Why Nebius Group (NBIS) Is Up 8.4% After $19.4 Billion Microsoft AI Cloud Deal Announcement

- Nebius Group recently reported a very large year-over-year revenue increase in the second quarter of 2025, driven by surging demand for AI cloud infrastructure, and announced a multi-year AI infrastructure agreement with Microsoft valued at up to US$19.4 billion.

- This landmark deal with Microsoft marks a major step for Nebius, signaling the company's expanding scale in a rapidly growing industry.

- We'll examine how the landmark Microsoft agreement could reshape Nebius Group's investment narrative and its prospects in AI cloud infrastructure.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Nebius Group Investment Narrative Recap

To own Nebius Group stock, an investor must believe in continued hypergrowth in demand for AI cloud infrastructure and the company’s ability to leverage high-profile partnerships to sustain this trajectory. The multi-year, multibillion-dollar agreement with Microsoft, announced in September 2025, is a material near-term catalyst, providing significant revenue visibility but also increasing expectations for execution and scaling capacity. At the same time, the highly competitive AI infrastructure market and ambitious expansion plans underscore the risk that rapid growth could be challenged by pricing pressure, high capital requirements, or operational missteps.

One of the most relevant recent announcements is Nebius Group’s expanded full-year annualized run-rate revenue guidance to a range of US$900 million to US$1.1 billion, reflecting strong underlying momentum from its pipeline and improved demand visibility. This updated outlook arrived in the wake of the Microsoft partnership and the company’s high double- and triple-digit growth rates, both of which are likely to intensify scrutiny on Nebius’s ability to translate backlog into profitable, recurring revenue at scale.

However, against these promising signals, investors should not lose sight of emerging risks such as...

Read the full narrative on Nebius Group (it's free!)

Nebius Group's narrative projects $3.2 billion revenue and $428.7 million earnings by 2028. This requires 133.9% yearly revenue growth and a $238.5 million earnings increase from $190.2 million currently.

Uncover how Nebius Group's forecasts yield a $97.40 fair value, a 10% downside to its current price.

Exploring Other Perspectives

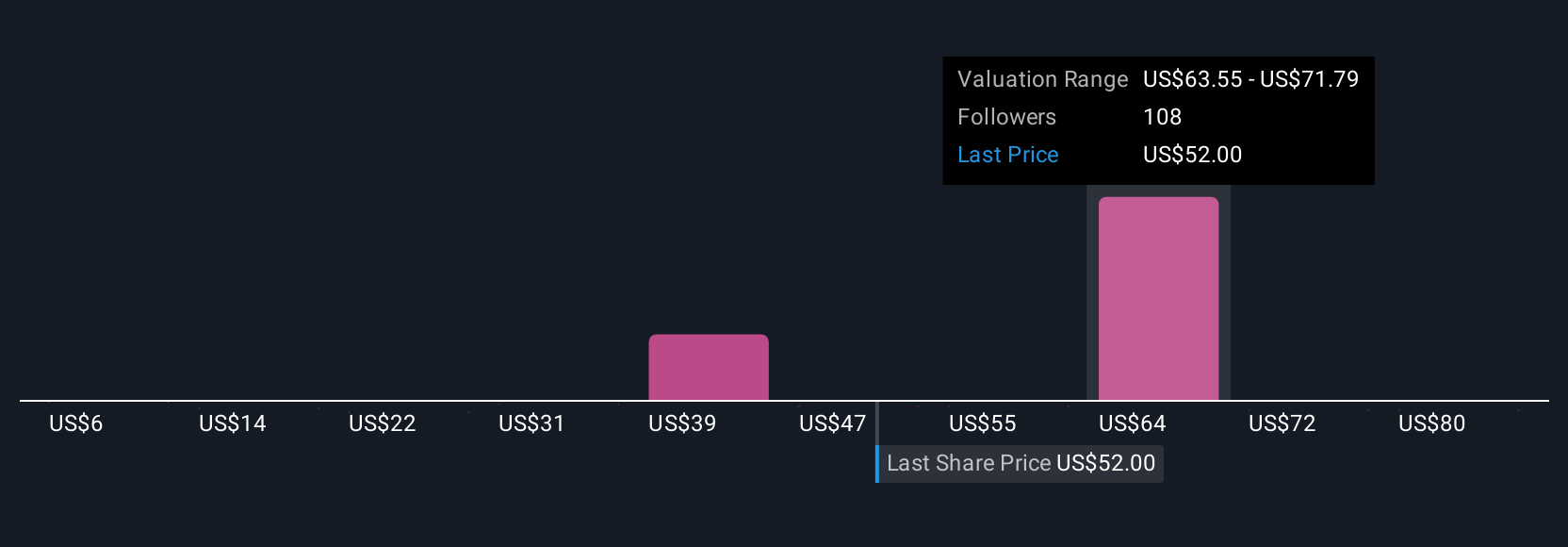

Simply Wall St Community members offered 38 fair value estimates for Nebius Group, ranging from US$7.35 to US$333.76 per share. While opinions run the gamut, the company’s reliance on sustained hypergrowth in AI cloud infrastructure may prove pivotal for future returns. Consider the varied views and see what others are projecting.

Explore 38 other fair value estimates on Nebius Group - why the stock might be worth over 3x more than the current price!

Build Your Own Nebius Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nebius Group research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Nebius Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nebius Group's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal