Assessing Agilent Technologies: Insights From 7 Financial Analysts

In the latest quarter, 7 analysts provided ratings for Agilent Technologies (NYSE:A), showcasing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

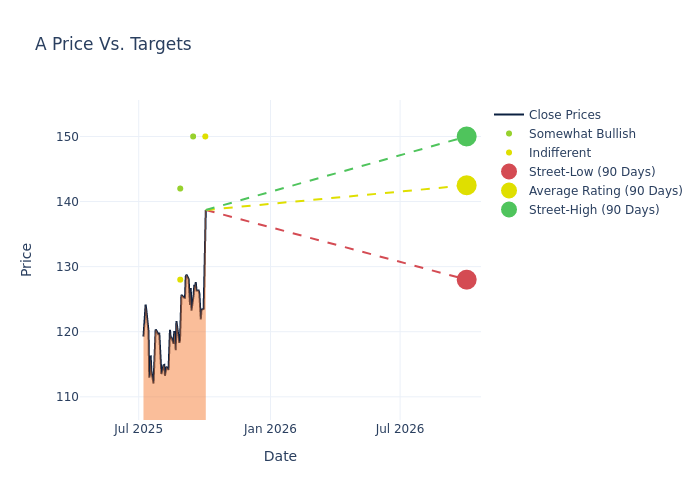

Analysts have set 12-month price targets for Agilent Technologies, revealing an average target of $137.86, a high estimate of $150.00, and a low estimate of $125.00. This current average reflects an increase of 4.78% from the previous average price target of $131.57.

Exploring Analyst Ratings: An In-Depth Overview

The perception of Agilent Technologies by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Luke Sergott | Barclays | Raises | Equal-Weight | $150.00 | $125.00 |

| Brandon Couillard | Wells Fargo | Raises | Overweight | $150.00 | $140.00 |

| Luke Sergott | Barclays | Maintains | Equal-Weight | $125.00 | $125.00 |

| Catherine Schulte | Baird | Raises | Outperform | $142.00 | $141.00 |

| Brandon Couillard | Wells Fargo | Raises | Overweight | $140.00 | $135.00 |

| Vijay Kumar | Evercore ISI Group | Lowers | In-Line | $128.00 | $130.00 |

| Vijay Kumar | Evercore ISI Group | Raises | In-Line | $130.00 | $125.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Agilent Technologies. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Agilent Technologies compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Agilent Technologies's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Agilent Technologies's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Agilent Technologies analyst ratings.

Get to Know Agilent Technologies Better

Originally spun out of Hewlett-Packard in 1999, Agilent has evolved into a leading life science and diagnostic firm. Today, Agilent's measurement technologies serve a broad base of customers with its three operating segments: life science and applied tools, cross lab consisting of consumables and services related to life science and applied tools, and diagnostics and genomics. Over half of its sales are generated from the biopharmaceutical, chemical, and advanced materials end markets, which we view as the stickiest end markets, but it also supports clinical lab, environmental, forensics, food, academic, and government-related organizations. The company is geographically diverse, with operations in the US and China representing the largest country concentrations.

A Deep Dive into Agilent Technologies's Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Positive Revenue Trend: Examining Agilent Technologies's financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 10.14% as of 31 July, 2025, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Agilent Technologies's net margin excels beyond industry benchmarks, reaching 19.33%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Agilent Technologies's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 5.37% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Agilent Technologies's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.76% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Agilent Technologies's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.54.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal