A Look at Gulfport Energy’s Valuation Following Its Largest Leasehold Investment in Six Years and Production Growth

Most Popular Narrative: 19.7% Undervalued

The dominant narrative points to Gulfport Energy being significantly undervalued, based on analyst expectations for strong future growth and cash returns.

Gulfport's direct access to premium Gulf Coast markets, exposure to the LNG export corridor, and ongoing negotiations to supply emerging large-scale power projects (driven by AI/data center growth and US/EU LNG infrastructure buildout) position the company to benefit from rising natural gas demand. This, in turn, could translate into improved realized prices, cash flows, and long-term revenues.

Curious how Gulfport is expected to leap ahead of industry peers? The most-followed valuation narrative is built on aggressive earnings expansion, strategic share reductions, and a profit margin transformation typically reserved for market disruptors. The true drivers, hidden in analyst forecasts, might just surprise you.

Result: Fair Value of $222.55 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, even with this momentum, concentrated exposure to core basins and swings in commodity prices remain key risks that could challenge Gulfport’s growth narrative.

Find out about the key risks to this Gulfport Energy narrative.Another View: The Multiples Approach

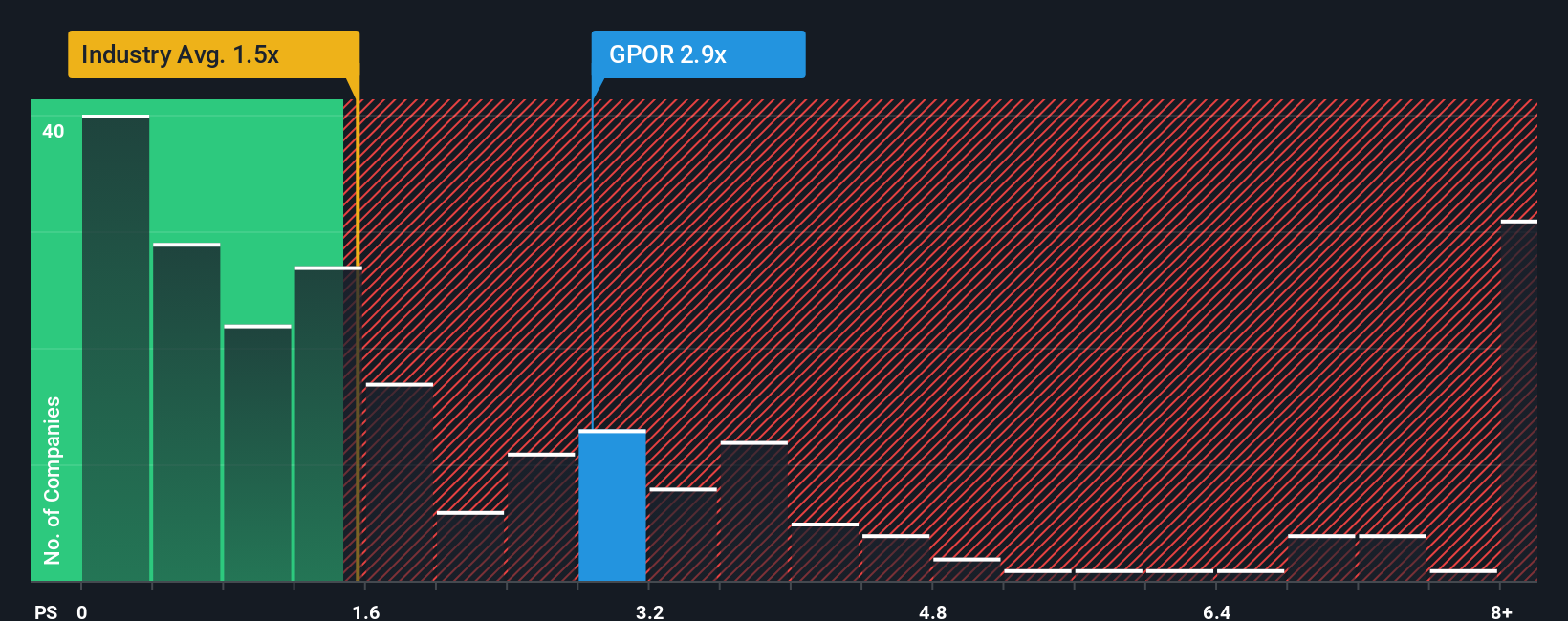

While analyst forecasts and cash flows suggest Gulfport Energy is deeply undervalued, looking at its value compared to other US oil and gas stocks tells a different story. By this measure, shares look somewhat expensive. Which lens best captures reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gulfport Energy Narrative

If you see things differently or want to dig into the numbers and uncover your own insights, crafting a personalized narrative takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Gulfport Energy.

Looking for More Investment Ideas?

Why limit your strategy to just one company? Future opportunities could be hiding where you least expect. Make the smart move and get ahead before others catch on by exploring hand-picked stocks ready for their next breakout.

- Tap into tomorrow’s breakthroughs by checking out the leaders at the intersection of artificial intelligence and healthcare with our healthcare AI stocks.

- Catch high-yield plays by scouting companies offering reliable, inflation-beating payouts using this focused dividend stocks with yields > 3%.

- Uncover potential overlooked winners in fast-moving markets by scanning our curated list of penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal