How Investors Are Reacting To Cooper Companies (COO) Sell Rating and Climate Forum Leadership

- On September 22, 2025, Cooper Companies participated in the 2nd Annual Climate & Sustainability Leadership Forum in New York, with Senior Director Aldo Zucaro presenting on corporate responsibility initiatives.

- Concurrently, Goldman Sachs began coverage on ophthalmology companies, giving Cooper Companies a Sell rating, highlighting valuation risks despite substantial sector opportunities.

- We'll consider how Goldman Sachs' new Sell rating and commentary on valuation may impact Cooper Companies' forward-looking investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Cooper Companies Investment Narrative Recap

To own Cooper Companies stock, you need confidence in the continued global shift toward premium daily contact lenses and the company’s ability to capture share with new higher-margin products. While the recent Sell rating from Goldman Sachs may raise some questions about near-term valuation, it does not appear to alter the most important short term catalyst: MyDAY’s expanded rollout and its expected impact on revenue and market share, nor does it materially change the main risk of unpredictable order patterns from the Clariti to MyDAY transition.

The most relevant recent announcement is Cooper Companies’ progress in resolving MyDAY’s manufacturing constraints and accelerating its global launch. This development directly supports the case for near-term revenue acceleration, which is crucial as the market evaluates the sustainability of growth catalysts amid concerns about valuation and shifting demand.

On the other hand, investors should keep a close eye on the unpredictable revenue gap created by the Clariti to MyDAY transition as...

Read the full narrative on Cooper Companies (it's free!)

Cooper Companies' narrative projects $4.9 billion in revenue and $786.2 million in earnings by 2028. This requires 6.4% yearly revenue growth and a $378.4 million earnings increase from $407.8 million today.

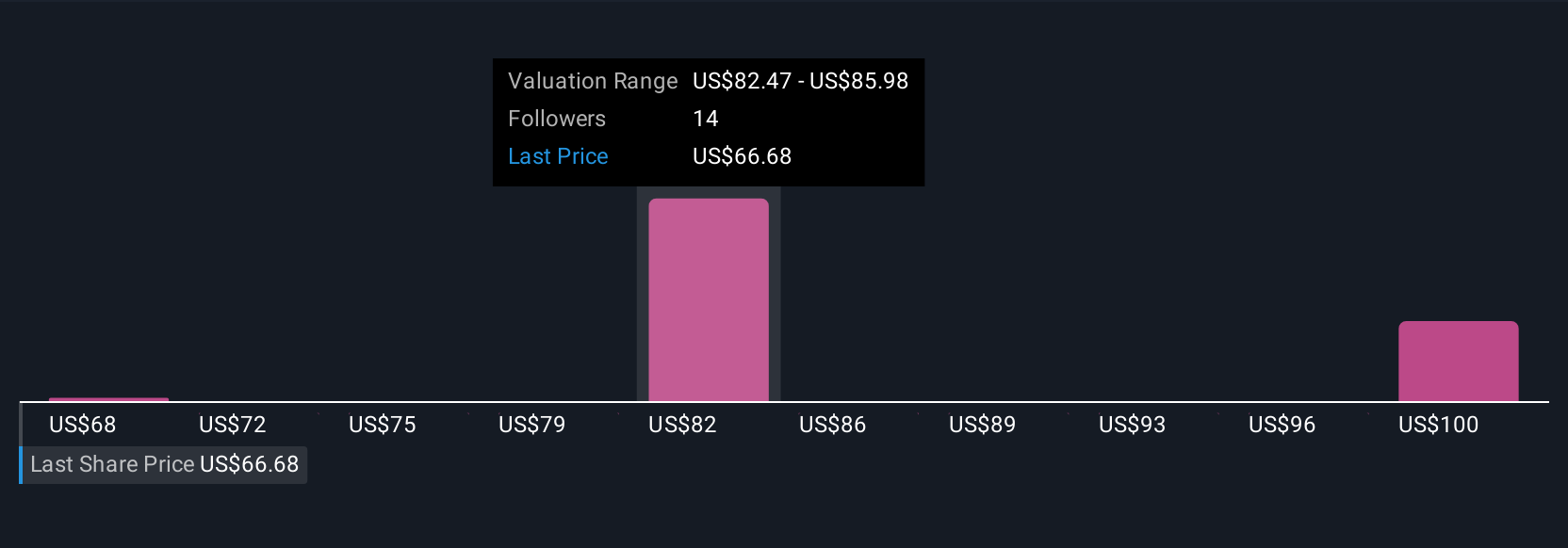

Uncover how Cooper Companies' forecasts yield a $84.47 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members’ fair value estimates for Cooper Companies range from US$68.44 to US$103.51, based on four distinct forecasts. As you consider these different views, remember that the company’s growth now relies heavily on successfully converting MyDAY fitting activity into sustained sales.

Explore 4 other fair value estimates on Cooper Companies - why the stock might be worth just $68.44!

Build Your Own Cooper Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cooper Companies research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cooper Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cooper Companies' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal