Thermo Fisher Scientific: Valuation Insights After Strategic Deals, Partnerships, and Major U.S. Expansion Moves

Thermo Fisher Scientific (TMO) has been making headlines after a flurry of strategic and operational announcements. Over the past week, the company clinched key partnerships, completed acquisitions, and committed fresh capital to expand its U.S. manufacturing and R&D footprint.

See our latest analysis for Thermo Fisher Scientific.

Thermo Fisher’s stock has caught a noticeable wave of bullish momentum, surging over 9% in the past week as investors responded to a string of major partnerships, acquisitions, and new manufacturing commitments. Recent buying activity points to renewed market optimism about Thermo Fisher’s role in global healthcare and life sciences innovation. While the share price has traded higher in recent sessions, longer-term total shareholder returns are more muted. This reflects a measured but steady performance over several years as the company adapts to a changing landscape.

If these big moves in biopharma have you exploring more opportunities, you might want to discover other leading healthcare stocks using our curated See the full list for free..

With this wave of bullish momentum and high-profile deals, the big question remains: is Thermo Fisher’s recent run just the start of a value opportunity, or has the market already priced in its future growth?

Most Popular Narrative: 4% Undervalued

Thermo Fisher Scientific’s fair value, according to the most widely followed narrative, stands above its recent closing price. This hints at untapped upside investors may be missing. The comparison draws attention to future growth and profit expansion as key drivers of this valuation.

The company's positioning as a trusted, end-to-end partner for pharma and biotech enables greater customer stickiness and deeper integration into high-growth markets like clinical research, outsourcing (CDMO), and lab services. This enhances recurring revenue streams and supports high single-digit earnings growth over time.

Curious how deep integration drives recurring revenue? The real intrigue rests in bullish growth projections and profit margin expansion, factors the consensus narrative quietly bakes into its fair value. Unpack the detailed assumptions for fresh insight into how this price target is built.

Result: Fair Value of $546.76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued weakness in academic and government funding, or persistent international headwinds, could derail these optimistic growth projections for Thermo Fisher Scientific.

Find out about the key risks to this Thermo Fisher Scientific narrative.

Another View: Is Multiples Analysis Sending a Different Signal?

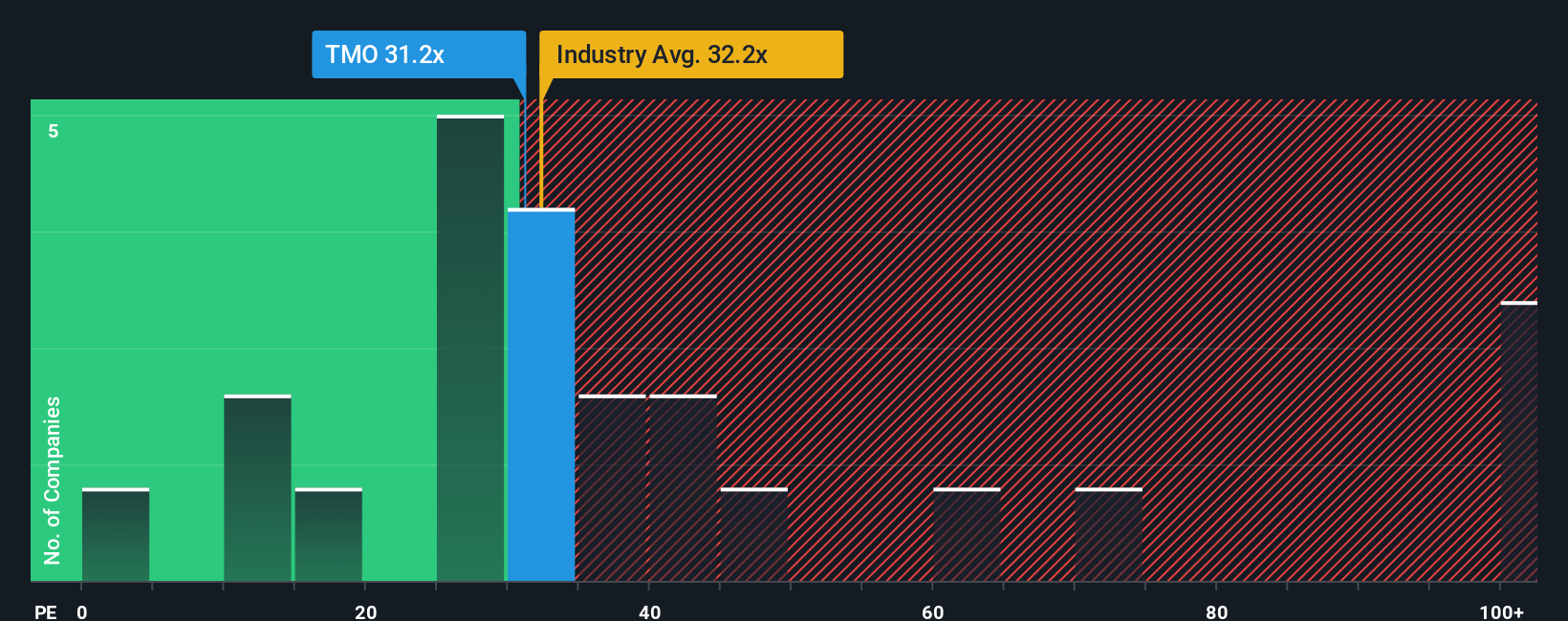

While the fair value estimate highlights upside potential, a different picture emerges when comparing current price-to-earnings ratios. Thermo Fisher trades at 30.1x earnings, above its fair ratio of 27.1x. It is also lower than the Life Sciences industry at 32.2x or peers at 34.2x. This creates a mixed signal. Does the market expect more muted growth, or is there hidden value others are overlooking?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thermo Fisher Scientific Narrative

If you see the story playing out differently, or want a hands-on look at the numbers yourself, you can build your own view from the ground up in just a few minutes. Do it your way.

A great starting point for your Thermo Fisher Scientific research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities pass you by. Now is the best moment to broaden your portfolio with stocks that match your goals and interests.

- Grow your potential with reliable payouts by securing your spot among these 19 dividend stocks with yields > 3% that consistently deliver yields above 3%.

- Unlock ground-floor technology trends by checking out these 23 AI penny stocks positioned at the forefront of artificial intelligence innovation.

- Take advantage of tomorrow’s leaders by scanning these 3569 penny stocks with strong financials offering robust fundamentals at entry-level prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal