FuelCell Energy Stock Surges Over 100% In The Past Month: What's Going On?

FuelCell Energy Inc (NASDAQ:FCEL) shares are continuing their upward trend on Wednesday, part of a rally that has seen the stock climb over 100% in the past month.

The momentum began after the company’s third-quarter earnings report revealed a 97% year-over-year revenue increase and a corporate restructuring.

What To Know: Investor enthusiasm is primarily linked to the growing energy demands of artificial intelligence data centers. FuelCell’s carbonate fuel cell platforms, which can be installed on-site, are seen as a viable solution for providing the reliable, continuous power required by AI infrastructure. The company has already established multi-megawatt projects with data center partners in the U.S. and Korea.

Read Also: FuelCell Energy Stock Jumps But Analysts Warn Shares Look Richly Valued

Wall Street has taken notice, with mixed but improving sentiment. While firms like Canaccord Genuity and KeyBanc have reiterated Hold ratings, price targets are being revised upwards. Notably, UBS recently raised its price target on FuelCell shares to $7.25, citing an improved outlook, though it maintained a Neutral rating.

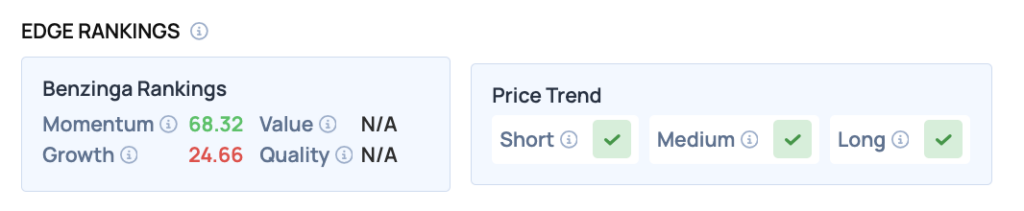

Benzinga Edge Rankings: Underscoring the stock’s recent performance, Benzinga Edge rankings show a strong Momentum score of 68.32.

FCEL Price Action: FuelCell Energy shares were up 11.47% at $8.70 at the time of publication on Wednesday, according to Benzinga Pro. The stock is trading within its 52-week range of $3.58 to $13.98.

Technical Momentum: The current price is significantly above the 50-day moving average of $5.46 and the 100-day moving average of $5.43, indicating a bullish trend. Immediate support is likely around the 50-day MA, while resistance may be encountered near the recent high of $8.72.

How To Buy FCEL Stock

By now, you're likely curious about how to participate in the market for FuelCell Energy — be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option or sell a call option at a strike price above where shares are currently trading — either way, it allows you to profit from the share price decline.

Photo: Courtesy FuelCell

Read Next:

• Plug Power, FuelCell, Bloom Energy Surge As AI Hype Meets Hydrogen Power

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal