GE HealthCare Technologies (GEHC): Taking Stock of Valuation Following U.S. Medical Device Security Investigation

If you hold GE HealthCare Technologies (GEHC) or are considering adding it to your portfolio, this week’s headlines may have you second-guessing your next move. Shares dropped after the U.S. Commerce Department launched a national security investigation into imported medical equipment, which could include the devices GE HealthCare manufactures. The prospect of new tariffs and supply chain disruption brings attention to risks that sometimes go unnoticed for healthcare tech investors, making this a moment where caution and curiosity go hand in hand.

Looking beyond the sudden jolt, the bigger picture emerges. GE HealthCare’s share price had already trended lower this year, with a 21% slide over the past twelve months and a negative trajectory for most of 2025. Recent product announcements and a dividend affirmation indicate the company is pressing ahead with its core strategies, but short-term momentum is clearly on the back foot. In this context, broader industry uncertainty seems to be amplifying pressure on the stock rather than reflecting only company-specific fundamentals.

After a year of declining prices and fresh external risks, is GE HealthCare Technologies a value play hiding in plain sight, or is the market simply bracing for more rough patches ahead?

Most Popular Narrative: 17.7% Undervalued

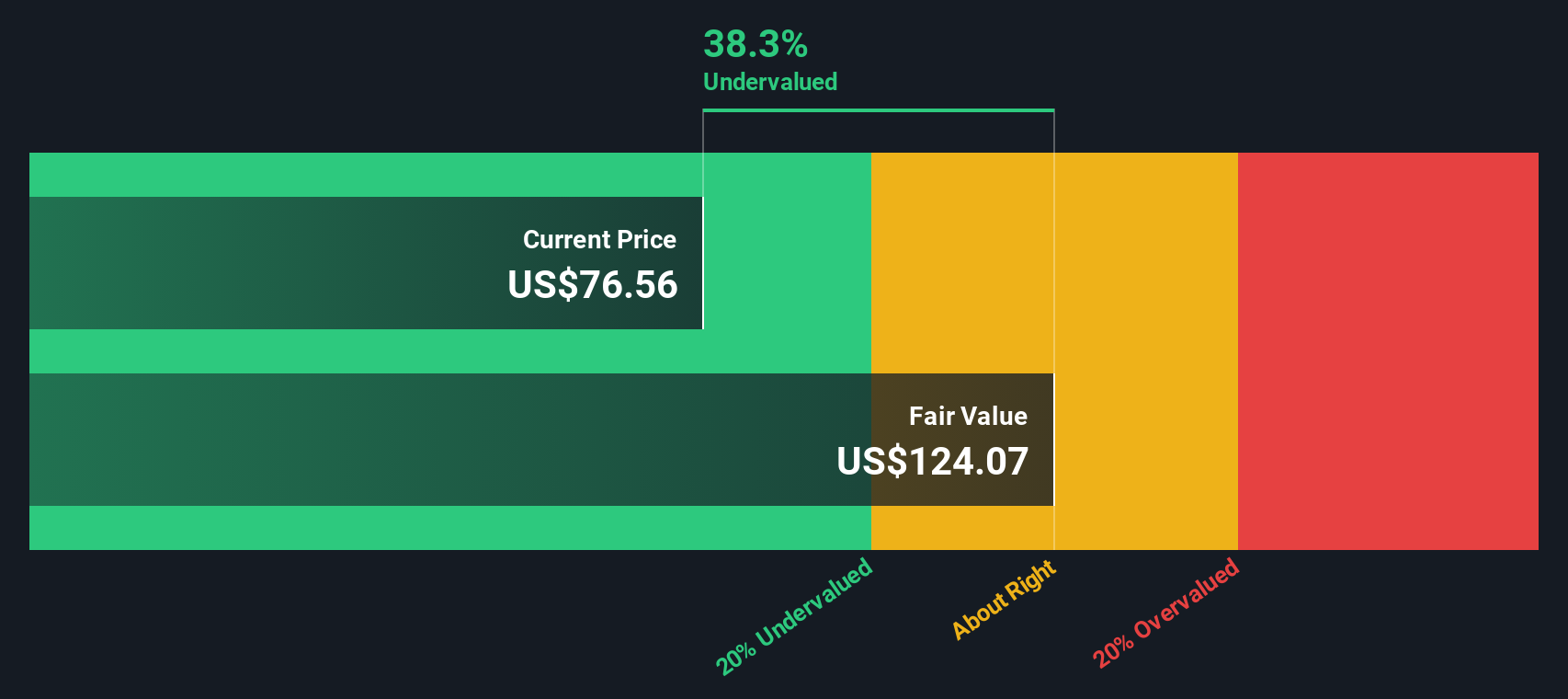

According to the most widely followed valuation narrative, GE HealthCare Technologies appears to be trading at a sizable discount to its estimated fair value. Investors may be overlooking the company's future prospects in the face of recent uncertainty.

"The pipeline of new high-impact products, like Radiopharmaceuticals, Total Body PET, and Photon Counting CT, is anticipated to drive future revenue growth and potentially improve margins. The focus on expanding recurring revenue, particularly in areas like digital solutions and advanced visualization, is expected to contribute positively to revenue stability and net margins."

Curious about the secret sauce behind this bullish view? The calculations hinge on forward-looking growth targets, anticipated margin movements, and a valuation multiple that splits the difference between today’s price and the industry’s lofty averages. Find out what financial forecasts and market shifts analysts believe will propel this stock closer to its fair value.

Result: Fair Value of $88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing tariff uncertainties and competitive pressures in emerging markets could easily reshape this positive scenario if conditions worsen unexpectedly.

Find out about the key risks to this GE HealthCare Technologies narrative.Another View: What Does Our DCF Model Reveal?

The story shifts when we look at GE HealthCare Technologies through the lens of our DCF model. Instead of market-based multiples, the DCF focuses on projected cash flows to estimate the company's value and suggests a different outcome. Could this model be picking up on things that multiples alone might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GE HealthCare Technologies Narrative

If these perspectives don't resonate, why not dig into the numbers on your own? You can craft and share your own analysis in just a few minutes. Do it your way

A great starting point for your GE HealthCare Technologies research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Take charge of your investment journey by checking out these powerful stock ideas and stay ahead of the next market moves.

- Tap into rapid price movements and potential turnarounds with penny stocks with strong financials, fueling growth for value-seekers and bold investors alike.

- Unlock tomorrow’s innovations and invest in companies revolutionizing healthcare with breakthrough algorithms through healthcare AI stocks.

- Boost your income and spot reliable cash generators by exploring high-yield opportunities with dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal