Option Care Health (OPCH): Valuation Insights as Stelara Contract Talks Add Uncertainty Following Inflation Reduction Act Changes

Most Popular Narrative: 29.6% Undervalued

According to the most widely followed narrative, Option Care Health is trading well below its estimated fair value. Analysts believe future earnings growth, expanding clinical capabilities, and margin improvements could materially increase the company's intrinsic worth.

Investments in technology (AI, analytics, digital infrastructure) and clinical resource efficiency projects are supporting increased operating leverage and process automation. These efforts are improving net margins and cash flow generation.

Strategic capital deployment through share repurchases, targeted M&A, and internal investments positions Option Care Health to further accelerate top-line growth and diversify earnings. This approach is driving long-term adjusted EPS and earnings expansion.

The secret behind this bullish outlook comes down to powerful profit drivers. Analysts are banking on a combination of technology upgrades and management initiatives to fuel substantial margin growth. Want to know which financial assumption could send the valuation soaring? Find out exactly what sets these projections apart from the crowd.

Result: Fair Value of $38.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifts toward lower-margin therapies or tougher contract negotiations with payers could challenge the current outlook and potentially disrupt Option Care Health’s projected growth.

Find out about the key risks to this Option Care Health narrative.Another View: Our DCF Model

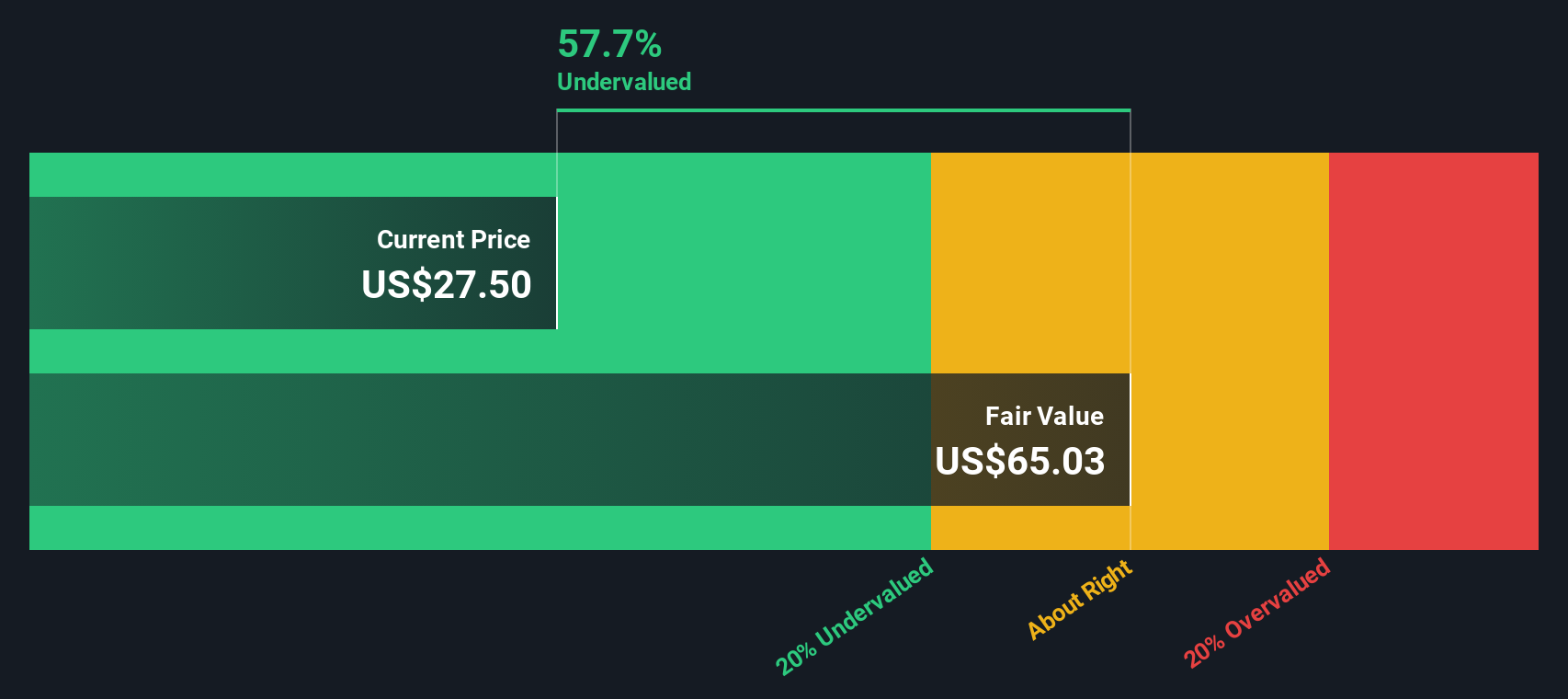

Looking at the SWS DCF model, a very different picture emerges for Option Care Health. This approach suggests the company is trading well below its fair value. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Option Care Health Narrative

If these perspectives do not fit your view, you can dive into the data and shape your own take on Option Care Health. All it takes is just a few minutes. Do it your way

A great starting point for your Option Care Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

The market is full of exceptional opportunities. Don't leave money on the table. Use the Simply Wall Street Screener to target powerful growth themes and value trends that others might miss.

- Maximize your portfolio's passive income by targeting consistent payers. Chart your course toward financial freedom with dividend stocks with yields > 3%.

- Supercharge your returns with underappreciated bargains. Find stocks trading below their intrinsic value using undervalued stocks based on cash flows.

- Ride the next tech boom by tapping into companies reshaping healthcare with AI. Start your search now with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal