Can Worthington (WOR) Overcome Margin Pressures Despite Strong Sales and Shareholder Returns?

- Worthington Enterprises, Inc. recently reported its first-quarter fiscal 2026 results, posting 18% year-over-year sales growth to US$303.71 million and net income of US$35.15 million, with contributions from the Elgen Manufacturing acquisition and new product launches.

- Despite solid operational gains, earnings and revenue did not meet consensus expectations, and management pointed to tariff costs and macroeconomic headwinds affecting profitability amid ongoing share buybacks and continued dividend payments.

- We’ll now examine how recent earnings shortfalls despite strong revenue growth influence Worthington Enterprises’ future investment narrative and outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Worthington Enterprises Investment Narrative Recap

To be a shareholder in Worthington Enterprises, you need conviction in the company's ability to drive steady growth through acquisitions and new product innovation, even as operational headwinds challenge near-term profitability. The recent earnings shortfall, despite double-digit revenue gains and contributions from Elgen Manufacturing, puts a spotlight on the balance between expansion strategies and persistent external risks, such as tariffs and wider macroeconomic pressures. These news events do not materially alter the main catalyst: integration and margin impact from acquisitions remain at the forefront; the largest risk is that trade and input cost headwinds could compress profitability if not managed.

Among recent company announcements, the completion of a 100,000 share buyback for US$6.3 million stands out. This move, together with ongoing dividends, signals a continued commitment to shareholder returns at a time when consistently improving margins and successful M&A integration are critical for supporting the growth narrative.

In contrast, investors should remain mindful of how quickly tariff-related costs or operational disruptions can...

Read the full narrative on Worthington Enterprises (it's free!)

Worthington Enterprises is projected to reach $1.4 billion in revenue and $213.4 million in earnings by 2028. This outlook is based on an expected annual revenue growth rate of 7.6% and a $117.3 million increase in earnings from the current $96.1 million.

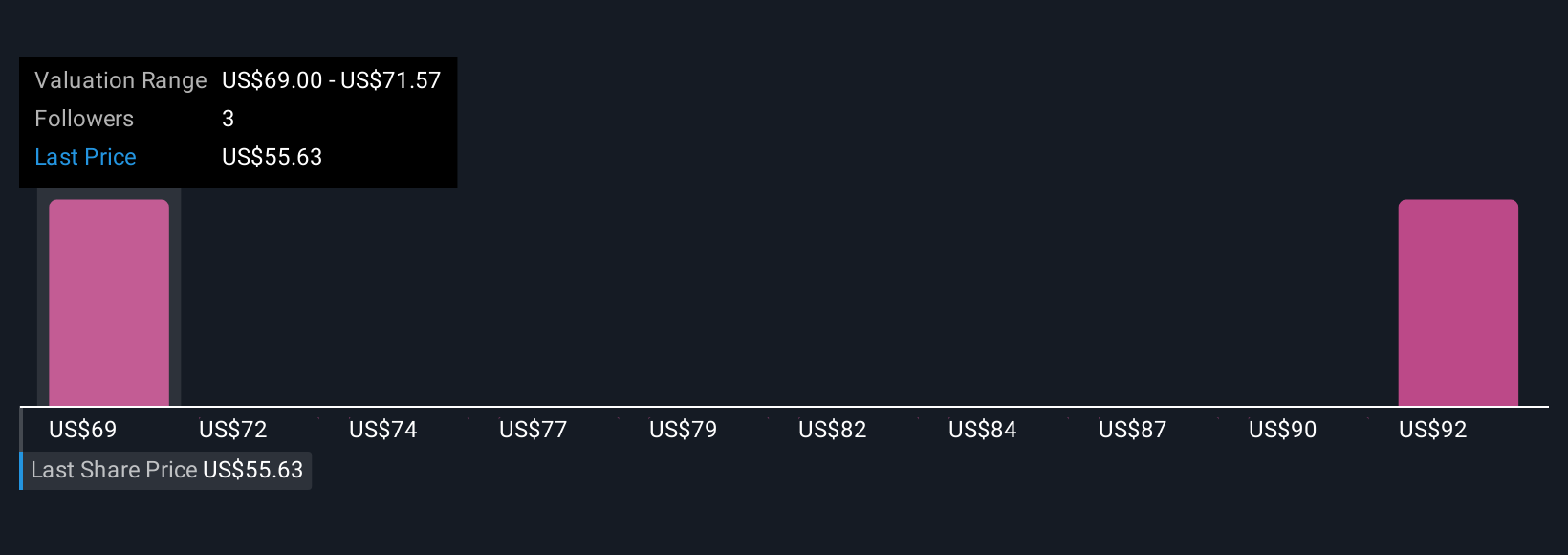

Uncover how Worthington Enterprises' forecasts yield a $69.00 fair value, a 27% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have fair value estimates for Worthington Enterprises ranging from US$69 to US$96, reflecting a variety of approaches to potential growth. Some highlight innovation and recent acquisitions as possible drivers, but ongoing tariff costs are a reminder that views on the company’s outlook differ widely, be sure to consider multiple perspectives when making decisions.

Explore 2 other fair value estimates on Worthington Enterprises - why the stock might be worth as much as 77% more than the current price!

Build Your Own Worthington Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Worthington Enterprises research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Worthington Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Worthington Enterprises' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal