Civitas Resources (CIVI) Is Up 8.1% After Expanding Share Buyback to 28% of Market Cap Has The Bull Case Changed?

- Earlier this month, Civitas Resources announced an expanded shareholder return program, increasing its share repurchase authorization to US$750 million, about 28% of its market capitalization at the time, and launching a US$250 million accelerated buyback to be completed by the end of the third quarter of 2025.

- A distinctive feature of the announcement was Civitas’s plan to direct 50% of post-dividend free cash flow toward annual buybacks and the remainder to paying down debt, alongside cost optimization and non-core asset sales.

- We’ll now explore how this renewed commitment to capital returns and balance sheet strengthening could influence Civitas Resources’ investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Civitas Resources Investment Narrative Recap

To be a shareholder in Civitas Resources right now means believing in the ongoing demand for oil and gas and the company’s ability to boost shareholder returns through disciplined capital allocation. The expanded US$750 million buyback program directly supports these goals, but does not fundamentally change the near-term focus on free cash flow sustainability or the current risk from Civitas’s elevated debt and ongoing exposure to commodity price fluctuations.

Among the recent announcements, the board's move to allocate 50% of post-dividend free cash flow to buybacks and the balance to debt reduction stands out. This approach is particularly relevant as it provides a clearer structure for capital returns, but may also increase sensitivity to swings in operating cash flow or oil market volatility. Despite these positive steps, investors should be aware that growing leverage could magnify the impact of ...

Read the full narrative on Civitas Resources (it's free!)

Civitas Resources is projected to reach $4.9 billion in revenue and $790.4 million in earnings by 2028. This outlook is based on a forecast revenue decline of 0.6% per year and an increase in earnings of about $34 million from the current level of $756.7 million.

Uncover how Civitas Resources' forecasts yield a $41.80 fair value, a 26% upside to its current price.

Exploring Other Perspectives

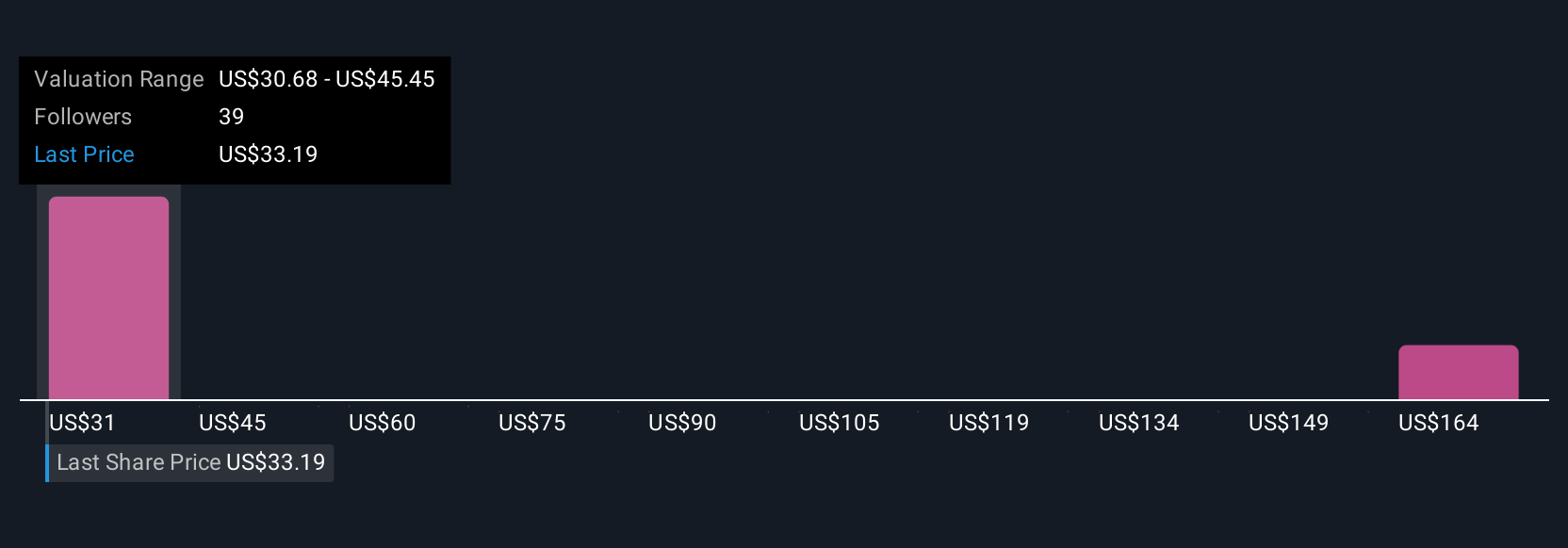

Community fair value estimates for Civitas Resources span from US$30.68 to US$190.52, based on six distinct member models from the Simply Wall St Community. These wide-ranging values underscore how views on debt risk and future cash generation can sharply impact expectations, so be sure to consider multiple opinions when assessing the company’s potential.

Explore 6 other fair value estimates on Civitas Resources - why the stock might be worth 8% less than the current price!

Build Your Own Civitas Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Civitas Resources research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Civitas Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Civitas Resources' overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal