Valuing KE Holdings (NYSE:BEKE) After S&P Global BMI Index Inclusion

KE Holdings (NYSE:BEKE) just caught headlines after being added to the S&P Global BMI Index, a meaningful marker for any stock. This inclusion could spark increased interest from institutional investors and index funds, as these portfolios often adjust holdings to match new index additions. For investors on the sidelines, index inclusion often raises the question of whether fresh attention and possible demand will drive shares higher, or if the impact might be more muted in the long run.

This move comes on the heels of a mixed year for KE Holdings. Over the past month, shares are up 9%, but the one-year return is flat. Longer-term holders have seen a 16% gain over the past three years, although the five-year return remains deep in the red. While there are signs of renewed momentum recently, the broader trajectory has been anything but a straight line, and market sentiment seems to be shifting as the company’s fundamentals improve.

So what does this fresh wave of interest mean for the stock? Are investors getting a bargain at today's prices, or is all the future growth already getting priced in?

Most Popular Narrative: 14.8% Undervalued

According to the most popular analyst narrative, KE Holdings trades well below its estimated fair value. The company is seen as undervalued based on a blend of future growth prospects, margin expansion, and risks unique to China’s real estate sector.

The company is capitalizing on China's ongoing urbanization and rising middle class. Despite short-term market softness, migration from lower-tier to higher-tier cities continues to fuel transaction volume, positioning KE Holdings to benefit from long-term structural demand recovery, which supports future revenue growth. Increasing digital adoption in China's real estate sector is benefiting KE Holdings as the company accelerates AI and SaaS initiatives (for example, AI-driven agent productivity tools and operational efficiencies). This enables higher agent and store productivity and efficiency, which is expected to drive operating leverage and ultimately improve net margins and earnings over time.

Curious what’s driving this bullish price target? The key metric here is a sharp increase in earnings power paired with a valuation multiple often reserved for sector leaders. Just how optimistic are these projections, and what hidden stress points might tip the scale? Dive into the full narrative to discover the numbers that power this surprising valuation call.

Result: Fair Value of $22.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weakness in China's property market or sudden regulatory changes could quickly challenge the current undervalued narrative for KE Holdings.

Find out about the key risks to this KE Holdings narrative.Another View: High Valuation Based on Earnings Ratio

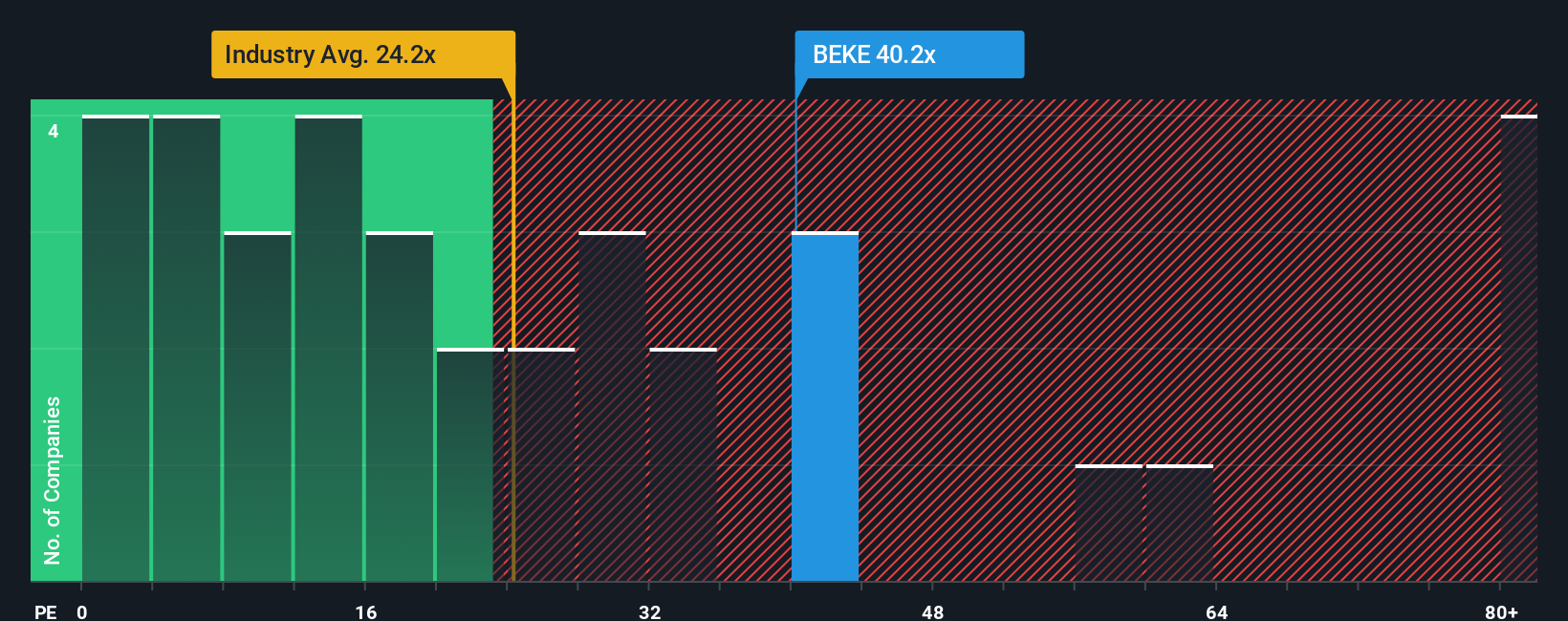

While the consensus sees KE Holdings as undervalued, a look at its price relative to earnings in the real estate sector suggests the share is more expensive than industry norms. Could optimism be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own KE Holdings Narrative

If you want to dig deeper and shape the story yourself, it only takes a few minutes to see what the data reveals for your own perspective. Do it your way.

A great starting point for your KE Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Do not just stop at KE Holdings when there are exciting trends shaking up global markets every day. You could be just one step away from your next winning stock pick with the right tools in hand.

- Tap into high-growth potential by searching for stocks at the forefront of the AI wave with our AI penny stocks.

- Uncover steady income opportunities by checking out companies with above-average yields through our dividend stocks with yields > 3%.

- Stay a step ahead by hunting for stocks trading below intrinsic value using our undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal