Assessing ATRenew's (NYSE:RERE) Valuation After Surge in Trade-In Activity Following iPhone 17 Launch

If you follow ATRenew (NYSE:RERE), this week's update will definitely catch your eye. The company just announced that consumer trade-in orders surged 70% on the first day of Apple's iPhone 17 release, compared to the iPhone 16 launch last year. In addition, ATRenew's ongoing collaborations with Xiaomi and Huawei on trade-in programs are expected to stir up even more upgrade activity in the coming weeks. For investors, this burst in trade-ins signals that ATRenew is capturing real momentum from tech cycles and manufacturer partnerships.

Looking at the bigger picture, ATRenew’s share price has more than doubled over the past 12 months, fueled by both upbeat results and growing excitement around electronics recycling in China. Short-term gains have also stacked up, with a 35% bump over the past 3 months, suggesting that investors are warming quickly to the company’s growth prospects. Even though there was barely any movement last month, that upward trend hints at shifting risk perceptions, especially as better-than-expected device sales start to show up in the company’s numbers.

So after such a strong run, is ATRenew undervalued for its growth story, or is the market already factoring in all the upside from these trade-in surges?

Most Popular Narrative: 32.6% Undervalued

The prevailing narrative sees ATRenew as substantially undervalued, with analysts estimating the current share price is trading well below fair value based on long-term growth drivers.

The continued integration of government-backed trade-in subsidies and eco-friendly consumption policies is accelerating consumer adoption of device recycling and recommerce in China. This trend presents a structural long-term tailwind for transaction volume and revenue growth.

Curious how ATRenew could be valued so much higher than today? The key lies in bold profit growth forecasts and a future margin leap that supports this price target. If you are interested in the numbers behind this optimistic scenario, keep reading to discover the full story of what is driving that steep fair value estimate.

Result: Fair Value of $7.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, such as potential reductions in government subsidies or rising competition. Either of these factors could dampen ATRenew's projected growth trajectory.

Find out about the key risks to this ATRenew narrative.Another View: Market Comparisons Tell a Different Story

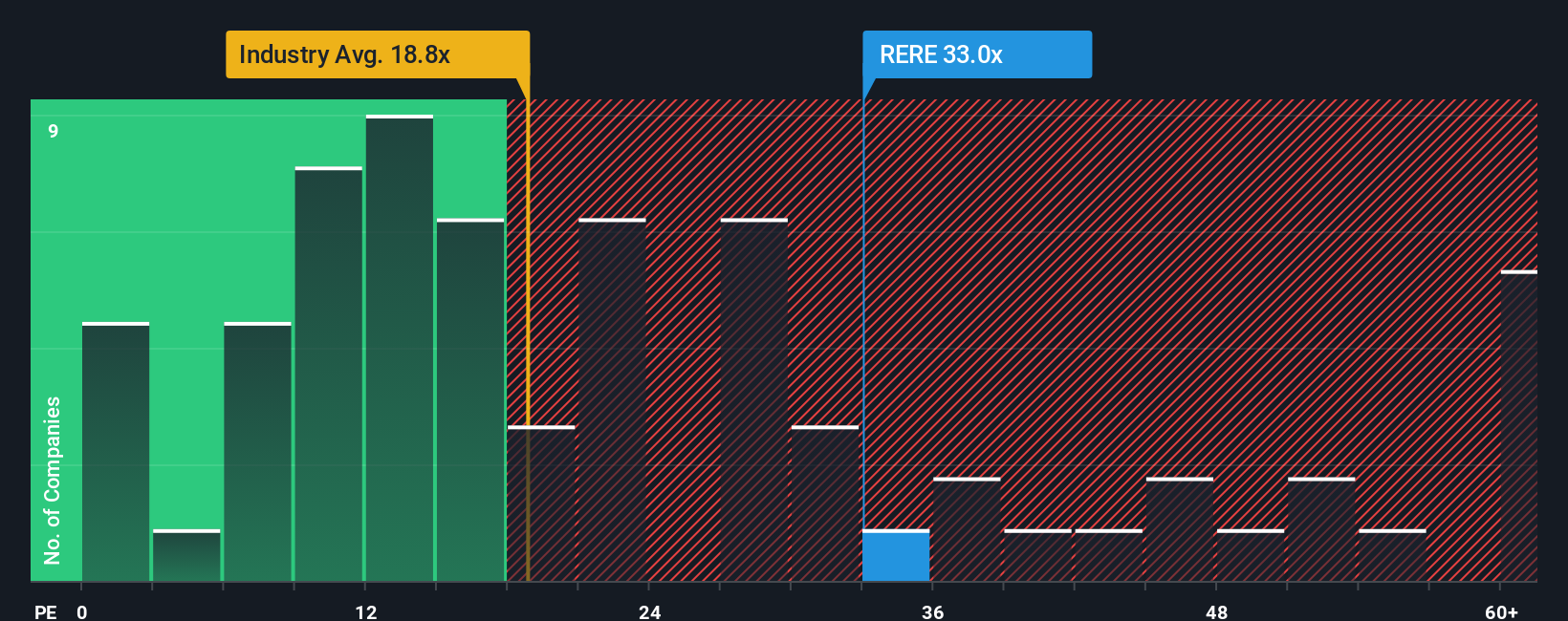

Looking from another angle, comparing ATRenew’s price to its profits makes the shares look expensive relative to the broader US Specialty Retail sector average. The question remains whether strong growth expectations can overcome this apparent premium.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own ATRenew Narrative

If you have a different perspective, or want to check the numbers for yourself, you can easily craft your own narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding ATRenew.

Looking for More Smart Investment Moves?

Don’t let your next potential winner slip through the cracks. The Simply Wall Street Screener uncovers stocks with explosive potential, hidden value, and reliable returns. Put your strategy to the test with these top ideas:

- Boost your income stream and find companies offering attractive payouts with dividend stocks with yields > 3%.

- Get ahead of tomorrow’s breakthroughs and spot innovators in machine learning with AI penny stocks.

- Catch emerging opportunities early and target high-upside plays using penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal