Evaluating Ameresco (AMRC) Valuation After Recent 42% Share Price Rally

Ameresco (AMRC) has seen its stock gain over 42% in the past month, drawing attention from investors interested in clean energy and infrastructure plays. Over the past 3 months, the stock is up more than 116%.

See our latest analysis for Ameresco.

Ameresco’s recent share price rally builds on extra momentum following a relatively muted period. While the past three months have seen its share price increase by more than 116%, the 1-year total shareholder return is still under 6%, reminding investors that sustained gains will depend on both earnings growth and improved sentiment around the company’s prospects. With clean energy and infrastructure spending in focus, hopes are high for more consistent performance ahead.

If Ameresco’s recent momentum has you looking for more opportunities, now is a great time to uncover fast growing stocks with high insider ownership.

After such a sharp rally, investors may wonder if Ameresco's shares remain undervalued or if the recent surge means the market is already anticipating higher growth. Is there still a buying opportunity, or has future upside already been priced in?

Most Popular Narrative: 6% Overvalued

Ameresco’s narrative-driven fair value comes in slightly below the current share price, highlighting potential optimism about future growth that may already be reflected in the valuation. This creates an interesting discussion between upward momentum and underlying business fundamentals.

Expanded government incentives for clean energy and storage (including ITCs and the Inflation Reduction Act) have allowed Ameresco to monetize new projects more quickly and enhance project economics, improving both revenue predictability and net margins through increased operating leverage.

Curious what’s driving sentiment beyond policy wins? The growth outlook rests on sharply rising recurring income, ambitious project ramp-ups, and future profit margins that could surprise even the bulls. Wondering what financial forecasts power this optimism? Click through to reveal the numbers behind the narrative’s fair value calculation.

Result: Fair Value of $34.22 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or shifting regulatory incentives could still challenge Ameresco’s growth narrative and put pressure on future earnings performance.

Find out about the key risks to this Ameresco narrative.

Another View: Multiples Tell a Different Story

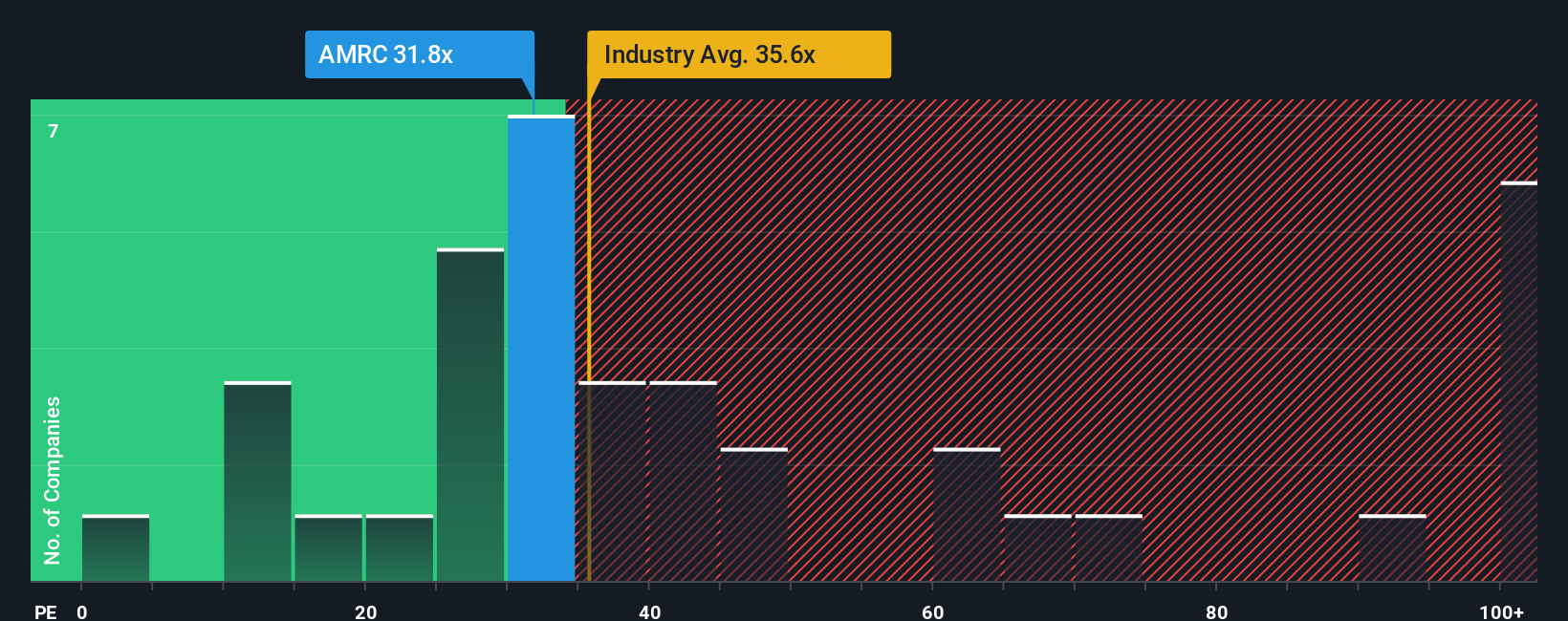

While the narrative approach suggests Ameresco may be overvalued, looking at its price-to-earnings ratio offers a different perspective. Ameresco trades at 30.9 times earnings, which is below the U.S. construction industry average of 36.1 and the peer average of 32.9. Compared to a fair ratio of 49.6, this difference suggests the market sees more risk or less future growth relative to its peers and the broader sector. Does this mean the market is being overly cautious, or identifying real challenges?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ameresco Narrative

If you want to dig into the numbers yourself or come to your own conclusions, shaping your personal view takes just a few minutes, so why not Do it your way?

A great starting point for your Ameresco research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for yesterday’s wins. Supercharge your portfolio by targeting promising opportunities most people miss, using top screeners curated by Simply Wall Street.

- Unlock the potential of up-and-coming companies by checking out these 3569 penny stocks with strong financials, which combine strong financials with rapid growth trajectories.

- Tap into the future of medicine and technology by reviewing these 31 healthcare AI stocks, leading advancements in healthcare powered by artificial intelligence.

- Maximize your income with these 19 dividend stocks with yields > 3%, featuring attractive yields above 3% to help you build wealth with confidence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal