Rising Bioprocessing Equipment Demand Could Be a Game Changer for West Pharmaceutical Services (WST)

- Earlier this week, KeyBanc Capital Markets released a research note highlighting renewed momentum in the bioprocessing sector following the BioProcess International conference, pointing to extended lead times for fill/finish equipment and industry optimism as key indicators.

- This development is seen as a sign that West Pharmaceutical Services could benefit from an improving bioprocessing market, potentially supporting stronger demand for its containment and delivery systems.

- We’ll explore how signals of increased fill/finish equipment demand may influence West Pharmaceutical Services’ investment narrative going forward.

Find companies with promising cash flow potential yet trading below their fair value.

West Pharmaceutical Services Investment Narrative Recap

West Pharmaceutical Services appeals to investors who see long-term value in health care delivery innovation, margin expansion from high-value product (HVP) components, and opportunities in GLP-1s and drug handling. This week’s industry optimism around bioprocessing, highlighted by extended fill/finish equipment lead times, provides a short-term boost in sentiment, but does not materially affect the main catalyst: accelerating biologics HVP demand. The biggest risk remains ongoing demand and facility constraints, which could disrupt near-term revenue growth.

Of recent developments, the appointment of Robert McMahon as CFO stands out, coming amid shifting customer needs and a renewed focus on operational efficiency. Turning new sector optimism into profitable growth will require steady hands at the financial helm, especially as West Pharmaceutical works to capture benefits from the improving bioprocessing market.

However, it’s important not to overlook growing concerns about near-term HVP demand constraints that investors should be aware of...

Read the full narrative on West Pharmaceutical Services (it's free!)

West Pharmaceutical Services is projected to reach $3.6 billion in revenue and $675.2 million in earnings by 2028. This outlook assumes annual revenue growth of 6.5% and an earnings increase of $187.5 million from the current $487.7 million.

Uncover how West Pharmaceutical Services' forecasts yield a $316.36 fair value, a 21% upside to its current price.

Exploring Other Perspectives

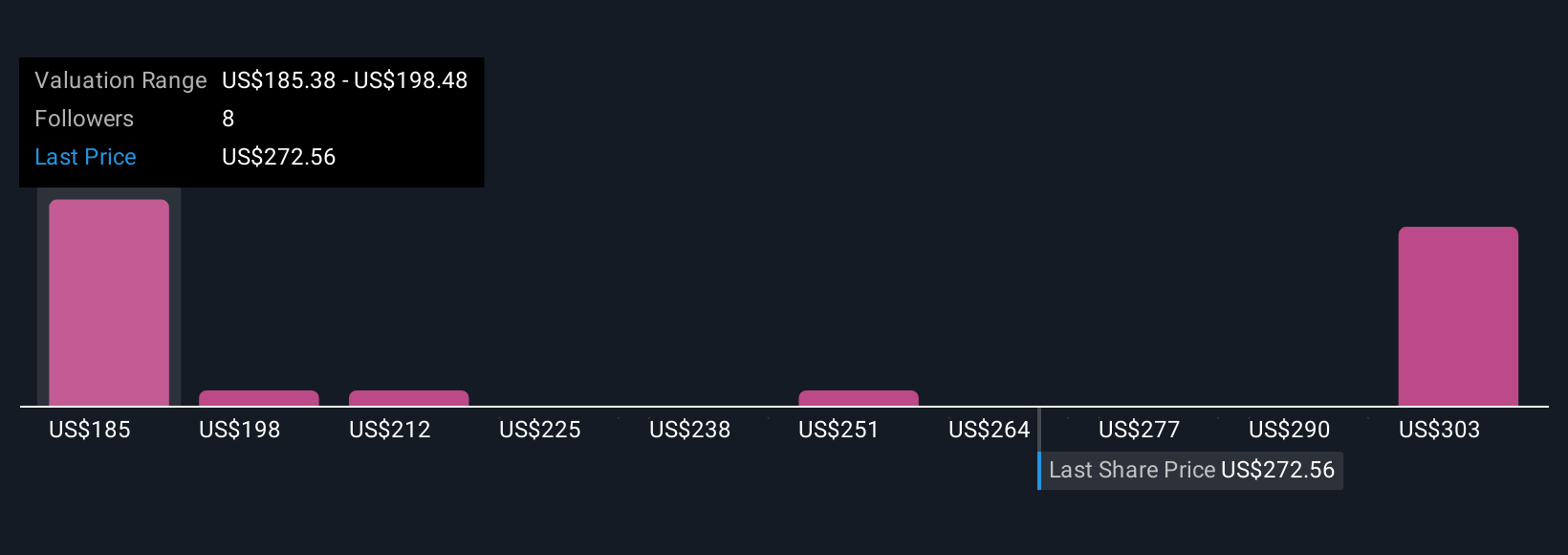

Five members of the Simply Wall St Community estimate West’s fair value between US$188.73 and US$316.36, highlighting the wide spread in expectations. With demand constraints for HVP components still an ongoing risk, you can see how opinions differ about the company’s ability to consistently grow revenue.

Explore 5 other fair value estimates on West Pharmaceutical Services - why the stock might be worth as much as 21% more than the current price!

Build Your Own West Pharmaceutical Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your West Pharmaceutical Services research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free West Pharmaceutical Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate West Pharmaceutical Services' overall financial health at a glance.

No Opportunity In West Pharmaceutical Services?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal