Will PFGC’s New Activist Board Member Shift Its Strategic Focus or Reinforce Existing Priorities?

- Performance Food Group Company recently announced a cooperation agreement with Sachem Head Capital Management, resulting in the appointment of Sachem Head's Scott Ferguson to the Board of Directors and Audit and Finance Committee, expanding the Board to thirteen members.

- This agreement not only resolves recent board nomination activity from Sachem Head, but also introduces an activist investor perspective to Performance Food Group's governance at a key time for the company.

- We'll explore how the addition of an activist investor to the Board could influence Performance Food Group's investment narrative and future direction.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Performance Food Group Investment Narrative Recap

To be a shareholder in Performance Food Group, an investor must believe in the company's ability to capture growth in foodservice, leverage its salesforce expansion, and execute disciplined acquisitions despite recent earnings softness. The appointment of an activist investor to the Board could bring new accountability and may influence key decisions, but the short-term catalyst, successful M&A execution and integration, remains unchanged, while integration risk and margin pressure remain the most immediate risks to watch.

Among recent company updates, the clean team agreement with US Foods stands out as most related to the current Board changes. This sets a framework for deeper evaluation of potential business combinations, relevant to Performance Food Group's goal of scaling through acquisitions, a process that, while offering upside, also underscores the importance of careful diligence and integration to mitigate risk.

In contrast, investors should be especially aware that with any ramp-up in M&A, questions around integration risk and financial flexibility remain...

Read the full narrative on Performance Food Group (it's free!)

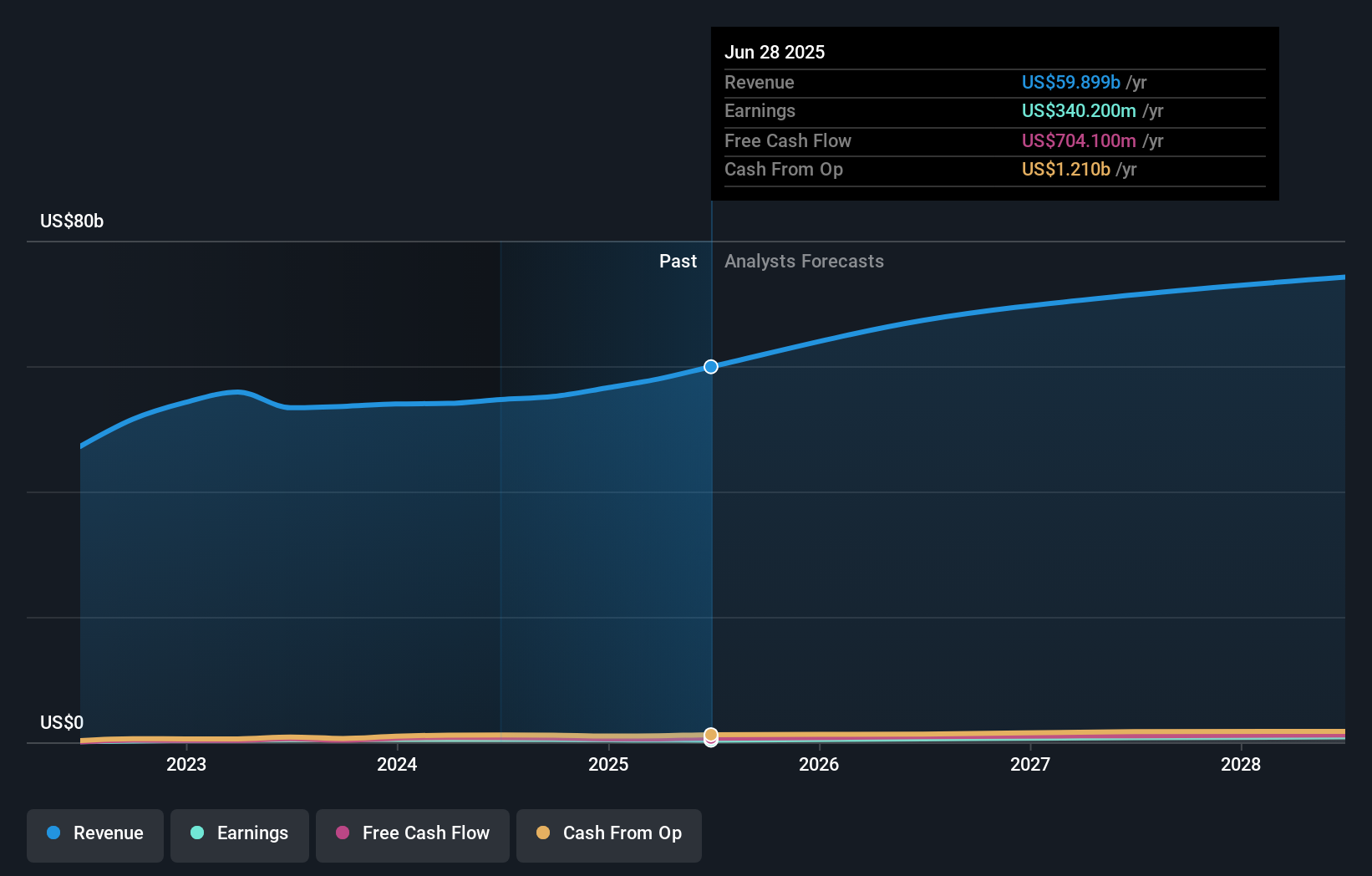

Performance Food Group's outlook anticipates $74.2 billion in revenue and $830.1 million in earnings by 2028. This scenario relies on 7.4% annual revenue growth and a $489.9 million earnings increase from the current $340.2 million.

Uncover how Performance Food Group's forecasts yield a $119.36 fair value, a 14% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community contributors have estimated Performance Food Group’s fair value between US$119.36 and US$173.51, highlighting two distinct perspectives. While opinions vary, the continuing focus on acquisition-driven growth and associated risks invites you to consider several alternative viewpoints for a fuller picture.

Explore 2 other fair value estimates on Performance Food Group - why the stock might be worth just $119.36!

Build Your Own Performance Food Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Performance Food Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Performance Food Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Performance Food Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal