Disciplined capital allocation through continued share buybacks, increasing MPLX distributions, and maintenance of an investment-grade balance sheet are set to drive higher earnings per share and sustained shareholder returns, aligning with positive long-term company trends.

Curious how this narrative arrives at a valuation so closely matched to the current price? There are significant assumptions about Marathon’s ability to accelerate profit growth, shift margins, and evolve its capital structure. Want to uncover the unexpected financial leaps analysts are betting on? Don’t miss what really drives the fair value behind the headlines.

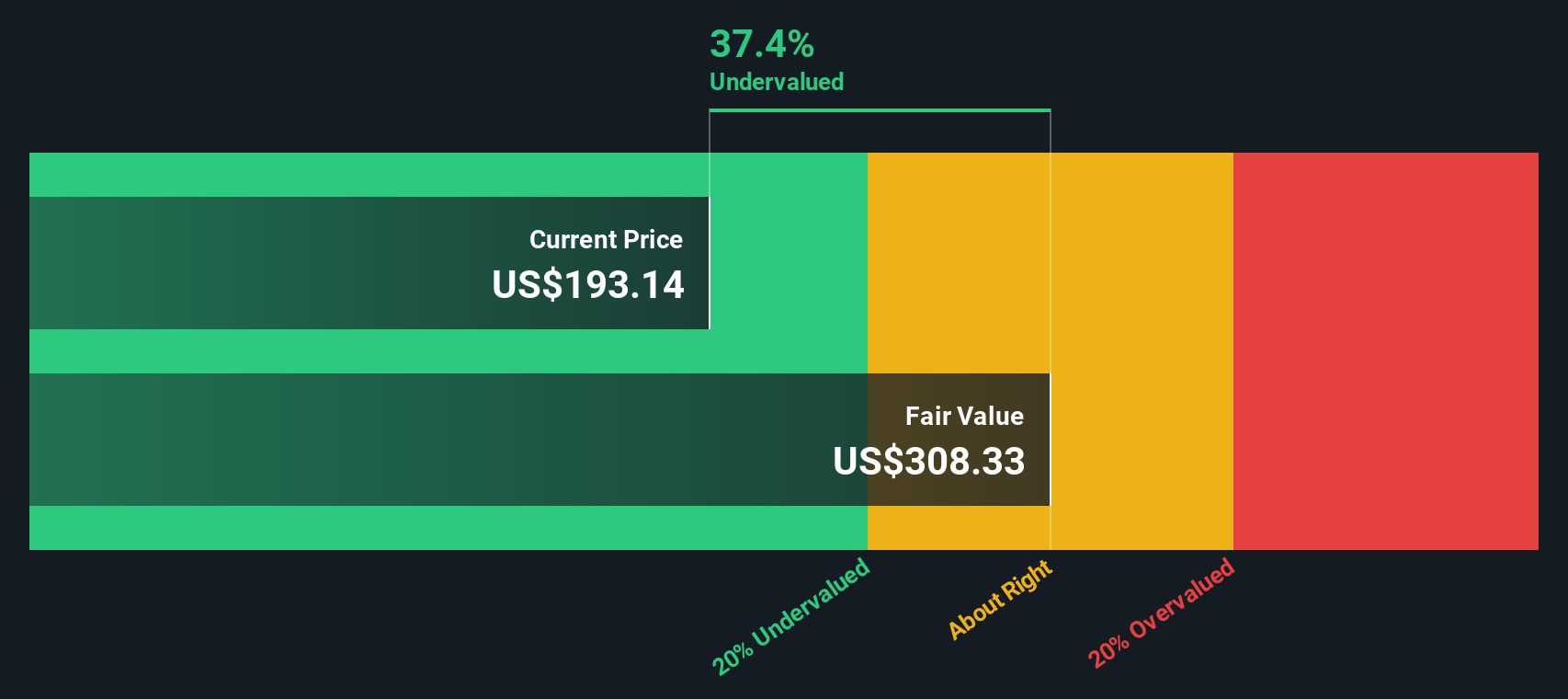

Result: Fair Value of $189.17 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, since accelerated electric vehicle adoption and tighter environmental policies could quickly erode demand and compress future refining margins.

Find out about the key risks to this Marathon Petroleum narrative.

Another View: What Does the SWS DCF Model Reveal?

Using the SWS DCF model as an alternative lens, Marathon Petroleum’s shares appear to be trading well below our estimate of fair value. This suggests the market might be discounting the company’s long-term cash flow potential. But does this optimistic DCF signal more upside or is it overlooking sector-specific risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marathon Petroleum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marathon Petroleum Narrative

If you see the numbers differently or want to dig deeper into Marathon Petroleum’s story, you can shape your own view in just a few minutes with Do it your way

A great starting point for your Marathon Petroleum research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your gains to just one stock. Secure a front-row seat to tomorrow’s winners with these unique stock ideas focused on growth and value.

- Unlock the latest opportunities in healthcare technology by checking out these 31 healthcare AI stocks, which is reshaping how medicine and data work together for smarter investing.

- Start earning stronger returns by targeting income with these 19 dividend stocks with yields > 3% and help ensure your portfolio benefits from robust yields above 3%.

- Join the wave of digital finance innovation by reviewing these 78 cryptocurrency and blockchain stocks, which is transforming payments and blockchain-based businesses around the world.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal