HCA Healthcare (HCA): Exploring Valuation Following Recent Analyst Upgrades and Improved Growth Outlook

Most Popular Narrative: 3.8% Overvalued

The most widely followed analyst narrative currently sees HCA Healthcare as modestly overvalued, suggesting the market price sits a bit above the calculated fair value.

Strategic capital allocation, advanced technology investments, and strengthened managed care positioning are expected to drive long-term value and operational efficiency. Regulatory uncertainties and increased costs present risks to HCA's revenue stability and net margins, with concerns about declining surgical volumes and Medicaid changes.

Want to know the assumptions powering this valuation call? The core of this narrative focuses on future earnings growth and efficiency upgrades, but also a significant shift in how investors may value the company in the years ahead. This outlook includes potential increases in revenue along with changes in long-term profit multiples. Interested to see which future numbers tip the balance? Keep reading for the full valuation playbook behind the price target.

Result: Fair Value of $403.81 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory changes or rising labor costs could still disrupt HCA’s growth outlook and challenge the current optimistic narrative.

Find out about the key risks to this HCA Healthcare narrative.Another View

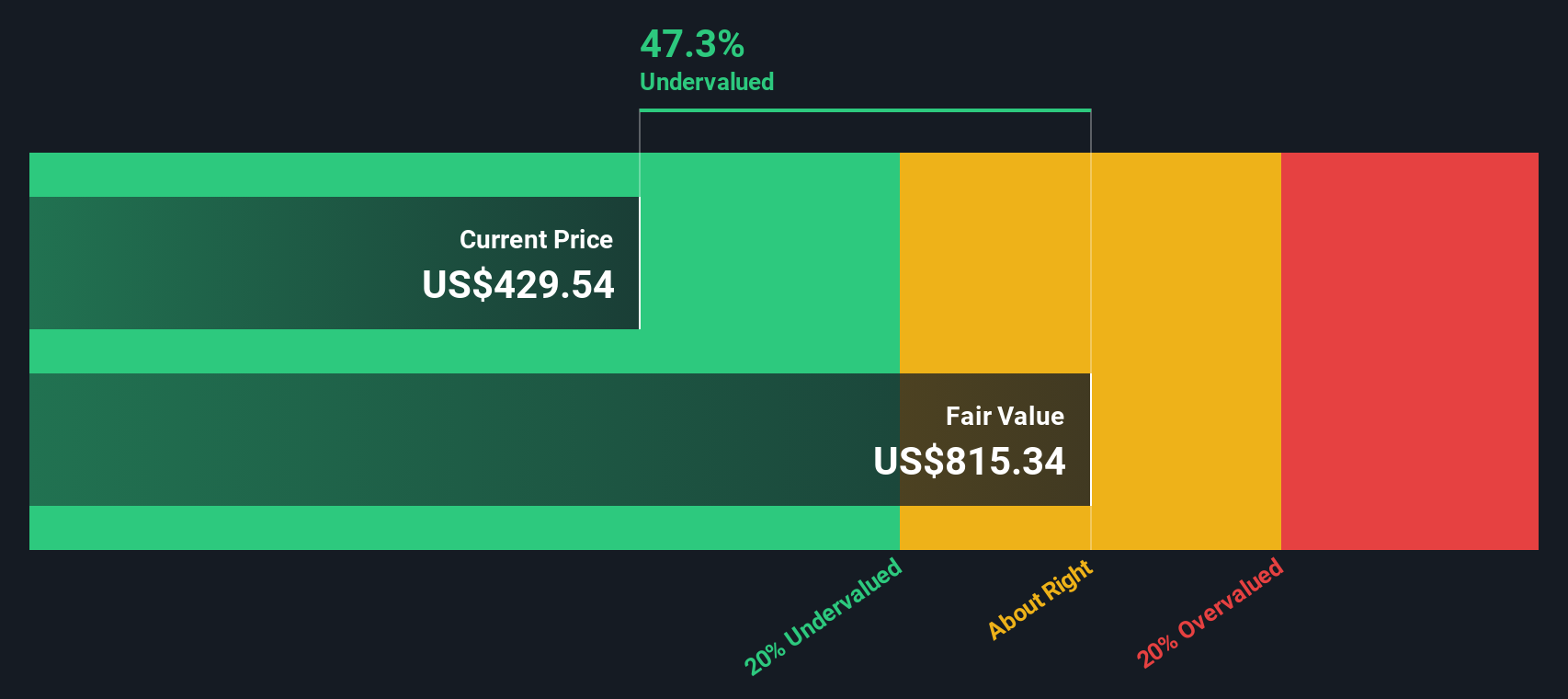

Taking a step back, our DCF model offers a strikingly different perspective and points to HCA Healthcare being undervalued. This challenges the market narrative that the company may already be priced for perfection. Which approach gets you thinking?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own HCA Healthcare Narrative

If you have a different angle or want to dive deeper into the numbers yourself, it’s easy to craft your own interpretation in just a few minutes. Do it your way

A great starting point for your HCA Healthcare research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by seizing opportunities others overlook. The Simply Wall Street Screener unlocks top investment ideas organized by what matters most to you. Start shaping your portfolio with confidence and never miss out on potential winners.

- Spot undervalued gems as you target stocks offering the strongest value by leveraging the advantages of undervalued stocks based on cash flows for future growth potential.

- Boost your income stream by selecting companies delivering impressive yields and steady payouts, thanks to dividend stocks with yields > 3% insights.

- Ride the wave of digital transformation and secure your place at the frontier with in-depth analysis from cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal