Could Analyst Downgrade of Cactus (WHD) Signal a Shift in its Competitive Positioning?

- In late September 2025, Cactus, Inc. (WHD) was added to the Zacks Rank #5 (Strong Sell) list following a downward revision in its earnings estimates by analysts.

- This shift in analyst sentiment signals increased caution around the company’s near-term financial prospects, potentially influencing investor confidence and market perception.

- We’ll explore how the recent analyst downgrade and earnings outlook revision may impact the broader investment case for Cactus.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cactus Investment Narrative Recap

To be a shareholder of Cactus, Inc., you’d need to believe in the long-term need for oilfield pressure control solutions and the company’s ability to capture value despite cycles in drilling activity and global supply trends. The recent Zacks Rank downgrade highlights short-term uncertainty around earnings, mainly due to softening in land drilling demand, but does not materially change the importance of the company’s ongoing cost controls or its exposure to near-term volatility in customer spending. One recent announcement of interest is the Q2 earnings release, where Cactus reported both revenue and net income declined year-over-year. This directly relates to current concerns around reduced U.S. land drilling and customer capital discipline, a risk that has only become more relevant following the latest analyst downgrades, increasing the focus on how quickly Cactus can offset demand weakness. But while cost efficiency remains a key catalyst, investors should be aware of the heightened risk that further softening in US drilling could…

Read the full narrative on Cactus (it's free!)

Cactus' narrative projects $1.7 billion revenue and $232.7 million earnings by 2028. This requires 15.3% yearly revenue growth and a $51.5 million earnings increase from $181.2 million today.

Uncover how Cactus' forecasts yield a $49.62 fair value, a 19% upside to its current price.

Exploring Other Perspectives

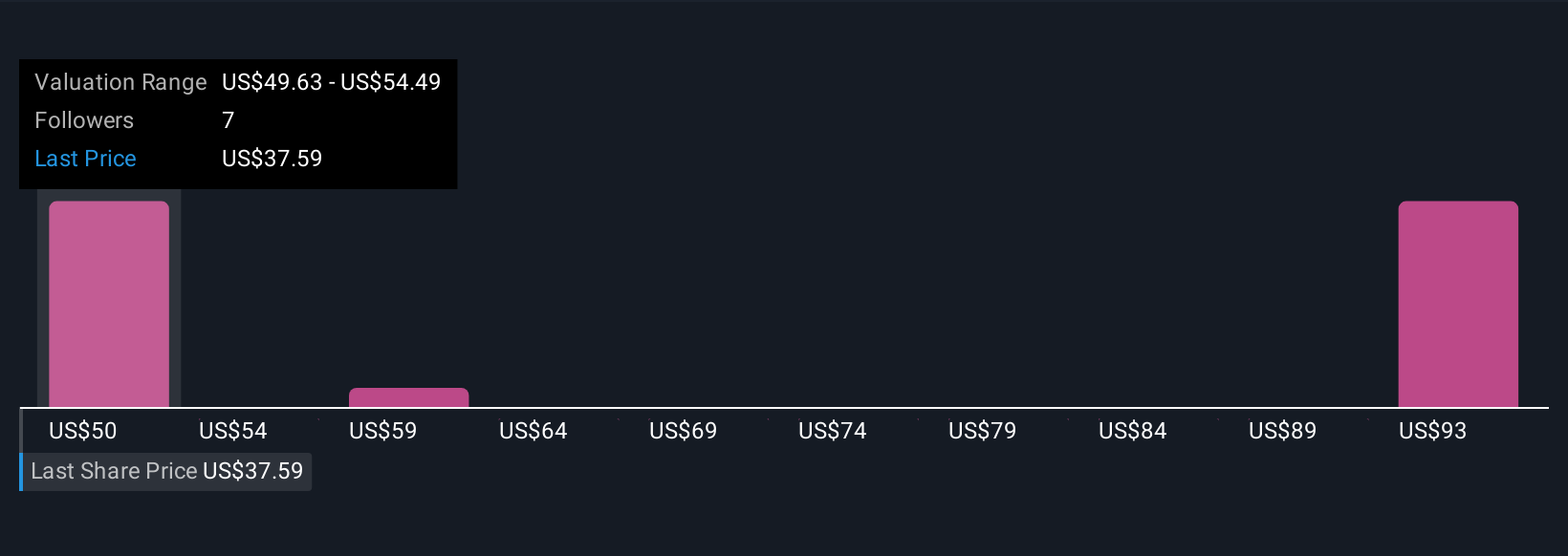

Three private investor fair value estimates for Cactus, Inc. from the Simply Wall St Community range from US$49.63 to US$60 per share. While many see upside, the current risk from persistent weakness in US land drilling activity could affect future performance, so consider the wide range of views before deciding for yourself.

Explore 3 other fair value estimates on Cactus - why the stock might be worth as much as 44% more than the current price!

Build Your Own Cactus Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cactus research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Cactus research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cactus' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal