Halliburton (HAL) Is Up 11.6% After Oil Prices Jump on NATO-Russia Tensions and Supply Fears

- In late September 2025, Halliburton attracted heightened investor attention after oil prices climbed due to escalating tensions between NATO and Russia, with NATO issuing strong warnings and Russia signaling possible export restrictions.

- This shift underscores how geopolitical risks and broader energy supply concerns can rapidly influence sentiment and capital flows across the oil and gas sector.

- We'll now explore how the recent surge in oil prices triggered by supply fears impacts Halliburton's underlying investment narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Halliburton Investment Narrative Recap

For investors considering Halliburton, the core belief is that global energy demand and ongoing reliance on oil and gas, despite near-term volatility, will drive steady demand for the company’s services. The recent surge in oil prices has provided a catalyst for sentiment and stock price, but the most immediate risk remains the pace of energy transition and regulatory pressures which could structurally challenge long-term demand, a factor not immediately changed by this week’s geopolitical news.

Among recent developments, Halliburton’s five-year well stimulation contract with ConocoPhillips in the North Sea stands out. This announcement directly ties to the catalyst of growing international diversification, as Halliburton seeks to reduce its earnings cyclicality outside the North American shale market, which is especially relevant amid current energy supply concerns.

Yet, in contrast to the current surge in oil prices, investors should also consider the persistent risk of...

Read the full narrative on Halliburton (it's free!)

Halliburton's outlook estimates $22.1 billion in revenue and $2.0 billion in earnings by 2028. This projection assumes a -0.2% annual revenue decline and a $0.1 billion increase in earnings from $1.9 billion today.

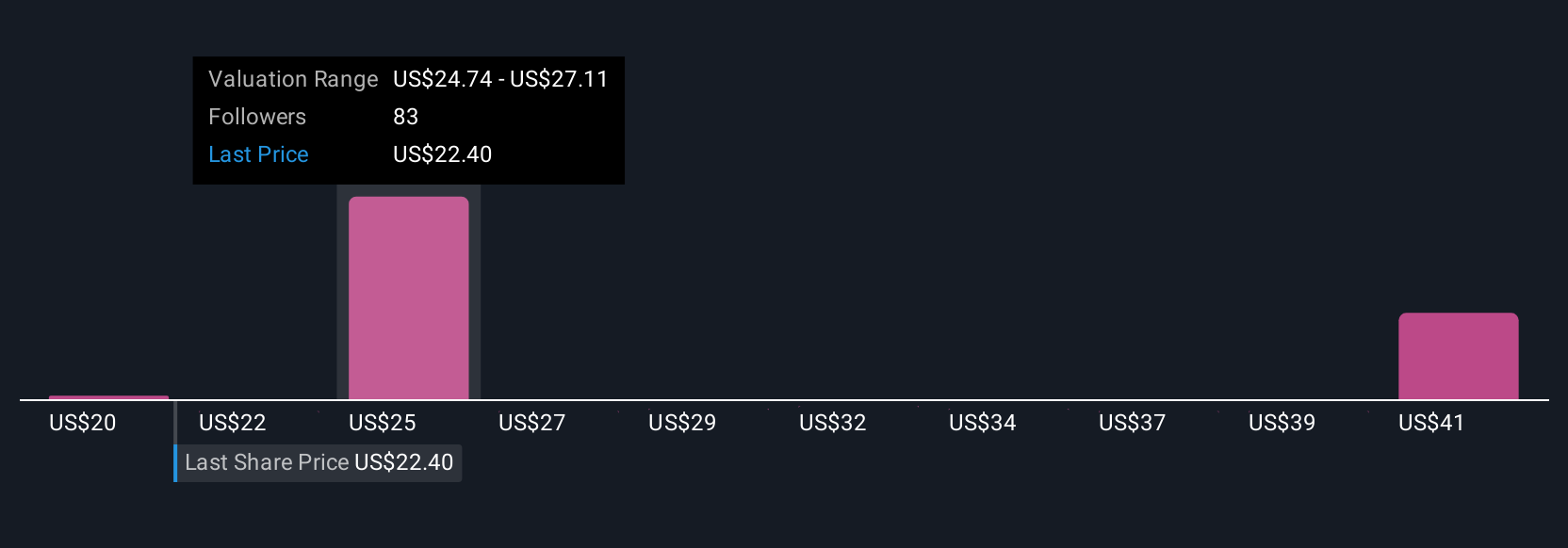

Uncover how Halliburton's forecasts yield a $26.54 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Twelve fair value estimates from the Simply Wall St Community span US$20 to US$45.10 a share, reflecting sharply differing opinions on Halliburton’s outlook. While the community remains split, the pace of renewable energy adoption and evolving regulation may play a bigger role in shaping the company’s future than this month’s geopolitical headlines suggest.

Explore 12 other fair value estimates on Halliburton - why the stock might be worth as much as 80% more than the current price!

Build Your Own Halliburton Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halliburton research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Halliburton research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halliburton's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal