Should Investors Look at Hess Midstream After Its Recent 15% Price Pullback in 2025?

If you are trying to figure out whether to buy, sell, or simply watch Hess Midstream stock, you are definitely not alone. After a solid multi-year run, with shares climbing a remarkable 244.0% over five years and 72.4% in the last three, investors have recently seen some turbulence. Over the last month, the stock pulled back by 15.5% and is down 6.9% for the year, despite a modest 7.0% gain over the past twelve months. Some of this movement can be chalked up to broader shifts in the energy sector and changing investor attitudes toward midstream assets, which often ebb and flow as the market reassesses risk and long-term cash flow potential.

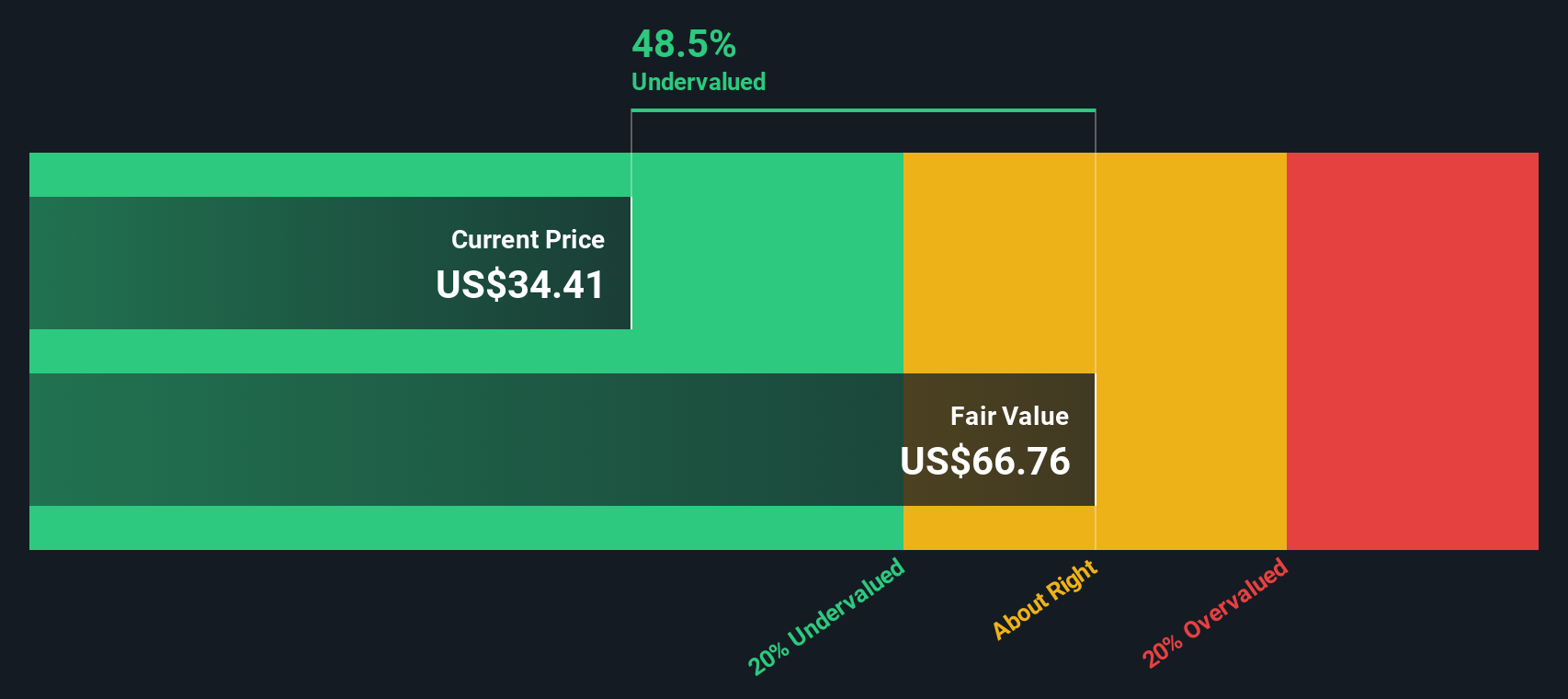

Of course, the big question is whether this pullback represents a genuine opportunity, or if investors should be wary of further downside. To cut through the noise, it is smart to turn to valuation, especially given that Hess Midstream currently boasts a value score of 5 out of a possible 6. That indicates the stock checks almost every box for being undervalued when tested across six classic valuation methods, which is a compelling setup regardless of short-term volatility.

In the next section, we will dig into these valuation approaches, see how Hess Midstream measures up, and explore what could make this analysis even more robust in today’s market.

Why Hess Midstream is lagging behind its peersApproach 1: Hess Midstream Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a classic valuation method that estimates a company's worth by projecting its future cash flows and discounting them back to their present value. In other words, it tries to answer what all of Hess Midstream's future cash profits are worth in today's dollars.

For Hess Midstream, the most recent reported Free Cash Flow (FCF) stands at $682.2 million. Analyst estimates extend out to 2029, projecting FCF to reach $708.6 million. Beyond that, projections are extrapolated, showing a gradual rise to $775.7 million by 2035. This pattern reflects a modest but steady growth in the company's future cash generation, with most of the forward estimates derived from both analyst coverage and reasonable growth assumptions for the business.

After discounting all these projected cash flows using the 2 Stage Free Cash Flow to Equity model, the calculated fair value for Hess Midstream stock is $63.71 per share. This is notably higher than its current market price, implying the stock is trading at a significant 45.1% discount to its intrinsic value. This margin suggests the company is undervalued based on its long-term cash-generating ability.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Hess Midstream.

Approach 2: Hess Midstream Price vs Earnings

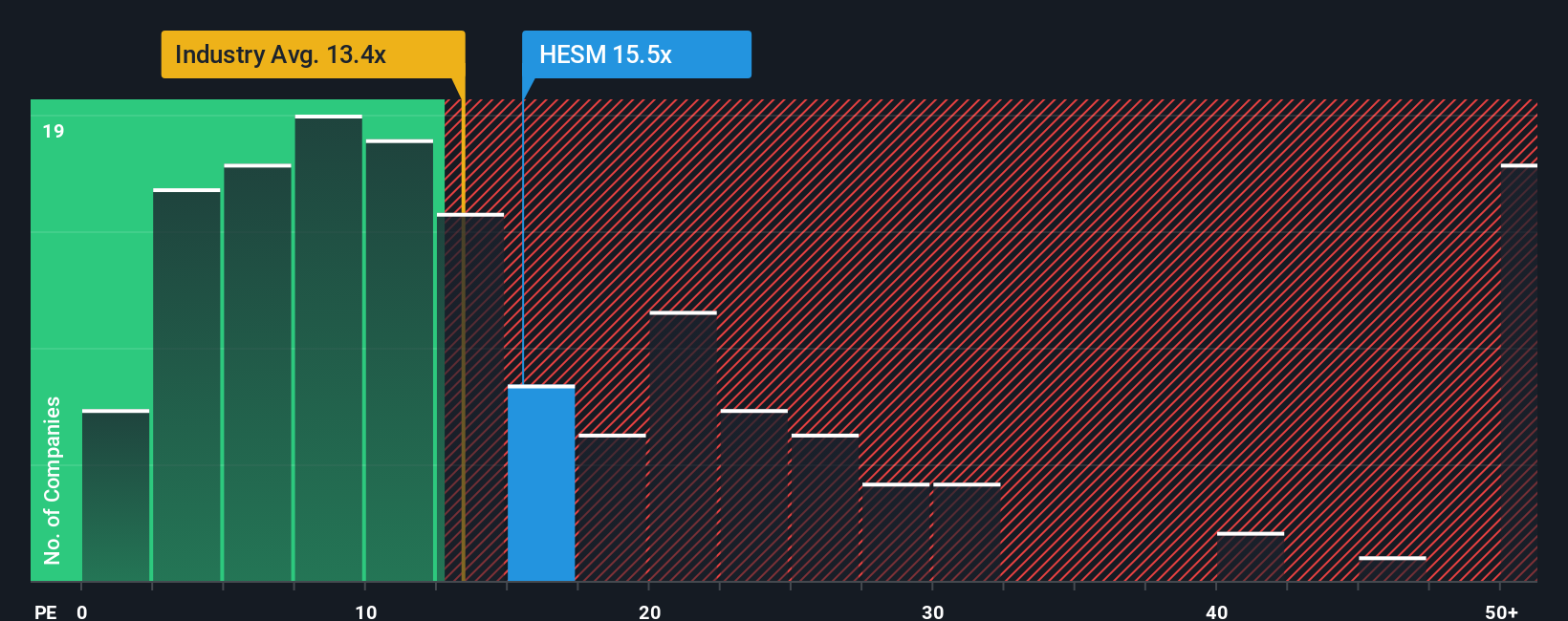

The Price-to-Earnings (PE) ratio is a favored valuation metric for profitable companies like Hess Midstream because it directly connects a company’s current share price to its earnings. This is an essential gauge of how much investors are willing to pay for each dollar of profit. For steady, cash-generative companies, PE multiples help highlight whether shares are priced attractively versus underlying earnings power.

However, what qualifies as a “normal” or fair PE ratio always depends on expectations for future growth, perceived risks, and overall profitability. Companies with strong growth prospects or lower risk generally command higher PE ratios, while those with slower growth or added uncertainties tend to trade at lower levels.

Hess Midstream’s current PE ratio sits at 15.8x. When compared to the broader Oil and Gas industry average of 13.5x, Hess Midstream appears to trade at a premium to its sector peers. That premium becomes more noticeable when compared to its closest listed peers, which average a PE of 31.6x, suggesting Hess is valued well below the peer group.

To provide a more nuanced view, Simply Wall St’s proprietary Fair Ratio model calculates what a justifiable PE for Hess Midstream should be, factoring in company-specific elements like expected earnings growth, industry dynamics, margins, and size. For Hess Midstream, the Fair Ratio is estimated at 22.6x, which is higher than both the company’s current 15.8x and the industry average. This Fair Ratio delivers a tailored comparison, overcoming the limitations of broad peer or sector benchmarks by accounting for Hess Midstream’s distinct risk and growth profile.

With the current PE ratio noticeably below its Fair Ratio, Hess Midstream stock appears undervalued by this approach. This supports the findings of the DCF analysis.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Hess Midstream Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply the story you believe about a company, such as Hess Midstream, tied directly to your assumptions about future revenue, earnings, and margins. Narratives bridge the gap between your outlook for the business, a financial forecast, and an estimate of fair value. This approach makes it easier for you to act with conviction.

On Simply Wall St's Community page, millions of investors already use Narratives to set out and debate their perspectives. For example, some may see long-term value in Hess Midstream’s strategic Bakken infrastructure and steady dividends, setting a high fair value based on expected throughput and resilient cash flow. Others may highlight increasing reliance on Chevron or rising ESG pressures, resulting in a far more conservative outlook and a lower fair value.

Narratives are an accessible tool designed for all investors, helping you decide if the stock is a buy or sell by instantly comparing your fair value to today's market price. Best of all, your Narrative updates dynamically in response to new earnings, news, or changes in outlook. This gives you a clearer, always-current guide to smarter decisions.

Do you think there's more to the story for Hess Midstream? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal