How Could Safety Allegations and Transparency Questions Reshape Encompass Health’s (EHC) Long-Term Reputation?

- Earlier this month, Encompass Health opened its first inpatient rehabilitation hospital in Connecticut, featuring 40 private beds and advanced therapy amenities for patients recovering from strokes, brain injuries, amputations, and complex orthopedic conditions.

- Attention on the company has heightened following the launch of a law firm investigation and significant media scrutiny regarding patient safety and disclosure practices at Encompass Health facilities.

- We’ll examine how recent allegations of patient safety concerns and transparency issues could affect Encompass Health’s investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Encompass Health Investment Narrative Recap

For an investor to be a shareholder in Encompass Health, you need to believe that strong demographic drivers and a shortage of inpatient rehabilitation beds will continue to fuel patient demand and revenue growth. The recent news highlighting patient safety and disclosure concerns introduces an immediate risk to the business, potentially shifting short-term focus from expansion to regulatory and reputational management. While the company’s continued facility development is a critical growth catalyst, patient safety allegations may have a material impact on sentiment and priorities in the near term.

Most relevant to the current news, Encompass Health's announcement of its 40-bed Connecticut hospital is part of a larger expansion effort this year, including several new facilities in Florida and Texas. These openings represent the company’s efforts to capture underserved markets and meet rising demand for rehabilitation services, supporting the investment narrative, but also drawing additional scrutiny regarding operational practices and patient outcomes.

By contrast, the recent focus on patient safety and disclosure is something investors should be aware of, especially as it may shift...

Read the full narrative on Encompass Health (it's free!)

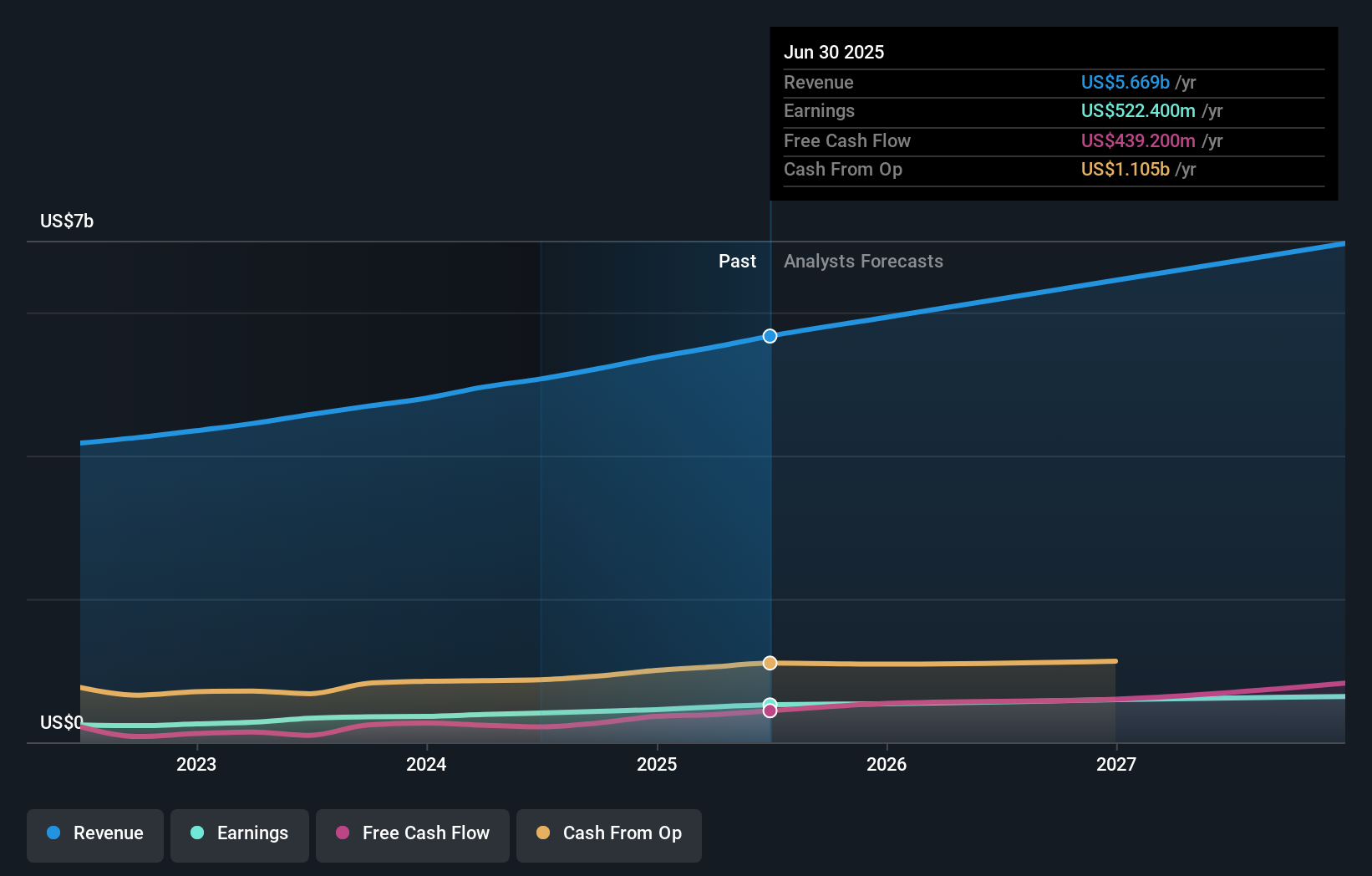

Encompass Health's narrative projects $7.2 billion in revenue and $711.6 million in earnings by 2028. This requires 8.1% yearly revenue growth and a $189.2 million increase in earnings from $522.4 million today.

Uncover how Encompass Health's forecasts yield a $137.42 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community fair value estimates place Encompass Health at exactly US$137.42 per share. While the expansion into new markets is a current strength, the recent patient safety concerns prompt discussion about long-term reputation and operational risk. Explore how differing views shape market expectations.

Explore 2 other fair value estimates on Encompass Health - why the stock might be worth just $137.42!

Build Your Own Encompass Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Encompass Health research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Encompass Health research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Encompass Health's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 31 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal