How Investors Are Reacting To Reliance (RS) Unveiling Rs 40,000 Crore Bet on Indian Food Manufacturing

- Reliance Consumer Products Ltd recently signed a Memorandum of Understanding with India's Ministry of Food Processing Industries to invest Rs 40,000 crore in building integrated food production units across the country using advanced technologies like AI and robotics.

- This initiative not only aims to establish Asia’s largest integrated food parks, but also signifies Reliance's growing ambitions in the FMCG sector and its intent to become a dominant player in India's consumer market.

- We’ll now explore how Reliance’s Rs 40,000 crore investment in Indian food manufacturing could reshape its broader investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Reliance Investment Narrative Recap

To own Reliance stock, you need to believe in its ability to leverage scale, technology, and a trusted brand to capture Indian consumer demand and become a leader in the fast-moving consumer goods space. The Rs 40,000 crore investment in food processing demonstrates the company’s intent and could support long-term sector positioning, but it is unlikely to immediately change the most important short-term catalyst, which remains robust demand in specialty materials and infrastructure markets. The biggest risk in the near term continues to be cost pressures from both inflation and supply volatility, and these are not directly resolved by the recent announcement.

A related update is Reliance’s recent $400 million term loan agreement, reflecting ongoing access to capital for new growth projects and continued debt management. This supports funding flexibility for both organic investments and acquisitions, and may complement longer-term strategic opportunities in consumer markets.

In contrast, investors should be aware that rising input costs and wage pressures could still threaten near-term profitability if...

Read the full narrative on Reliance (it's free!)

Reliance's narrative projects $15.3 billion revenue and $1.0 billion earnings by 2028. This requires 3.7% yearly revenue growth and a $262 million earnings increase from $737.9 million.

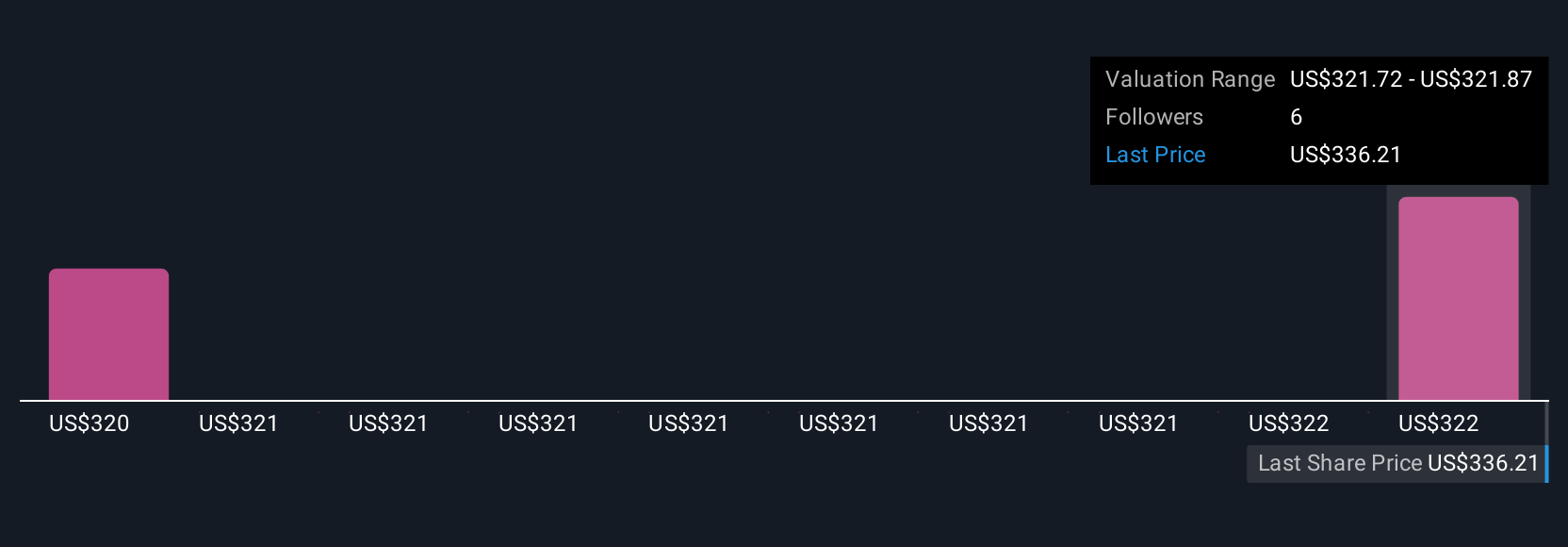

Uncover how Reliance's forecasts yield a $329.12 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community member fair values range widely from US$235.31 to US$329.13 per share. While optimism for sector catalysts persists, cost inflation and margin pressures remain pressing issues for company performance. Explore a range of views now.

Explore 2 other fair value estimates on Reliance - why the stock might be worth 17% less than the current price!

Build Your Own Reliance Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reliance research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Reliance research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reliance's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal