Can Casey’s (CASY) Digital Media Push Unlock New Value or Stretch Its Brand Identity?

- Casey’s General Stores recently announced a partnership with K9s For Warriors to fund the training of a service dog for military veterans, and a collaboration with GSTV to launch branded video content across its fuel dispensers at over 2,900 locations.

- These initiatives enhance Casey’s community engagement efforts while substantially expanding its digital retail media footprint across its store network.

- We'll look at how the expansion of Casey's digital retail media network through the GSTV collaboration influences its investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Casey's General Stores Investment Narrative Recap

To be a Casey’s General Stores shareholder, you need to believe that continued store expansion, innovation in high-margin food offerings, and investment in digital capabilities can overcome regional and industry-specific challenges, such as exposure to shifts in fuel demand and Midwest economic trends. The recent partnership with GSTV to roll out branded content to over 2,900 fuel dispensers broadens the company’s digital retail media reach, yet this move is unlikely to materially impact Casey’s most important catalyst, which remains successful integration and margin enhancement from acquired stores. The largest short-term risk continues to be slower than expected synergy realization from acquisitions, rather than digital media network expansion.

Among Casey’s recent announcements, the planned opening of at least 80 new stores in fiscal 2026 stands out in relevance. This expansion initiative directly supports the core catalysts of scaling up, tapping into underpenetrated markets, and driving top-line growth, which are central tenets for most investors considering the stock. The effectiveness of new store integration and conversion for food and margin upside remains a critical watchpoint, especially as Casey’s growth becomes increasingly dependent on market share gains outside of its traditional strongholds.

By contrast, investors should be aware of the ongoing challenges surrounding integration of recently acquired stores and the possibility that expected margin gains may be slower to appear...

Read the full narrative on Casey's General Stores (it's free!)

Casey's General Stores' narrative projects $19.5 billion in revenue and $760.7 million in earnings by 2028. This requires 6.0% yearly revenue growth and a $179 million earnings increase from the current $581.7 million.

Uncover how Casey's General Stores' forecasts yield a $571.38 fair value, a 4% upside to its current price.

Exploring Other Perspectives

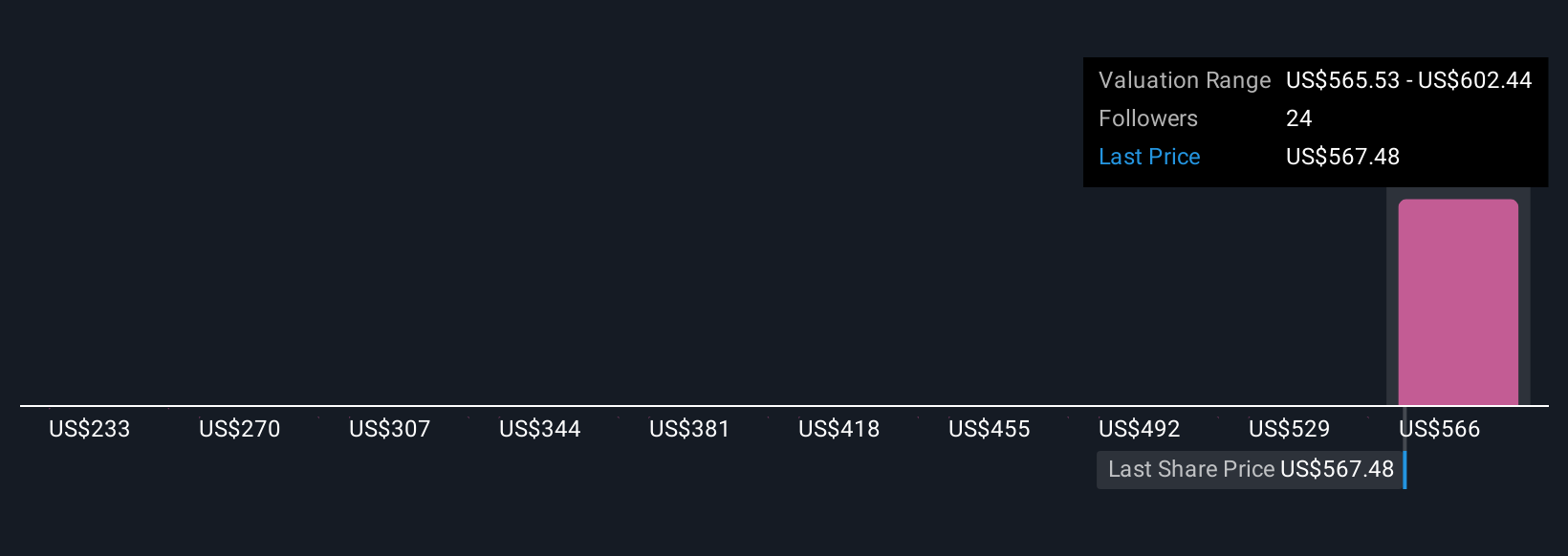

Fair value estimates for Casey’s from three Simply Wall St Community members range from US$233.38 to US$604.19 per share. As investors weigh this diversity of opinion, the pace and effectiveness of store integration, and its impact on future earnings, remains central to the company’s performance outlook.

Explore 3 other fair value estimates on Casey's General Stores - why the stock might be worth as much as 10% more than the current price!

Build Your Own Casey's General Stores Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casey's General Stores research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Casey's General Stores research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casey's General Stores' overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal