Will Albertsons’ (ACI) Retail Media Partnership with Perion Transform Its Digital Growth Strategy?

- Perion Network Ltd. and Albertsons Media Collective recently announced a partnership, enabling advertisers to leverage Albertsons’ purchase-based first-party audiences across digital and out-of-home formats, reaching over 100 million verified shoppers with targeted campaigns.

- This collaboration, combined with the expansion of Albertsons' For U loyalty program to include travel rewards and key board changes, highlights the company's ongoing push to drive shopper engagement and strengthen its position in the fast-evolving retail media landscape.

- We’ll explore how the expansion of Albertsons’ retail media capabilities may influence its long-term growth and investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Albertsons Companies Investment Narrative Recap

To be a shareholder in Albertsons Companies right now, you need to believe in the company's ability to expand digital and omnichannel operations, boosting shopper engagement to support returns despite margin pressures. The new partnership with Perion Network could further strengthen retail media ambitions, but rising labor costs from recent union agreements remain the key risk, with digital profitability still lagging competitors. Near-term, these updates could deepen customer loyalty and data monetization, but do not materially change the biggest catalysts or immediate risks.

Among recent announcements, the addition of travel rewards to the For U loyalty program stands out for its direct connection to digital growth and customer retention, the same areas targeted by Albertsons' new retail media capabilities. While margin compression and labor costs continue to pose challenges, these customer-focused innovations may support recurring revenue and further integration of digital and store experiences.

However, investors should also consider the risk from persistent labor cost pressures if wage agreements outpace efficiency gains...

Read the full narrative on Albertsons Companies (it's free!)

Albertsons Companies' outlook anticipates $86.1 billion in revenue and $1.1 billion in earnings by 2028. This scenario implies a 2.1% annual revenue growth rate and an earnings increase of about $146 million from current earnings of $954.3 million.

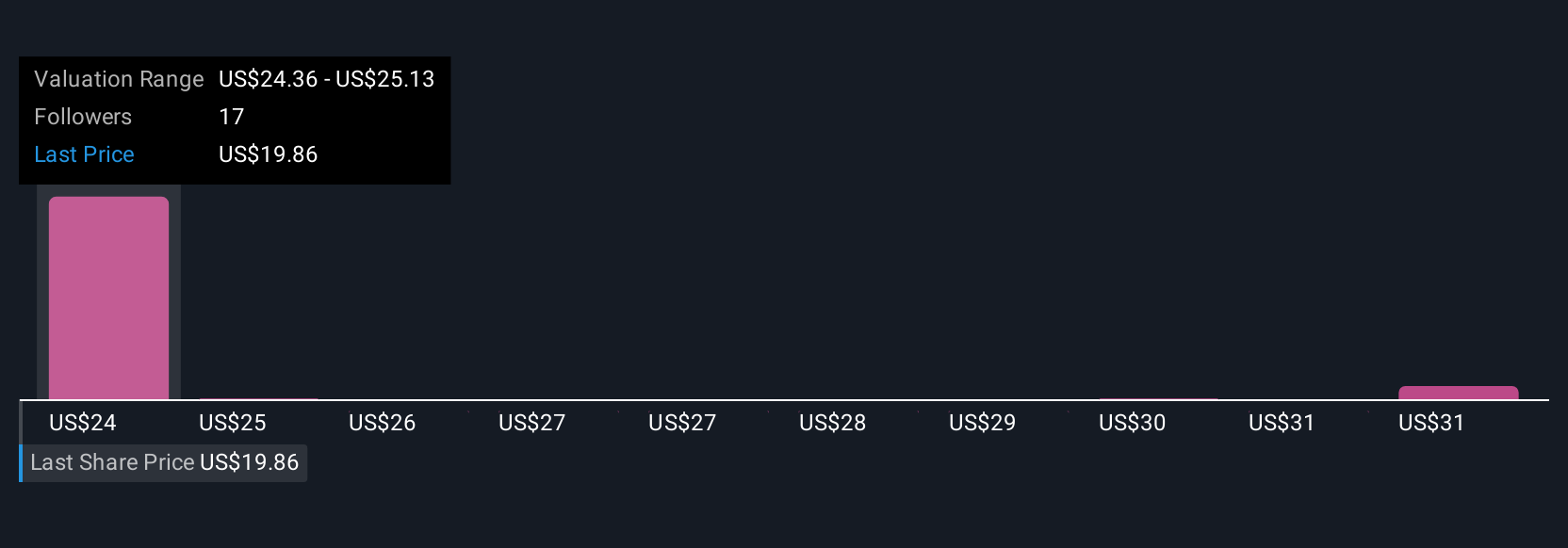

Uncover how Albertsons Companies' forecasts yield a $24.19 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community members estimate Albertsons' fair value between US$19.77 and US$39.70 per share. While you weigh these varying views, consider how wage cost risks could weigh on profit improvement, explore what others think and why perspectives differ.

Explore 6 other fair value estimates on Albertsons Companies - why the stock might be worth just $19.77!

Build Your Own Albertsons Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Albertsons Companies research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Albertsons Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Albertsons Companies' overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal