The Analyst Verdict: HF Sinclair In The Eyes Of 14 Experts

HF Sinclair (NYSE:DINO) underwent analysis by 14 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 4 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 2 | 0 | 0 |

| 2M Ago | 2 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 2 | 0 | 0 |

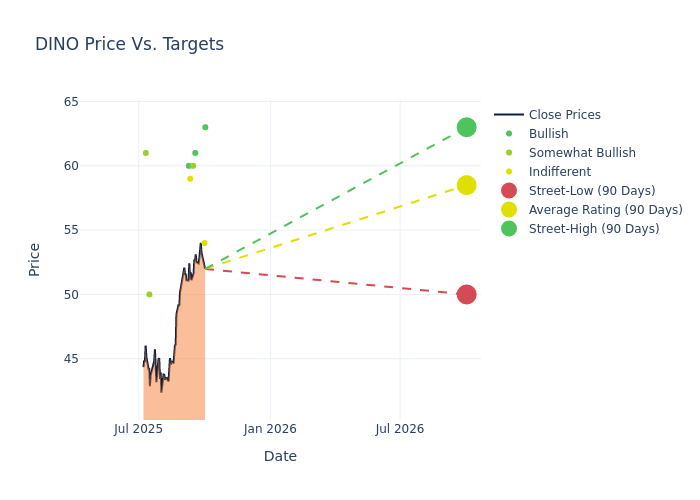

The 12-month price targets, analyzed by analysts, offer insights with an average target of $55.43, a high estimate of $63.00, and a low estimate of $43.00. Observing a 12.96% increase, the current average has risen from the previous average price target of $49.07.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of HF Sinclair's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Manav Gupta | UBS | Raises | Buy | $63.00 | $58.00 |

| Theresa Chen | Barclays | Raises | Equal-Weight | $54.00 | $45.00 |

| Neil Mehta | Goldman Sachs | Raises | Buy | $61.00 | $54.00 |

| Nitin Kumar | Mizuho | Raises | Outperform | $60.00 | $52.00 |

| Ryan Todd | Piper Sandler | Raises | Neutral | $59.00 | $51.00 |

| Justin Jenkins | Raymond James | Raises | Strong Buy | $60.00 | $57.00 |

| Manav Gupta | UBS | Raises | Buy | $58.00 | $51.00 |

| Nitin Kumar | Mizuho | Raises | Outperform | $52.00 | $50.00 |

| Manav Gupta | UBS | Raises | Buy | $51.00 | $48.00 |

| Ryan Todd | Piper Sandler | Lowers | Neutral | $51.00 | $53.00 |

| Connor Lynagh | Morgan Stanley | Raises | Overweight | $50.00 | $44.00 |

| Ryan Todd | Piper Sandler | Raises | Overweight | $53.00 | $43.00 |

| Paul Cheng | Scotiabank | Raises | Sector Outperform | $61.00 | $49.00 |

| Theresa Chen | Barclays | Raises | Equal-Weight | $43.00 | $32.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to HF Sinclair. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of HF Sinclair compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of HF Sinclair's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into HF Sinclair's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on HF Sinclair analyst ratings.

About HF Sinclair

HF Sinclair is an integrated petroleum refiner that owns and operates seven refineries serving the Rockies, midcontinent, Southwest, and Pacific Northwest, with a total crude oil throughput capacity of 678,000 barrels per day. It can produce 380 million gallons of renewable diesel annually. It holds a marketing business with over 300 distributors and 1,500 wholesale branded sites across 30 states. It also owns and operates 4,400 miles of petroleum product pipelines and terminals principally in the southwestern United States.

HF Sinclair's Financial Performance

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Decline in Revenue: Over the 3M period, HF Sinclair faced challenges, resulting in a decline of approximately -13.54% in revenue growth as of 30 June, 2025. This signifies a reduction in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 3.04%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): HF Sinclair's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.23%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): HF Sinclair's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.23%, the company showcases efficient use of assets and strong financial health.

Debt Management: HF Sinclair's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.34.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal