QuidelOrtho (QDEL): Valuation Spotlight After New Rapid Flu and COVID Test Launch

Most Popular Narrative: 34.8% Undervalued

The most widely followed narrative values QuidelOrtho as significantly undervalued compared to its fair value estimate, reflecting strong optimism about the company's recovery potential and future growth prospects.

Expansion into international markets such as Latin America, Asia Pacific, and underpenetrated regions like China, where differentiated technology, low market share, and a large runway for immunoassay growth exist, positions QuidelOrtho to capture increased demand stemming from global health system focus on early detection and public health surveillance. This should drive topline revenue growth.

Wondering what financial secrets justify this sizable valuation gap? The most popular narrative is built on bold projections such as a turnaround to profitability, margin improvements, and aggressive global expansion. Which core assumptions are driving this underappreciated story, and could they really propel the company to new highs? The answers might surprise you.

Result: Fair Value of $43.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent declines in COVID testing revenue and challenges from discontinued product lines could quickly undermine the bullish recovery case for QuidelOrtho.

Find out about the key risks to this QuidelOrtho narrative.Another View: What Does the SWS DCF Model Say?

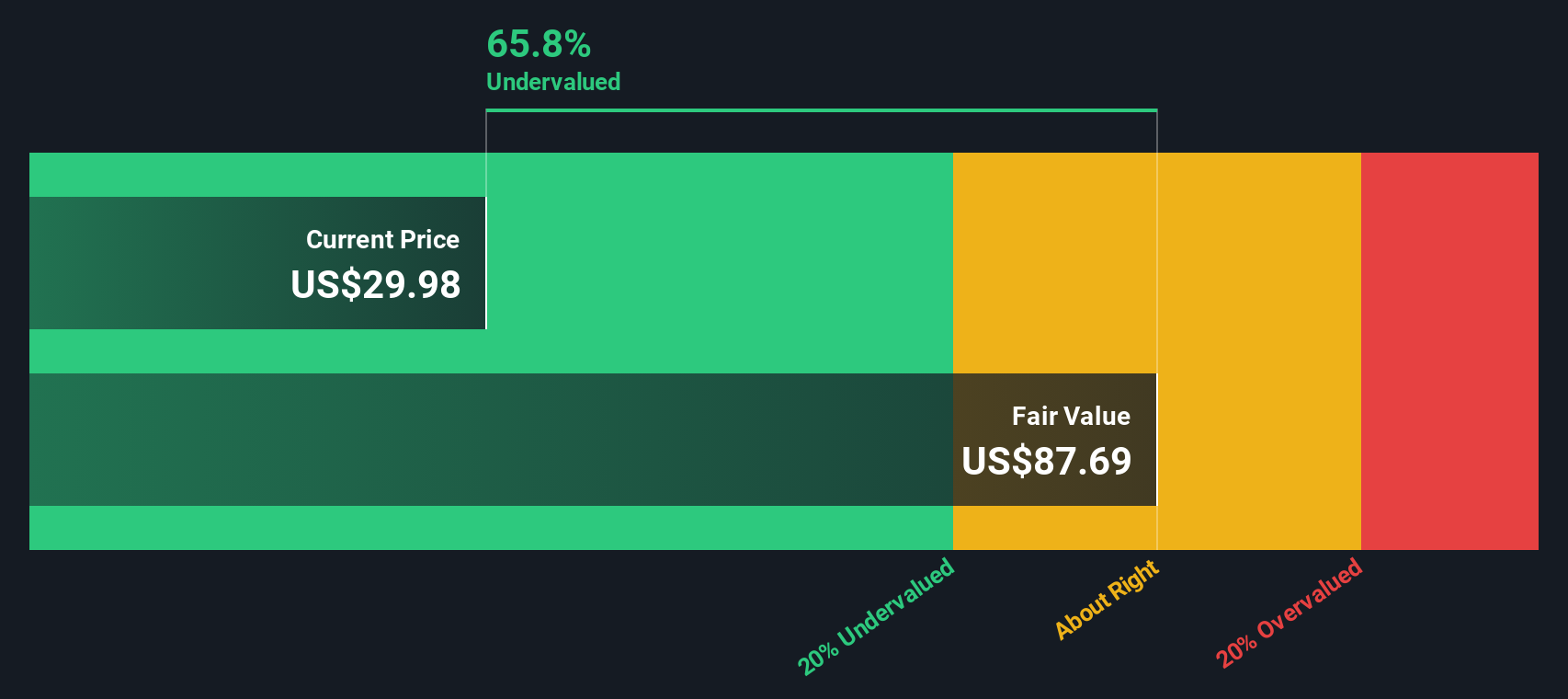

While the consensus targets suggest QuidelOrtho is undervalued, our DCF model supports that view and indicates the market price is well below its intrinsic value. Could the gap point to real upside, or are there hidden risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own QuidelOrtho Narrative

If you want to dig into the numbers yourself or have a different take, you can piece together your own narrative in just a few minutes. Do it your way

A great starting point for your QuidelOrtho research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You’re not limited to just QuidelOrtho. Take charge of your portfolio by uncovering compelling opportunities other investors are missing using Simply Wall Street’s powerful screeners.

- Uncover fast-growing companies at bargain prices with our selection of undervalued stocks based on cash flows, featuring strong financial upside and growth potential.

- Stay ahead of the next wave in healthcare by sorting through healthcare AI stocks, which are transforming patient care with artificial intelligence.

- Unlock consistent cash flow by exploring dividend stocks with yields > 3% for stocks offering robust yields and reliable, shareholder-friendly payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal